Hiring a Quantitative Trader is like finding a needle in a haystack of numbers. As a recruiter, you're tasked with identifying candidates who can blend complex mathematical models with financial acumen to drive profitable trading strategies. The challenge? Many companies underestimate the unique skill set required, often confusing quantitative trading with traditional financial roles. This misconception can lead to mismatched hires and costly turnover.

This comprehensive guide will walk you through the process of hiring top-notch Quantitative Traders. We'll cover everything from crafting an effective job description to conducting technical interviews. For a deeper dive into the specific skills to look for, check out our detailed breakdown of Quantitative Trader skills.

Table of contents

Why Hire a Quantitative Trader?

Quantitative traders can help solve complex financial challenges using data-driven strategies. For instance, they might develop algorithms to optimize trading decisions, manage risk, or identify market inefficiencies that your firm can capitalize on.

Consider hiring a quantitative trader if you're looking to:

- Enhance your trading strategies with mathematical models

- Improve risk management through statistical analysis

- Automate trading processes for increased efficiency

Before committing to a full-time hire, assess if your current data infrastructure and trading volume justify the investment. If you're unsure, starting with a quantitative trading consultant can help you evaluate the potential impact on your business.

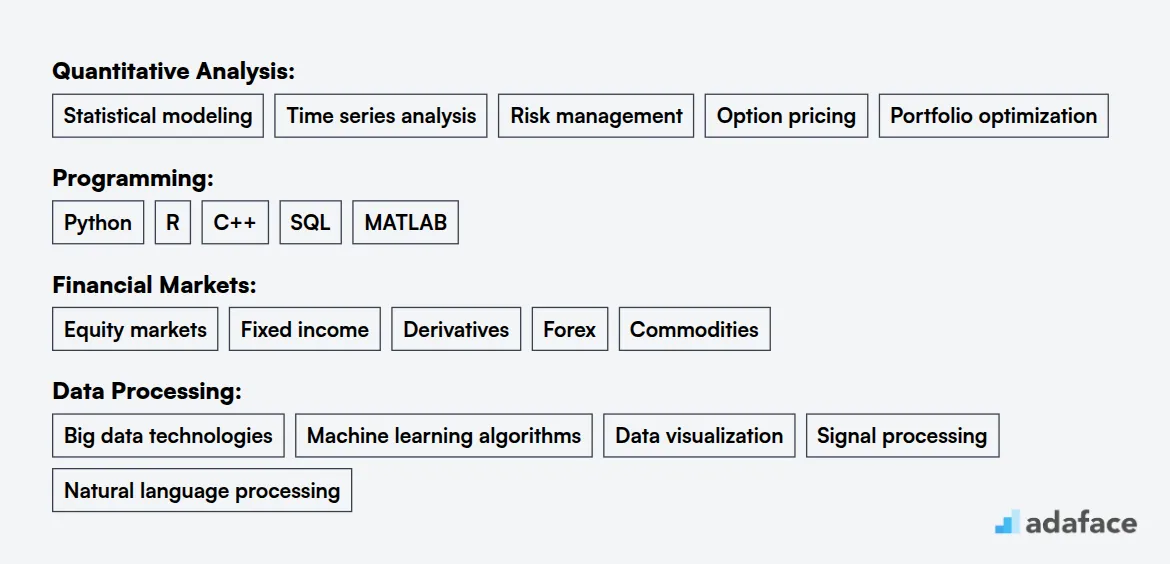

Key Skills and Qualifications for Hiring a Quantitative Trader

Crafting a candidate profile for a Quantitative Trader can be challenging, as the necessary qualifications might vary significantly between organizations. Recruiters often face the risk of overlooking specific skills that are critical for success in this role. Understanding the fine line between what's required and what's preferred is essential in attracting the right talent.

When hiring a Quantitative Trader, consider these required skills:

- Bachelor's degree in Mathematics, Statistics, Physics, or a related quantitative field

- Strong programming skills in Python, R, or C++

- Proficiency in statistical analysis and machine learning techniques

- Experience with financial markets and trading strategies

- Excellent problem-solving and analytical skills

Additionally, look for these preferred qualifications:

- Master's or PhD in a quantitative discipline

- Experience with high-frequency trading systems

- Knowledge of market microstructure

- Familiarity with cloud computing platforms (AWS, GCP)

- CFA or FRM certification

Focusing on these skills and qualifications will help you build a stronger candidate profile to attract the best quantitative traders. For more guidance on effective talent assessment, refer to Adaface's skills assessment tools.

| Required skills and qualifications | Preferred skills and qualifications |

|---|---|

| Bachelor's degree in Mathematics, Statistics, Physics, or related quantitative field | Master's or PhD in a quantitative discipline |

| Strong programming skills in Python, R, or C++ | Experience with high-frequency trading systems |

| Proficiency in statistical analysis and machine learning techniques | Knowledge of market microstructure |

| Experience with financial markets and trading strategies | Familiarity with cloud computing platforms (AWS, GCP) |

| Excellent problem-solving and analytical skills | CFA or FRM certification |

How to write a Quantitative Trader job description?

Once you have a candidate profile ready, the next step is to capture that information in the job description to attract the right candidates. An effective job description makes a significant difference in sourcing top talent.

- Highlight key responsibilities and impact: Clearly outline the daily tasks and expected outcomes for a Quantitative Trader. Emphasise how their work will influence trading strategies and overall business performance to attract motivated professionals.

- Balance technical skills with industry expertise: While technical skills like proficiency in programming languages (e.g., Python, C++) and statistical analysis are essential, don't forget to mention the importance of understanding market dynamics and risk management. A well-rounded candidate excels not just in coding but also in making data-driven decisions.

- Showcase your company’s unique selling points: Share what makes your company stand out in the financial landscape. Highlight opportunities for innovation in trading strategies or a collaborative culture that encourages continuous learning. These elements can set your role apart and attract the best candidates.

For a solid foundation, refer to our comprehensive Quantitative Trader job description.

10 platforms to hire Quantitative Traders

Now that we have a job description for a quantitative trader, it's time to source candidates through various job listing sites. These platforms provide access to a wide range of applicants with the necessary skills in quantitative analysis and trading.

Indeed

Ideal for finding full-time quantitative trader positions due to its large database of job listings and diverse industry coverage.

Glassdoor

Useful for hiring full-time quantitative traders as it provides company reviews, which can help assess potential employers.

Great for networking and finding quantitative traders through professional connections and job postings.

Among the top platforms for hiring quantitative traders, Indeed and Glassdoor are excellent choices for full-time positions, offering large databases and company insights. For professional networking, LinkedIn is invaluable, while Hired targets tech and finance roles specifically. To explore freelance options, platforms like Upwork and Freelancer can connect you with temporary talent. Additionally, specialized sites like Quantster and eFinancialCareers focus on finance roles, whereas Dice caters to tech-specific positions, and We Work Remotely is optimal for remote hiring.

How to Screen Quantitative Trader Resumes

Resume screening is an initial yet vital step in the hiring process for a Quantitative Trader, helping to filter out candidates who may not meet your requirements. It saves time by reducing the pool to only those who potentially fit the role, allowing for more focused and productive interviews.

When screening manually, focus on primary and secondary keywords relevant to the role. Look for fundamental skills like programming proficiency in languages such as Python, R, or C++, and experience with financial markets and trading strategies. This approach helps eliminate those who lack the foundational skills and qualifications.

Using AI and large language models can make resume screening faster and more accurate. These tools can scan resumes to match key qualifications you're looking for, helping to speed up the process. Platforms like Adaface's skill mapping and quantitative trader interview questions offer resources to assist in your search.

Here's a prompt you can use with AI tools to help with resume screening:

TASK: Screen resumes to match job description for Quantitative Trader role

INPUT: Resumes

OUTPUT: For each resume, provide following information:

- Email id

- Name

- Matching keywords

- Score (out of 10 based on keywords matched)

- Recommendation (detailed recommendation of whether to shortlist this candidate or not)

- Shortlist (Yes, No or Maybe)

RULES:

- If you are unsure about a candidate's fit, put the candidate as Maybe instead of No

- Keep recommendation crisp and to the point.

KEYWORDS DATA:

- Programming (Python, R, C++)

- Financial Markets (Equity markets, Derivatives)

- Quantitative Analysis (Statistical modeling, Risk management)

Recommended Skills Tests to Screen Quantitative Traders

Evaluating quantitative traders through skills tests is a straightforward approach to ensure candidates have the right abilities for the role. Skills tests provide objective insights into a candidate's proficiency, allowing for informed hiring decisions. Here are our recommended tests to assess quantitative traders:

Quantitative Aptitude Test: This test evaluates candidates' mathematical and analytical skills, crucial for developing trading strategies. It's designed to identify those who can solve complex problems quickly and accurately. Find out more about this test on our Quantitative Aptitude Test page.

Statistics Online Test: A strong statistical foundation is vital for any quantitative trader. This test assesses a candidate's understanding of statistical methods crucial for analyzing market data and predicting trends. Explore the Statistics Online Test for more details.

Probability Online Test: Probability concepts are at the heart of quantitative trading. This test measures how well candidates grasp probability and stochastic processes, which are pivotal in making trading decisions. Check the Probability Online Test for more information.

Financial Modeling Test: Understanding financial modeling is key for translating data into actionable trading insights. This test evaluates the ability to create financial forecasts and models. For further information, see our Financial Modeling Test.

Data Analysis Test: Quantitative traders must effectively analyze vast datasets. This test assesses proficiency in data analysis techniques, essential for identifying lucrative trading opportunities. Visit the Data Analysis Test to learn more.

Structuring Technical Interviews for Quantitative Trader Candidates

After candidates pass initial skills tests, it's crucial to conduct thorough technical interviews. These interviews help assess a candidate's hard skills in real-world scenarios, which is essential for finding the best fit for a Quantitative Trader role. Here are some sample interview questions to consider:

- Can you explain a trading strategy you've developed and how you backtested it?

- How would you approach building a model to predict stock prices?

- Describe a time when you had to debug a complex trading algorithm.

- What methods do you use to manage risk in your trading strategies?

- How do you stay updated with the latest developments in quantitative finance?

- Can you walk me through how you would implement a pairs trading strategy?

These questions help evaluate a candidate's practical experience, problem-solving skills, and theoretical knowledge in quantitative trading.

How much does it cost to hire a Quantitative Trader?

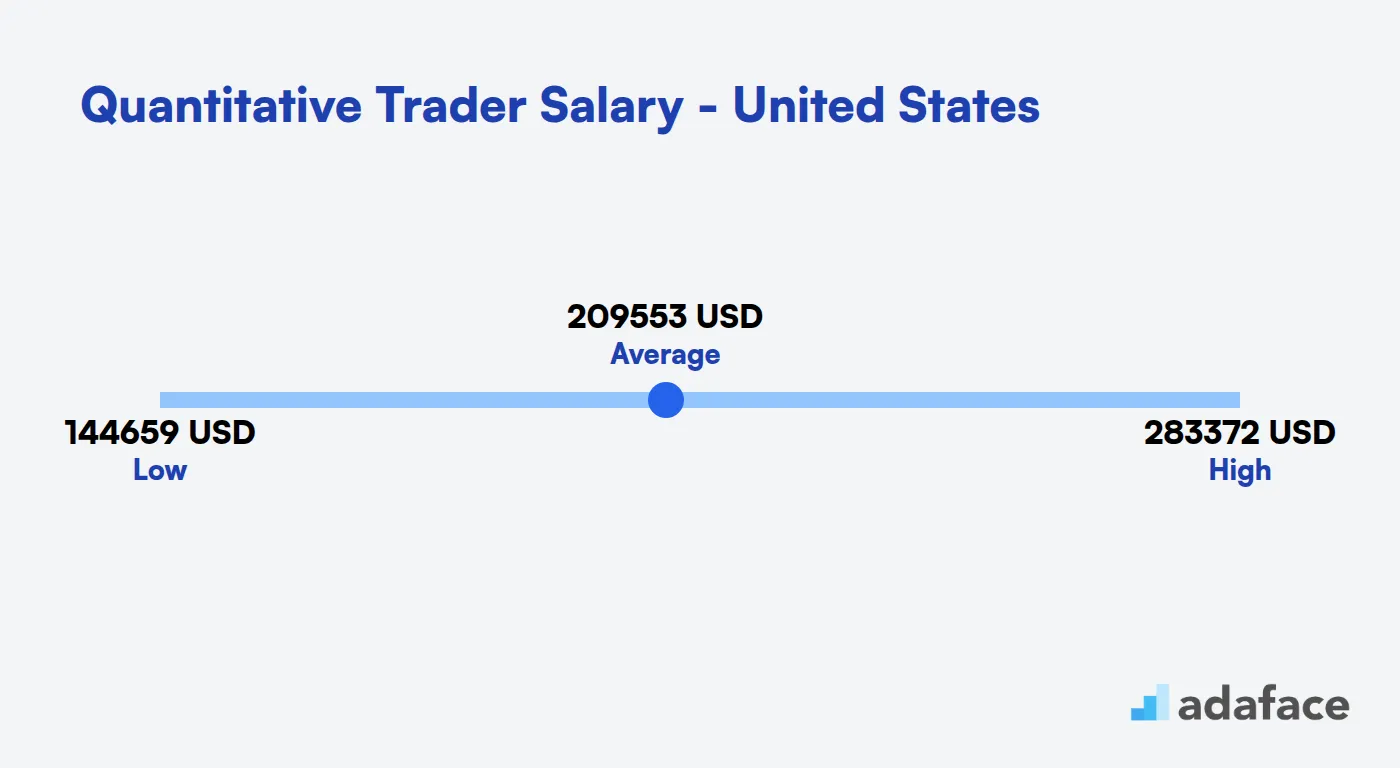

Hiring a Quantitative Trader involves competitive compensation packages, typically driven by factors like experience and location. In the United States, the average salary is around $209,554. Salaries can range from $144,659 to $283,372, with New York, NY offering some of the highest averages at approximately $243,362, while cities like Seattle, WA might offer salaries around $101,287.

Quantitative Trader salary United States

In the United States, a Quantitative Trader can expect an average salary of around $209,554. Salaries can range from a low of $144,659 to a high of $283,372, depending on factors such as location and experience. For instance, New York, NY offers one of the highest average salaries at approximately $243,362, while locations like Seattle, WA may offer lower averages around $101,287.

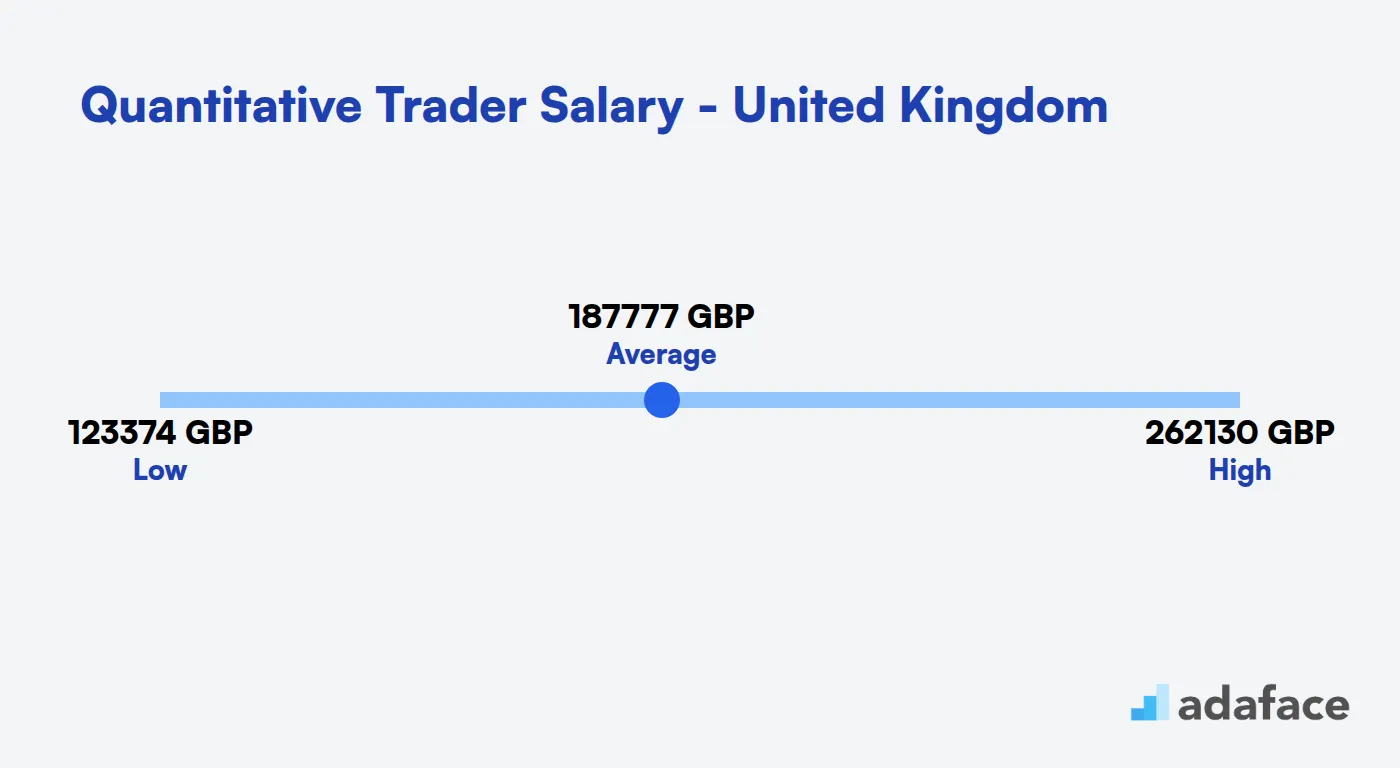

Quantitative Trader Salary in the United Kingdom

Quantitative Traders in the UK earn competitive salaries. According to recent data, the average annual salary for a Quantitative Trader in the United Kingdom ranges from £60,000 to £150,000. However, top performers at prestigious firms can earn significantly more, with total compensation packages potentially exceeding £500,000 per year, including bonuses and profit-sharing.

What's the difference between a Quantitative Trader and an Algorithmic Trader?

While Quantitative Traders and Algorithmic Traders both operate in the realm of finance, they are often confused due to their overlapping skill sets and methodologies. The primary distinction lies in their approach and focus areas, making it crucial for recruiters to understand these differences when hiring.

Quantitative Traders primarily rely on quantitative models to analyze market patterns and data. They possess a strong background in mathematics, finance, or economics, and their core skills include statistical analysis and risk management. Their objective is to maximize returns through complex models, utilizing tools such as statistical software and quantitative platforms.

On the other hand, Algorithmic Traders focus on executing trades at high speeds using algorithm-driven strategies. They typically come from a background in computer science or engineering and are skilled in coding and algorithm development. Their main goal is to optimize trade execution and leverage technologies like trading algorithms and APIs.

| Quantitative Trader | Algorithmic Trader | |

|---|---|---|

| Trading Approach | Quantitative Models | Algorithm-Driven Strategies |

| Core Skillset | Statistical Analysis, Risk Management | Algorithm Development, Coding |

| Programming Languages | Python, R, SQL | Python, C++, Java |

| Educational Background | Mathematics, Finance, Economics | Computer Science, Engineering |

| Focus | Market Patterns, Data Analysis | Execution Speed, Automation |

| Experience Level | Finance Industry Experience | Software Development Experience |

| Tools | Statistical Tools, Quant Platforms | Trading Algorithms, APIs |

| Outcome Objective | Maximize Returns via Quant Models | Optimize Trade Execution |

What are the ranks of Quantitative Traders?

Quantitative traders often have a clear career progression path within financial institutions. The ranks can vary slightly between organizations, but generally follow a similar structure.

- Junior Quantitative Trader: Entry-level position for recent graduates with strong mathematical and programming skills. They typically assist senior traders and work on smaller trading strategies.

- Quantitative Trader: Mid-level position with a few years of experience. These traders develop and implement their own trading strategies, manage risk, and contribute to team projects.

- Senior Quantitative Trader: Experienced professionals who lead trading teams, mentor junior traders, and manage larger portfolios. They often specialize in specific asset classes or trading strategies.

- Head of Quantitative Trading: Top-level position overseeing the entire quantitative trading department. They set strategic direction, manage resources, and interface with other departments and stakeholders.

- Chief Investment Officer (CIO): Some quantitative traders may progress to this C-suite role, where they oversee all investment strategies for the firm, including both quantitative and traditional approaches.

As quantitative traders advance through these ranks, their responsibilities and skill requirements evolve. Higher positions often require a mix of technical expertise, leadership skills, and strategic business acumen.

Hire the Best Quantitative Traders for Your Team

We've covered the essential aspects of hiring quantitative traders, from understanding their role to identifying key skills, writing effective job descriptions, and conducting thorough screenings. The process involves careful consideration of technical abilities, analytical skills, and cultural fit within your organization.

The key takeaway is to use accurate job descriptions and targeted skills assessments to ensure a precise hiring process. Implementing a quantitative aptitude test can help you evaluate candidates' numerical and analytical capabilities objectively. Remember, finding the right quantitative trader is about balancing technical expertise with the ability to apply that knowledge in real-world trading scenarios.

Quantitative Aptitude Online Test

FAQs

Look for candidates with strong mathematical and statistical backgrounds, typically with degrees in fields like Mathematics, Physics, or Computer Science. They should have programming skills (particularly in languages like Python or C++), knowledge of financial markets, and experience with machine learning and data analysis techniques.

Use a combination of methods including quantitative aptitude tests, coding challenges, and technical interviews. Ask candidates to solve real-world trading problems or explain complex trading strategies to evaluate their practical skills and theoretical knowledge.

Specialized job boards like QuantNet and Wilmott are good starting points. LinkedIn, academic job boards of top universities, and quantitative finance conferences can also be valuable sources. Consider partnering with financial recruitment agencies that specialize in quant roles.

Start with an initial screening call, followed by a technical assessment. Then conduct a series of interviews including a deep dive into their quantitative skills, a discussion on financial markets, and a culture fit assessment. Consider including a practical trading simulation or case study as part of the process.

Look for candidates with strong analytical thinking, problem-solving abilities, and attention to detail. Good communication skills are crucial as they'll need to explain complex strategies to non-technical team members. Adaptability and the ability to work under pressure are also key traits.

While there's overlap, Quantitative Traders focus more on developing mathematical models and strategies, while Algorithmic Traders primarily implement these strategies into automated trading systems. During interviews, delve into their experience with model development versus algorithm implementation to understand their primary focus and expertise.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources