Evaluating candidates for financial modeling roles requires a clear understanding of their skills and knowledge. It's about ensuring they can build sound financial models, interpret data, and provide valuable insights, similar to what's needed for a budget analyst.

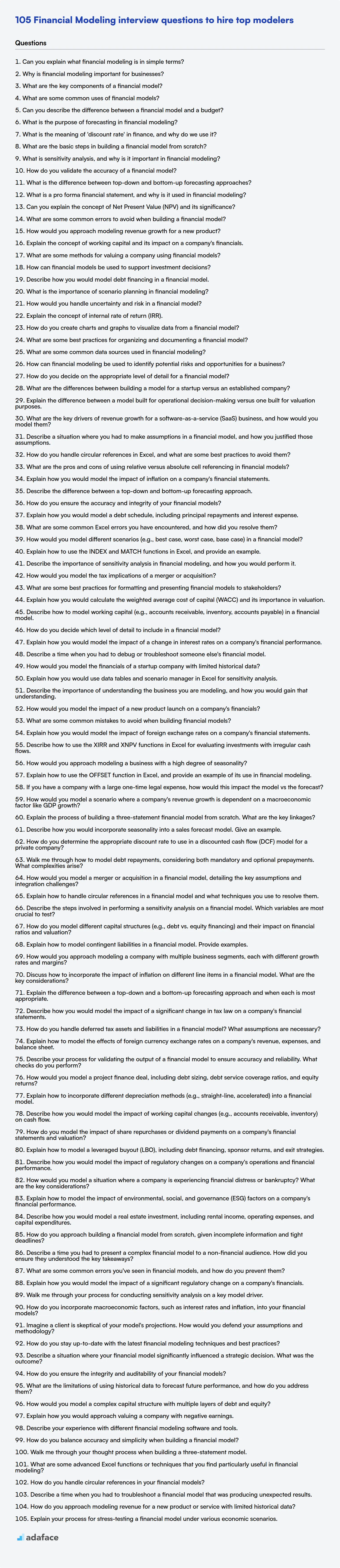

This blog post provides a curated list of financial modeling interview questions, covering various experience levels from freshers to experienced professionals. It also includes multiple-choice questions (MCQs) to assess a candidate's foundational understanding.

By using these questions, you can refine your hiring process and identify candidates who possess the skills to excel in financial modeling; use our Financial Modeling Test before the interview to make your process even better.

Table of contents

Financial Modeling interview questions for freshers

1. Can you explain what financial modeling is in simple terms?

Financial modeling is like building a simplified version of a company or investment in a spreadsheet. It uses historical data and assumptions about the future to forecast how the company will perform. Think of it as a financial 'what-if' machine.

It helps you answer questions like:

- What will profits be next year?

- How much is the company worth?

- Should we invest in this project?

- Can the company afford to take on debt?

2. Why is financial modeling important for businesses?

Financial modeling is crucial for businesses because it provides a quantitative framework for making informed decisions. It helps in forecasting future financial performance, assessing the viability of projects, and understanding the potential impact of different business strategies. By building models, companies can simulate various scenarios, identify risks, and optimize resource allocation, leading to better strategic planning and improved profitability.

Specifically, financial models assist in things like securing funding (investors require projections), valuing potential acquisitions, managing budgets and performance, and performing sensitivity analysis to understand how changing variables impact financial outcomes. They enable data-driven decisions, reducing reliance on guesswork and improving overall business outcomes.

3. What are the key components of a financial model?

Key components of a financial model typically include: Assumptions, which are the driving forces behind the model (e.g., growth rates, inflation). The Historical Data which is the base data used to make future projections. Revenue Model, detailing how revenue is generated and projected. Expense Model, which outlines all costs and expenses and how they're forecasted. The Financial Statements consists of the Income Statement, Balance Sheet, and Cash Flow Statement. Finally, the Valuation section uses outputs from the financial statements to calculate metrics like DCF, ratios, and sensitivity analyses to assess the business's value.

Essentially, a financial model takes assumptions, forecasts financial statements, and then uses those statements to derive valuation metrics and conduct sensitivity analyses.

4. What are some common uses of financial models?

Financial models are used for a variety of purposes, primarily revolving around forecasting future financial performance and making informed decisions. Some common uses include:

- Valuation: Determining the intrinsic value of a company or asset.

- Budgeting and Forecasting: Projecting future revenues, expenses, and cash flows for planning and resource allocation.

- Investment Analysis: Evaluating the potential returns and risks of investment opportunities.

- Capital Budgeting: Assessing the feasibility of long-term investment projects (e.g., building a new factory).

- Mergers and Acquisitions (M&A): Analyzing the financial implications of a potential merger or acquisition.

- Fundraising: Supporting funding from investors and financial institutions

- Sensitivity Analysis: Assessing how changes in key assumptions impact financial outcomes.

5. Can you describe the difference between a financial model and a budget?

A budget is a short-term financial plan, typically covering a year or less, that outlines expected revenues and expenses. It's used for control and monitoring, showing how resources will be allocated and how performance will be measured against planned targets. A financial model, on the other hand, is a longer-term, forward-looking projection of a company's financial performance, often spanning several years.

The key difference lies in their purpose and scope. A budget focuses on operational control, while a financial model is used for strategic decision-making, valuation, and scenario planning. Budgets are usually more detailed and static, whereas financial models are dynamic and can incorporate various assumptions and sensitivities to analyze different potential outcomes.

6. What is the purpose of forecasting in financial modeling?

The primary purpose of forecasting in financial modeling is to predict future financial performance. This involves estimating future revenues, expenses, and cash flows, which are essential for making informed business decisions. These decisions include budgeting, investment analysis, valuation, and strategic planning.

Forecasting helps businesses anticipate future financial outcomes and potential risks. By understanding likely future scenarios, companies can proactively adjust strategies to maximize profitability, manage resources effectively, and secure funding. For example, forecasts can inform decisions about capital expenditures, pricing strategies, and inventory management.

7. What is the meaning of 'discount rate' in finance, and why do we use it?

The discount rate in finance represents the rate of return used to discount future cash flows back to their present value. It reflects the time value of money – the idea that money available today is worth more than the same amount in the future due to its potential earning capacity.

We use the discount rate to determine the present value of future cash flows, which is crucial for investment decisions. It allows us to compare investments with different cash flow patterns by expressing them in today's dollars. A higher discount rate implies a greater risk or a higher opportunity cost, leading to a lower present value, and vice-versa.

8. What are the basic steps in building a financial model from scratch?

Building a financial model typically involves these steps:

- Define the Purpose: Clearly establish the model's objective (e.g., valuation, forecasting, investment analysis). This dictates the scope and level of detail.

- Gather Historical Data: Collect relevant financial statements (income statement, balance sheet, cash flow statement) and market data. Ensure data accuracy and consistency.

- Build Assumptions: Develop key assumptions about revenue growth, cost structure, capital expenditures, and other drivers. These assumptions should be realistic and well-supported. Sensitivity analysis can be used.

- Model Construction: Design the model's structure, linking inputs (assumptions) to outputs (financial projections). This often involves using spreadsheet software like Excel. Ensure formulas are accurate.

- Project Financial Statements: Forecast the income statement, balance sheet, and cash flow statement based on the assumptions and historical data. Use appropriate formulas to link the statements.

- Calculate Key Metrics: Calculate relevant financial ratios, valuation metrics (e.g., discounted cash flow), and other key performance indicators (KPIs) based on the projected financial statements.

- Sensitivity Analysis & Scenario Planning: Test the model's sensitivity to changes in key assumptions. Create different scenarios (best case, worst case, base case) to assess the range of potential outcomes.

- Validation & Review: Validate the model's accuracy by comparing its outputs to historical data or industry benchmarks. Have the model reviewed by another qualified professional. Iterate and refine as needed.

9. What is sensitivity analysis, and why is it important in financial modeling?

Sensitivity analysis is a technique used in financial modeling to determine how changes in the assumptions of a model affect the model's output. It essentially tests the robustness of a model by examining how sensitive the results are to variations in input variables. You can accomplish this by varying a single input at a time (one-way sensitivity analysis) or by varying multiple inputs simultaneously (scenario analysis).

It's important because it helps understand the range of possible outcomes and identify the key drivers of a model's results. This allows for better decision-making by understanding the risks and opportunities associated with different scenarios. It also helps to assess the validity of a model and communicate the uncertainty inherent in financial forecasts to stakeholders.

10. How do you validate the accuracy of a financial model?

Validating a financial model's accuracy involves several steps. First, check the input data for errors and inconsistencies. Ensure the data sources are reliable and the data is appropriately transformed and used in calculations. Second, review the model's formulas and assumptions. Verify that the calculations are logically sound and align with financial principles. Sensitivity analysis, scenario analysis, and stress testing can help to assess how the model responds to changes in key assumptions. Compare the model's output to historical data or industry benchmarks to assess its reasonableness. Finally, conduct backtesting (if historical data is available) or compare the model's predictions to actual results as they become available to evaluate its predictive power.

Specifically, you could validate the accuracy of a financial model by:

- Input Validation: Verify the integrity and accuracy of all input data.

- Formula Auditing: Review the formulas to ensure they are correctly implemented.

- Assumption Testing: Assess the reasonableness of key assumptions.

- Sensitivity Analysis: Test the model's response to changes in input variables.

- Scenario Analysis: Evaluate the model under different economic scenarios.

- Backtesting: Compare the model's results to historical data. This is crucial.

11. What is the difference between top-down and bottom-up forecasting approaches?

Top-down forecasting starts with the aggregate and then breaks it down into smaller components. For example, you might forecast total sales for a company and then allocate those sales across different product lines or regions. Bottom-up forecasting starts with the individual components and then aggregates them to create the overall forecast. For example, you might forecast sales for each product in each region and then sum those forecasts to get the total sales forecast.

Choosing between the two depends on the context. Top-down is useful when aggregate data is more reliable, or when detailed data is unavailable. Bottom-up is useful when you have good data at the component level and when you believe that the overall forecast should be driven by the individual components. Bottom-up can be more accurate when local knowledge is important. Top-down is often easier and faster to implement.

12. What is a pro forma financial statement, and why is it used in financial modeling?

A pro forma financial statement is a projection of a company's future financial performance. It's based on certain assumptions and hypothetical scenarios, showing what the financials would look like if those assumptions hold true. This differs from historical financial statements, which report actual past results.

Pro forma statements are crucial in financial modeling for several reasons. They help in forecasting future earnings, assessing the potential impact of planned investments or transactions (like mergers or acquisitions), determining funding needs, and evaluating the feasibility of business plans. They enable decision-makers to analyze different possible outcomes and make informed choices.

13. Can you explain the concept of Net Present Value (NPV) and its significance?

Net Present Value (NPV) is a method used in capital budgeting to analyze the profitability of an investment or project. It calculates the present value of expected future cash flows, discounted back to their present value using a discount rate (which reflects the cost of capital or desired rate of return). This present value is then compared to the initial investment.

NPV is significant because it indicates whether an investment will add value to the firm. A positive NPV suggests that the investment is expected to generate more value than its cost, making it a potentially good investment. A negative NPV indicates that the investment is expected to lose money. An NPV of zero suggests the investment will break even.

14. What are some common errors to avoid when building a financial model?

Some common errors to avoid when building a financial model include:

- Incorrect formulas: Double-check all calculations and ensure formulas are logically correct and refer to the correct cells. Circular references are a frequent culprit here.

- Hardcoding assumptions: Avoid hardcoding assumptions directly into formulas. Use dedicated input cells and refer to those cells in your formulas. This allows for easy sensitivity analysis.

- Inconsistent time periods: Make sure all time periods (months, quarters, years) are consistent throughout the model. Mismatching timeframes can skew results significantly.

- Ignoring taxes: Failing to account for the impact of taxes on profitability and cash flow can result in inaccurate valuations.

- Overly complex models: Keep the model as simple as possible while still addressing the core objectives. Unnecessary complexity increases the risk of errors and reduces transparency.

- Poor formatting and documentation: Lack of clear formatting and documentation makes the model difficult to understand and maintain, making errors harder to spot.

15. How would you approach modeling revenue growth for a new product?

To model revenue growth for a new product, I'd start with a bottoms-up approach, estimating units sold based on market size, penetration rate, and adoption curve assumptions. I'd consider different customer segments and their willingness to pay, factoring in pricing strategy, competitive landscape, and potential cannibalization of existing products. This would lead to a revenue forecast, which could then be adjusted based on sensitivity analysis and scenario planning. I'd also monitor key performance indicators (KPIs) post-launch to refine the model.

16. Explain the concept of working capital and its impact on a company's financials.

Working capital represents the difference between a company's current assets and its current liabilities. It is a measure of a company's short-term liquidity, reflecting its ability to meet its immediate obligations. A positive working capital indicates that a company has enough liquid assets to cover its short-term debts, while a negative working capital may signal financial distress.

The impact of working capital on financials is significant. Efficient management of working capital improves cash flow, profitability, and operational efficiency. For example, reducing inventory holding periods or speeding up accounts receivable collections frees up cash that can be reinvested in the business or used to reduce debt. Conversely, poor working capital management can lead to cash flow problems, increased borrowing costs, and even insolvency. Key ratios used to assess working capital management include the current ratio, quick ratio, and cash conversion cycle.

17. What are some methods for valuing a company using financial models?

Several methods exist for valuing a company using financial models. Common approaches include Discounted Cash Flow (DCF) analysis, which projects future free cash flows and discounts them back to present value using a discount rate (WACC). Relative valuation methods compare a company's financial metrics (e.g., P/E ratio, EV/EBITDA) to those of its peers or industry averages to determine if it's over or undervalued. Another method is precedent transactions, which analyzes past mergers and acquisitions of similar companies to estimate a company's value based on the multiples paid in those transactions.

DCF is inherently forward looking, relying on projections. Relative valuation depends on the accuracy and comparability of peer companies. Precedent transactions depends on the availability and similarity of the transactions.

18. How can financial models be used to support investment decisions?

Financial models are essential tools for supporting investment decisions by providing a framework to analyze and forecast the potential financial outcomes of different investment opportunities. They allow investors to quantify risks and rewards, compare various investment options, and make informed decisions based on data-driven insights. For example, a discounted cash flow (DCF) model can estimate the intrinsic value of a company by projecting its future cash flows and discounting them back to their present value.

Specifically, financial models can help in: identifying undervalued or overvalued assets, stress-testing investment portfolios under different economic scenarios, and determining the optimal asset allocation strategy. By using models, investors can avoid making emotionally driven decisions and improve the likelihood of achieving their investment goals.

19. Describe how you would model debt financing in a financial model.

To model debt financing, I'd start by creating a debt schedule. This schedule outlines the initial debt balance, interest rate, payment frequency, and term. Each period, I would calculate the interest expense (debt balance * interest rate) and the principal repayment. The principal repayment reduces the debt balance, which in turn affects future interest expense calculations. The cash flow statement incorporates the principal repayment, while the income statement reflects the interest expense.

I would also incorporate debt covenants (e.g., debt service coverage ratio) and model their impact. If a covenant is breached, I'd trigger a flag or adjustment in the model, potentially affecting interest rates, repayment terms, or even triggering mandatory prepayments. Sensitivity analysis would be performed to assess the model's output given change in interest rates or other key debt assumptions.

20. What is the importance of scenario planning in financial modeling?

Scenario planning is crucial in financial modeling because it addresses the inherent uncertainty of future events. Financial models often rely on assumptions about key variables like interest rates, sales growth, and operating costs. By creating multiple scenarios (e.g., best-case, worst-case, base-case), financial models can assess the potential impact of various outcomes on a company's financial performance and valuation. This allows for a more robust and informed decision-making process.

Scenario planning helps to identify potential risks and opportunities that might be missed if relying solely on a single forecast. It enables businesses to prepare for a range of possibilities, develop contingency plans, and make strategic decisions that are more resilient to unexpected events. This process can reveal sensitivities in the model and highlight areas where further analysis or risk mitigation strategies are needed.

21. How would you handle uncertainty and risk in a financial model?

I'd handle uncertainty and risk in a financial model by incorporating techniques like sensitivity analysis, scenario planning, and Monte Carlo simulation. Sensitivity analysis helps identify which inputs have the greatest impact on the model's output. Scenario planning involves creating multiple potential future scenarios (best case, worst case, most likely case) and assessing the model's performance under each.

Monte Carlo simulation uses random sampling to generate a distribution of possible outcomes, providing a probabilistic view of the model's potential results. I would also use techniques such as adding risk-adjusted discount rates to reflect the level of risk associated with future cash flows. Additionally, stress testing can be used to evaluate the model's resilience to extreme, but plausible, events.

22. Explain the concept of internal rate of return (IRR).

Internal Rate of Return (IRR) is a discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero. In simpler terms, it's the rate at which an investment breaks even. It is used to evaluate the attractiveness of a potential investment.

A project is generally considered a good investment if its IRR is greater than the company's cost of capital or the required rate of return. Higher IRR suggests a more desirable investment, assuming projects are of similar risk.

23. How do you create charts and graphs to visualize data from a financial model?

To create charts and graphs from a financial model, I typically use tools like Excel, Python (with libraries like Matplotlib, Seaborn, and Plotly), or dedicated BI tools like Tableau or Power BI. In Excel, I select the data range, then choose an appropriate chart type (e.g., line chart for trends, bar chart for comparisons, pie chart for proportions) from the 'Insert' tab. I then customize the chart's appearance, labels, and axes for clarity. For more sophisticated visualizations, I prefer Python, leveraging its powerful charting libraries and data manipulation capabilities with Pandas. import matplotlib.pyplot as plt, then you can define your chart, such as plt.plot(x,y) followed by plt.show().

24. What are some best practices for organizing and documenting a financial model?

When organizing a financial model, clarity and maintainability are key. Start by structuring your spreadsheet logically: input assumptions should be clearly separated from calculations and outputs. Use distinct worksheets for different sections (e.g., revenue, expenses, balance sheet) and color-code cells for easy identification of inputs vs. formulas. Use clear and consistent naming conventions for variables and ranges.

For documentation, include a summary page that outlines the model's purpose, key assumptions, and limitations. Within the model, use comments extensively to explain complex formulas and logic. Regularly review and update your documentation as the model evolves. Consider including sensitivity analysis and scenario planning sections to demonstrate the model's robustness. Always include version control using file naming or dedicated software to track changes.

25. What are some common data sources used in financial modeling?

Common data sources in financial modeling include:

- Market Data Providers: Bloomberg, Refinitiv (formerly Thomson Reuters), FactSet, and S&P Capital IQ provide historical and real-time stock prices, indices, interest rates, and other market data.

- Company Financial Statements: SEC filings (10-K, 10-Q), annual reports, and investor relations websites offer information on revenue, expenses, assets, and liabilities. These are crucial for building financial models.

- Economic Data: Government agencies (e.g., Bureau of Economic Analysis, Federal Reserve) and international organizations (e.g., World Bank, IMF) provide macroeconomic data such as GDP growth, inflation rates, and unemployment figures.

- Alternative Data: This category encompasses non-traditional sources like social media sentiment, credit card transaction data, satellite imagery, and web scraping data, which can provide unique insights. Depending on the model's purpose, this data can add more color.

- Industry-Specific Data: Trade associations and research firms often publish data specific to particular industries, providing insights into market size, growth rates, and competitive dynamics.

26. How can financial modeling be used to identify potential risks and opportunities for a business?

Financial modeling helps identify risks and opportunities by simulating different scenarios. By changing key assumptions like sales growth, interest rates, and operating costs, the model can reveal vulnerabilities and potential upsides. For example, a sensitivity analysis might show that a slight increase in raw material prices significantly impacts profitability, highlighting a supply chain risk. Scenario planning can also reveal opportunities, such as identifying the potential revenue from entering a new market under favorable economic conditions.

Specifically, financial models can expose risks like excessive leverage (leading to financial distress), dependence on a single customer (customer concentration risk), or vulnerability to interest rate changes. Opportunities might include identifying an optimal capital structure, justifying investments in new projects (through NPV analysis), or determining the potential benefits of a merger or acquisition. Ratio analysis within the financial model can reveal if certain financial ratios are trending in a risky or opportunistic direction.

27. How do you decide on the appropriate level of detail for a financial model?

The appropriate level of detail in a financial model depends primarily on the model's purpose and the audience. If the model is for high-level strategic decision-making (e.g., evaluating a major acquisition), a more simplified model with fewer granular assumptions might suffice. However, if the model is for operational planning or securing project financing, a detailed model with robust assumptions and sensitivity analyses is crucial. The model's complexity should also align with the data available and the time/resources allocated for its development.

Consider these factors: Purpose of the model, Audience for the model, Availability of data, Time and resources available, Materiality of impact. A good financial model strikes a balance between accuracy and usability, avoiding unnecessary complexity that obscures the key drivers and insights. More detail doesn't always equal better; sometimes simplicity provides more clarity. The model should be detailed enough to address the core questions while remaining transparent and easy to understand.

28. What are the differences between building a model for a startup versus an established company?

Building models for startups versus established companies differs primarily in data availability, resources, and the stage of problem definition. Startups often face a scarcity of labeled data, requiring creative solutions like synthetic data generation or active learning. They also operate with limited computational resources and a smaller team, necessitating simpler, more interpretable models that can be rapidly deployed and iterated upon. The problem itself might be vaguely defined, so model building involves a significant amount of exploration and pivoting.

Established companies, conversely, typically possess vast amounts of historical data, allowing for more complex models. They have access to substantial computing power and specialized teams, enabling them to experiment with computationally intensive techniques like deep learning. The problem space is usually well-defined, with clear performance metrics and business objectives, leading to a more focused model development process. The risk tolerance for model failures is generally lower in established companies, leading to more rigorous validation and testing procedures before deployment.

Financial Modeling interview questions for juniors

1. Explain the difference between a model built for operational decision-making versus one built for valuation purposes.

Models for operational decision-making prioritize speed and actionable insights, focusing on optimizing current processes. They often involve real-time data and require frequent updates to reflect changing conditions. The accuracy is important, but secondary to delivering timely recommendations that impact immediate actions, such as optimizing inventory levels, pricing, or routing.

Valuation models, on the other hand, emphasize accuracy and long-term projections. These models are used to estimate the intrinsic value of an asset or business, which may involve more complex calculations and historical data analysis. While speed is still important, the focus is on creating a robust and defensible valuation that can withstand scrutiny and inform strategic decisions, such as mergers, acquisitions, or investment strategies.

2. What are the key drivers of revenue growth for a software-as-a-service (SaaS) business, and how would you model them?

Key drivers of SaaS revenue growth include new customer acquisition, expansion revenue (upselling/cross-selling existing customers), and retention (minimizing churn). I'd model them as follows:

- New Customer Acquisition: Number of new customers * Average contract value (ACV). Model new customer growth using marketing spend, sales team size, conversion rates, and market trends. ACV can be influenced by pricing strategy and product features.

- Expansion Revenue: Number of existing customers * Expansion rate. Expansion rate is derived from upselling, cross-selling, and add-on modules. Model this by identifying successful upsell paths and product adoption rates.

- Retention: (1 - Churn Rate) * Recurring Revenue. Churn is the percentage of customers who cancel their subscriptions. Model churn using customer satisfaction scores, product usage data, and competitor analysis. Reducing churn through improved customer success and product enhancements significantly impacts long-term growth.

3. Describe a situation where you had to make assumptions in a financial model, and how you justified those assumptions.

In a previous role, I was tasked with building a financial model to project the profitability of a new product line. Since the product was entirely new, we lacked historical sales data. Therefore, I had to make assumptions about market penetration and customer adoption rates. To justify these assumptions, I conducted thorough market research, analyzed comparable product launches in similar industries, and consulted with our sales and marketing teams to gather their insights on expected customer behavior.

Specifically, I used competitor's growth rate as a proxy. I also ran sensitivity analyses to understand how changes in these key assumptions would impact the overall profitability forecast. This allowed us to identify the most critical assumptions and develop contingency plans in case the actual results deviated significantly from our initial projections. We actively monitored the actual sales data after the product launch and refined the model based on real-world performance.

4. How do you handle circular references in Excel, and what are some best practices to avoid them?

Circular references in Excel occur when a formula directly or indirectly refers back to its own cell. Excel usually warns you about this. To handle them, first enable iterative calculations under File > Options > Formulas. This allows Excel to resolve circular references up to a certain tolerance. You can also trace the circular reference using Formulas > Error Checking > Circular References. This shows the chain of cells causing the problem.

Best practices to avoid circular references include careful planning of your formulas and spreadsheets, avoiding formulas that directly refer to the cell they are in, and breaking down complex calculations into smaller, independent steps. Use named ranges to improve readability and reduce errors. Thoroughly test and review your spreadsheets, especially when dealing with complex formulas or data models.

5. What are the pros and cons of using relative versus absolute cell referencing in financial models?

Relative cell references change when a formula is copied to another cell, while absolute references remain constant. Pros of relative referencing include enabling quick replication of formulas across rows or columns, adapting to different inputs for each cell. The main con is that unintended cells may be referenced if the formula is copied to a location where the relative references point to incorrect input cells. Pros of absolute referencing include maintaining a consistent reference to a specific cell, ensuring that a particular input remains constant regardless of where the formula is copied. A con is that you need to manually adjust the absolute references if the location of the constant changes, or if you need the reference to change under specific circumstances.

6. Explain how you would model the impact of inflation on a company's financial statements.

To model inflation's impact, I'd adjust historical financial data using price indexes like the Consumer Price Index (CPI). This involves restating non-monetary assets (e.g., property, plant, and equipment, inventory) to their current value. For example, if inventory was purchased when CPI was 100 and current CPI is 110, the inventory value is increased by 10%. Cost of goods sold (COGS) and depreciation expense would also need adjustments based on the restated asset values, impacting net income. Monetary items (cash, receivables, payables) aren't adjusted as they are already stated in current dollars.

Furthermore, I'd analyze how inflation affects revenues and expenses. If a company can't raise prices proportionally to inflation, profitability decreases. Conversely, companies with debt benefit during inflationary periods as the real value of their debt decreases. I'd use sensitivity analysis to project financial statements under different inflation scenarios, highlighting potential risks and opportunities.

7. Describe the difference between a top-down and bottom-up forecasting approach.

Top-down forecasting starts with an aggregate forecast for the overall market or organization and then breaks it down into smaller, more specific forecasts. For example, you might forecast total sales for the year and then allocate that total across regions, product lines, or individual sales representatives. This approach is useful when you have limited data at the detailed level or when overall trends are more reliable.

Bottom-up forecasting, conversely, begins with forecasts at a granular level and then aggregates them to create an overall forecast. For example, you might forecast sales for each product in each store and then sum these forecasts to get a total sales forecast. This approach is useful when you have detailed data available and when local factors significantly influence demand. The key difference is the direction of aggregation: Top-down moves from general to specific, while bottom-up moves from specific to general.

8. How do you ensure the accuracy and integrity of your financial models?

I ensure accuracy and integrity of financial models through several methods. Firstly, I meticulously document all assumptions, data sources, and formulas used in the model. Secondly, I rigorously validate the model's outputs against historical data or independent benchmarks. This includes sanity checks on key metrics and stress-testing the model under various scenarios. Finally, I implement version control to track changes and facilitate collaboration, ensuring that any modifications are properly reviewed and approved. I also adopt coding best practices like modularization and clear variable naming for better readability and maintainability. For example, in Excel, I use the FORMULATEXT function to document complex calculations and use named ranges to improve readability.

To maintain integrity, I implement data validation checks at the input stage to prevent errors. I also use sensitivity analysis to understand the impact of changes in key assumptions and identify potential risks. Regularly reviewing the model's logic and updating it with new information or insights is crucial. Finally, I get the model reviewed by peers to identify any hidden bugs and to ensure a second opinion.

9. Explain how you would model a debt schedule, including principal repayments and interest expense.

A debt schedule models the repayment of a loan over time. It typically includes columns for period number, beginning balance, scheduled payment, interest expense, principal repayment, and ending balance. The interest expense for a period is calculated by multiplying the beginning balance by the interest rate. The principal repayment is the scheduled payment minus the interest expense. The ending balance is the beginning balance minus the principal repayment. This process is repeated for each period until the ending balance is zero.

To build this, a common approach is to use a spreadsheet or a programming language. For example, using Python with pandas:

import pandas as pd

def debt_schedule(principal, interest_rate, periods):

data = []

beginning_balance = principal

for period in range(1, periods + 1):

interest_expense = beginning_balance * interest_rate

scheduled_payment = (principal * interest_rate) / (1 - (1 + interest_rate)**-periods) # Assuming amortizing loan for example, use the PMT formula.

principal_repayment = scheduled_payment - interest_expense

ending_balance = beginning_balance - principal_repayment

data.append([period, beginning_balance, scheduled_payment, interest_expense, principal_repayment, ending_balance])

beginning_balance = ending_balance

df = pd.DataFrame(data, columns=['Period', 'Beginning Balance', 'Scheduled Payment', 'Interest Expense', 'Principal Repayment', 'Ending Balance'])

return df

# Example

debt_schedule(100000, 0.05, 30)

10. What are some common Excel errors you have encountered, and how did you resolve them?

I've encountered several common Excel errors. #DIV/0! occurs when a formula attempts to divide by zero or an empty cell; I resolve this by using IFERROR to return a 0 or a custom message when the denominator is zero. #NAME? arises when Excel doesn't recognize text in a formula, often due to typos or undefined named ranges; I fix it by carefully reviewing the formula for spelling errors and ensuring all named ranges are correctly defined.

Another frequent error is #VALUE!, which appears when a formula expects a specific data type but receives a different one (e.g., trying to add text to a number). I debug this by checking the cell formats and the inputs to the formula, using functions like VALUE() or TEXT() to convert data types as needed. Lastly, I see #REF! when a formula refers to a cell that has been deleted; I address it by updating the formula to point to the correct cell or range.

11. How would you model different scenarios (e.g., best case, worst case, base case) in a financial model?

To model different scenarios in a financial model, I would typically adjust key input variables that drive the model's outputs. For example, in a sales forecast, I might have variables like market growth rate, market share, and pricing.

I would then create distinct sets of these input variables for each scenario:

- Best Case: Optimistic assumptions for key drivers (e.g., high market growth, increased market share).

- Worst Case: Pessimistic assumptions for key drivers (e.g., low market growth, decreased market share, aggressive pricing).

- Base Case: Most likely or expected assumptions for key drivers (based on historical data and current market conditions).

By running the model with each set of assumptions, I can observe the range of possible outcomes and assess the potential risks and rewards.

12. Explain how to use the INDEX and MATCH functions in Excel, and provide an example.

The INDEX and MATCH functions in Excel are often used together to perform more advanced lookups than VLOOKUP or HLOOKUP. INDEX returns the value of a cell within a range based on its row and column number. MATCH returns the position of a value within a range. By combining them, you can look up a value based on both row and column criteria, even when the data isn't in a specific order.

Example: =INDEX(C1:E10, MATCH("ProductB", A1:A10, 0), MATCH("Price", C1:E1, 0)). This formula searches for "ProductB" in column A (using MATCH to find the row number) and "Price" in row 1 (using MATCH to find the column number). Then, INDEX returns the value at the intersection of that row and column within the range C1:E10.

13. Describe the importance of sensitivity analysis in financial modeling, and how you would perform it.

Sensitivity analysis is crucial in financial modeling because it helps to understand how changes in input variables impact the model's outputs. It reveals the model's robustness and identifies key drivers of results, allowing for better decision-making by highlighting potential risks and opportunities. By quantifying the impact of uncertainty, sensitivity analysis informs risk management and scenario planning.

To perform sensitivity analysis, I would systematically vary one or more input variables while holding others constant and observe the effect on the output. This can be done manually by creating different scenarios or using tools like Excel's Data Tables or Goal Seek. More advanced techniques include Monte Carlo simulations to randomly sample input values from specified distributions, providing a probabilistic assessment of potential outcomes. The results are then analyzed to determine the sensitivity of the model to each input.

14. How would you model the tax implications of a merger or acquisition?

Modeling the tax implications of a merger or acquisition involves a complex interplay of factors. Key considerations include the deal structure (stock vs. asset purchase), the tax basis of the assets involved, and any potential carryover tax attributes (net operating losses, tax credits). The model would need to project taxable income or loss, consider applicable tax rates, and factor in any tax planning strategies to minimize the overall tax burden. The specific tax code sections relevant to M&A (e.g., Section 338, Section 368) must be considered, along with any state and local tax implications.

A quantitative model would typically incorporate scenarios for various deal structures and their corresponding tax consequences. Sensitivity analysis can be performed to assess the impact of key assumptions, such as future profitability and the utilization of tax attributes. Furthermore, modeling should account for timing differences in tax payments and the present value of tax benefits and costs.

15. What are some best practices for formatting and presenting financial models to stakeholders?

When presenting financial models, clarity and accuracy are key. Format numbers consistently (e.g., using commas, consistent decimal places, currency symbols). Use clear and concise labels for all inputs, outputs, and calculations. Employ cell formatting (colors, borders) to highlight key areas and differentiate between inputs and outputs. Structure the model logically, often with a clear separation of assumptions, calculations, and results.

To ensure effective communication, include a summary dashboard presenting the key metrics and insights. Use charts and graphs to visualize the model's outputs and sensitivities. Document assumptions clearly, explaining their rationale and potential impact. Consider providing scenario analysis to demonstrate the model's behavior under different conditions. Finally, ensure the model is auditable and transparent, making it easy for stakeholders to understand the calculations and underlying logic.

16. Explain how you would calculate the weighted average cost of capital (WACC) and its importance in valuation.

The Weighted Average Cost of Capital (WACC) is the average rate of return a company expects to pay to finance its assets. It's calculated by taking the weighted average of the costs of each component of the company's capital structure – debt and equity. The formula is: WACC = (E/V) * Cost of Equity + (D/V) * Cost of Debt * (1 - Tax Rate), where E is the market value of equity, D is the market value of debt, V is the total market value of capital (E+D). Cost of equity can be estimated using CAPM or dividend discount model, and cost of debt is typically the yield to maturity on outstanding debt. The tax rate reduces the effective cost of debt due to the tax deductibility of interest payments.

WACC is a crucial input in valuation because it's used as the discount rate to calculate the present value of a company's future cash flows in discounted cash flow (DCF) analysis. A lower WACC results in a higher present value, making the company more attractive. It's also used to evaluate investment opportunities and to determine the feasibility of projects. Projects with an expected return higher than the company's WACC are typically considered value-creating, while those with a lower return may not be worthwhile.

17. Describe how to model working capital (e.g., accounts receivable, inventory, accounts payable) in a financial model.

Modeling working capital involves projecting the balances of key current assets and liabilities. Accounts Receivable is often modeled as a function of sales, using Days Sales Outstanding (DSO). Inventory can be modeled using either Days Inventory Outstanding (DIO) or inventory turnover, linked to Cost of Goods Sold (COGS). Accounts Payable is similarly linked to COGS, using Days Payable Outstanding (DPO).

The formulas are as follows:

- Accounts Receivable = (Sales / 365) * DSO

- Inventory = (COGS / 365) * DIO

- Accounts Payable = (COGS / 365) * DPO

These calculations are crucial for forecasting cash flow and understanding a company's operational efficiency. Changes in these metrics can significantly impact a company's cash flow needs and overall financial health.

18. How do you decide which level of detail to include in a financial model?

The level of detail in a financial model should be driven by the model's purpose and the availability of reliable data. Start with the key drivers of the business and model those in detail. Simplify or aggregate less critical areas. Consider the audience; a model for high-level strategic planning requires less granularity than one used for detailed operational forecasting.

Prioritize accuracy and transparency. Adding excessive detail doesn't always improve accuracy and can make the model more complex to understand and maintain. Focus on the variables that have the most significant impact on the output, such as revenue drivers, key costs, and major capital expenditures. Regularly review and refine the model, adjusting the level of detail as needed to balance accuracy with simplicity and interpretability.

19. Explain how you would model the impact of a change in interest rates on a company's financial performance.

Changes in interest rates can significantly impact a company's financial performance. Higher interest rates increase borrowing costs, reducing profitability, especially for companies with substantial debt. This can lead to lower net income and potentially decreased investment in growth opportunities. Conversely, lower interest rates decrease borrowing costs, increasing profitability and potentially stimulating investment. Companies with variable-rate debt are most directly affected.

Specifically, I'd analyze several key metrics: 1. Net Interest Expense: This is the most direct impact. 2. Discounted Cash Flow (DCF): Higher rates increase the discount rate, lowering the present value of future cash flows. 3. Capital Expenditures (CAPEX): Higher borrowing costs may delay or reduce planned investments. 4. Working Capital: Higher rates can increase the cost of financing working capital needs. A full financial model would need to incorporate these factors to predict the change. Also look at how the company hedges to mitigate the impact.

20. Describe a time when you had to debug or troubleshoot someone else's financial model.

In a previous role, a colleague built a financial model to forecast revenue growth for a new product line. When the projections seemed overly optimistic, I was asked to review it. The model was complex, with numerous interconnected sheets and formulas. My approach involved first understanding the model's overall structure and key drivers. I then traced the flow of data through the model, examining each formula and assumption for accuracy and reasonableness. I identified a few key issues:

- An incorrect growth rate formula was being applied. It was using an arithmetic mean instead of a geometric mean, inflating the projected growth.

- Several assumptions about market share penetration were not supported by market research.

- A couple of hardcoded numbers were used instead of referencing the relevant cells.

After correcting these issues and discussing the revised assumptions with the product team, the model produced a more realistic and defensible forecast. I documented all the changes I made and also suggested improvements to model structure to make it easier to maintain and audit.

21. How would you model the financials of a startup company with limited historical data?

When modeling the financials of a startup with limited historical data, I would rely heavily on assumptions and industry benchmarks. I'd start by building a bottom-up revenue forecast, estimating units sold, pricing, and market penetration based on comparable companies or market research. Cost of goods sold would be estimated based on anticipated production costs or service delivery expenses. Operating expenses would be projected based on the planned team size, marketing spend, and other essential overhead, referencing industry averages for similar-stage startups.

For the income statement, I would project revenue, COGS, and operating expenses over a 3-5 year period. The balance sheet would be built by estimating assets like cash (linked to funding and profitability), accounts receivable (linked to sales), and liabilities like accounts payable. A cash flow statement would then be derived, focusing on cash burn rate, runway, and the timing of future funding rounds. Sensitivity analysis would be crucial to assess the impact of key assumptions on the model's outcome, allowing for more informed decision-making given the inherent uncertainty.

22. Explain how you would use data tables and scenario manager in Excel for sensitivity analysis.

Data tables and Scenario Manager are Excel tools for sensitivity analysis. Data tables show how changes in one or two input variables affect one or more formulas. You set up a table with the input variables and the formulas you want to analyze. Excel then calculates the formula results for each combination of input values. Scenario Manager, on the other hand, lets you define multiple "scenarios" representing different sets of input values. For example, you might have a "best case", "worst case", and "most likely case" scenario. You can then easily switch between scenarios to see how your formulas change based on these different input sets. While data tables show impact of incremental changes in a few variables, scenarios let you manage and quickly switch between drastically different input sets.

23. Describe the importance of understanding the business you are modeling, and how you would gain that understanding.

Understanding the business you are modeling is crucial for building effective and relevant solutions. Without it, you risk creating models that are technically sound but fail to address real-world needs or produce meaningful insights. A strong business understanding ensures that the model's objectives align with the organization's goals, the input data is relevant and accurate, and the results are interpretable and actionable. Ultimately, it bridges the gap between technical expertise and practical application, leading to more successful and impactful outcomes.

To gain this understanding, I would employ several strategies. First, I'd engage in thorough discussions with stakeholders across different departments to learn about their roles, challenges, and objectives. Secondly, I'd review existing documentation, reports, and data sources to grasp the current processes and key performance indicators. Finally, I would actively participate in workshops or shadowing opportunities to observe the business in action and gain firsthand experience.

24. How would you model the impact of a new product launch on a company's financials?

To model the financial impact of a new product launch, I'd create a financial forecast incorporating key assumptions. This involves estimating unit sales, pricing, cost of goods sold (COGS), marketing expenses, and any required capital expenditures. I'd then project revenue (unit sales * price), gross profit (revenue - COGS), operating expenses (marketing, sales, etc.), and ultimately, net income. Sensitivity analysis, varying key assumptions like sales volume and price, helps understand the range of potential outcomes and identify key risks and opportunities.

Specifically, I'd build a discounted cash flow (DCF) model to determine the product's net present value (NPV). This model would project free cash flows generated by the product over its estimated lifespan, discounted back to the present using an appropriate discount rate (weighted average cost of capital). A positive NPV suggests the product launch is financially viable.

25. What are some common mistakes to avoid when building financial models?

Common mistakes in financial modeling include hardcoding assumptions instead of using formulas and drivers, which reduces flexibility and increases the risk of errors. It's also important to avoid inconsistent time periods or mismatching units (e.g., mixing monthly and annual data) and neglecting sensitivity analysis to understand how changes in key assumptions impact the results.

Another frequent issue is overcomplicating the model, making it difficult to understand, audit, and maintain. Ensure the model is transparent, well-documented, and uses clear formulas. Additionally, neglecting to properly validate the model with historical data or benchmark it against industry standards can lead to inaccurate forecasts.

26. Explain how you would model the impact of foreign exchange rates on a company's financial statements.

The impact of foreign exchange rates on a company's financial statements is primarily modeled through translation and transaction effects. Translation effects occur when a company consolidates financial statements of foreign subsidiaries. Assets and liabilities denominated in foreign currencies are translated into the reporting currency (e.g., USD) using either the current exchange rate (for balance sheet items) or the average exchange rate for the period (for income statement items). This translation can result in a translation gain or loss, which is typically reported in the cumulative translation adjustment (CTA) within equity.

Transaction effects arise from actual transactions (e.g., sales, purchases, loans) denominated in foreign currencies. When these transactions are settled, the difference between the exchange rate at the transaction date and the settlement date results in a transaction gain or loss, which is recognized in the income statement. Companies often use hedging strategies (e.g., forward contracts, options) to mitigate these transaction exposures. These hedging instruments are accounted for separately, with changes in their value recognized in profit or loss or other comprehensive income, depending on the hedging designation.

27. Describe how to use the XIRR and XNPV functions in Excel for evaluating investments with irregular cash flows.

XIRR (Extended Internal Rate of Return) and XNPV (Extended Net Present Value) are Excel functions used to evaluate investments when cash flows occur at irregular intervals. Unlike IRR and NPV, which assume cash flows happen at equal time periods, XIRR and XNPV take specific dates into account.

XIRR calculates the internal rate of return for a series of cash flows that occur at irregular intervals. You provide XIRR with two ranges: a range of cash flows (including the initial investment as a negative value) and a corresponding range of dates for those cash flows. The formula is =XIRR(values, dates, [guess]). XNPV calculates the net present value of a series of cash flows occurring at irregular intervals, given a discount rate. The syntax is =XNPV(rate, values, dates). You provide XNPV with the discount rate, a range of cash flows, and a corresponding range of dates. The values and dates ranges must be the same size. The result is the present value of the cash flows, discounted by the given rate.

28. How would you approach modeling a business with a high degree of seasonality?

To model a business with high seasonality, I'd primarily focus on incorporating time series analysis. This involves techniques like:

- Decomposition: Breaking down the time series data into trend, seasonal, and residual components.

- ARIMA/SARIMA: Utilizing Seasonal ARIMA models to capture the autocorrelation and seasonality within the data. SARIMA (Seasonal ARIMA) explicitly handles the seasonal components. I would choose parameters based on ACF and PACF plots.

- Regression with Seasonal Dummies: Including dummy variables for different seasons (e.g., months, quarters) in a regression model.

- Prophet: Leveraging the Prophet library, which is specifically designed for forecasting time series data with strong seasonality. I'd also incorporate external regressors if available to further improve model accuracy. Careful feature engineering of seasonal features is paramount.

29. Explain how to use the OFFSET function in Excel, and provide an example of its use in financial modeling.

The OFFSET function in Excel returns a reference to a range that is a specified number of rows and columns from a starting reference point. The syntax is OFFSET(reference, rows, cols, [height], [width]). reference is the starting point, rows is the number of rows to offset (positive moves down, negative moves up), cols is the number of columns to offset (positive moves right, negative moves left), height is the height of the returned range, and width is the width of the returned range.

For example, in financial modeling, you might use OFFSET to create a dynamic range for calculating a moving average. If your data starts in cell A1 and represents monthly sales figures, OFFSET(A1,ROW(A1:A12)-1,1) could be used to shift the starting cell to next column to calculate sales of subsequent years (assuming 12 months of data). Similarly, OFFSET(A1, 0, 0, 5, 1) creates a 5 row by 1 column range starting at A1, which could represent the past 5 months of sales.

30. If you have a company with a large one-time legal expense, how would this impact the model vs the forecast?

A large, one-time legal expense would significantly impact the model differently than the forecast. In the model, particularly a financial model used for valuation or projections, this expense would be treated as a non-recurring item. It would reduce the current period's profitability, impacting metrics like net income and earnings per share. To get a clearer picture of the company's ongoing performance, analysts often 'adjust' earnings by removing the effect of this one-time event. This adjustment provides a better view of normalized earnings for valuation purposes.

In a forecast, especially one focusing on future periods, the one-time legal expense should not be included, unless there's a very high probability of a similar event occurring in the forecast horizon. Including it would distort future profitability projections and potentially lead to an inaccurate assessment of the company's future financial health. Forecasts aim to predict sustainable performance, and a one-time item is, by definition, unsustainable. The expense might, however, indirectly influence future assumptions – perhaps increased compliance costs if the legal issue revealed a systemic weakness.

Financial Modeling intermediate interview questions

1. How would you model a scenario where a company's revenue growth is dependent on a macroeconomic factor like GDP growth?

I would model the company's revenue growth as a function of GDP growth using a regression model. A simple linear regression could be Revenue Growth = α + β * GDP Growth, where α is the intercept (revenue growth independent of GDP) and β is the coefficient representing the sensitivity of revenue growth to GDP growth. More complex models like polynomial regression or incorporating other macroeconomic factors might be used for increased accuracy. We could use historical data to estimate these coefficients and then use the model to forecast future revenue growth based on projected GDP growth.

Alternatively, I could use scenario analysis, defining a range of GDP growth scenarios (e.g., low, medium, high) and estimating the corresponding revenue growth for each. This allows for a more flexible and less rigid approach than a strict formula, especially if the relationship between GDP and revenue is not linear or easily quantifiable. For example, IF GDP Growth < 1% THEN Revenue Growth = 2%; IF GDP Growth >= 1% AND GDP Growth < 3% THEN Revenue Growth = 5%; IF GDP Growth >= 3% THEN Revenue Growth = 8%.

2. Explain the process of building a three-statement financial model from scratch. What are the key linkages?

Building a three-statement financial model involves creating an income statement, balance sheet, and cash flow statement, and linking them dynamically. You typically start with the income statement, projecting revenue based on historical trends and assumptions. Expenses are then projected, leading to net income. This net income flows to the retained earnings section of the balance sheet. The balance sheet also requires projections for assets (like accounts receivable, inventory, and PP&E) and liabilities (like accounts payable and debt). These are often linked to revenue or cost of goods sold using ratios.

The cash flow statement is derived from changes in balance sheet accounts and the income statement. Net income from the income statement is the starting point for the cash flow from operations section. Changes in working capital (accounts receivable, accounts payable, inventory) also affect cash flow from operations. Capital expenditures (CAPEX) drive cash flow from investing. Debt and equity transactions influence cash flow from financing. The ending cash balance on the cash flow statement should match the cash balance on the balance sheet, creating a circularity that requires iterative calculations (e.g., using Excel's iterative calculation settings or goal seek). Key linkages include net income flowing to retained earnings and cash flow statement, changes in balance sheet items driving cash flow from operations, and depreciation expense impacting both the income statement and cash flow statement (as a non-cash charge).

3. Describe how you would incorporate seasonality into a sales forecast model. Give an example.

To incorporate seasonality into a sales forecast model, I would first analyze historical sales data to identify recurring patterns within a year. This involves techniques like time series decomposition to separate the seasonal component from the trend and residual components. I would then use this seasonal component, often represented as seasonal indices, to adjust the baseline forecast generated by a non-seasonal model (like linear regression or ARIMA). For example, if December sales are consistently 1.5 times higher than the average monthly sales, the December seasonal index would be 1.5. The baseline forecast for December would then be multiplied by 1.5 to incorporate the seasonality.

For example, if a basic ARIMA model predicts 100 units sold in December, and the seasonal index for December (based on historical data) is 1.2, then the seasonality-adjusted forecast would be 100 * 1.2 = 120 units. This assumes the identified seasonal pattern will persist in the future.

4. How do you determine the appropriate discount rate to use in a discounted cash flow (DCF) model for a private company?

Determining the discount rate for a private company in a DCF model is challenging due to the lack of publicly traded stock data. A common approach is to use the Capital Asset Pricing Model (CAPM), but with adjustments. Since beta is not readily available, you can use the beta of comparable publicly traded companies in the same industry. Then, unlever the beta to remove the impact of debt, average the unlevered betas of the comparables, and relever it using the target company's debt-to-equity ratio. Furthermore, a size premium may be added to reflect the higher risk associated with smaller companies. Finally, a company-specific risk premium should be considered to account for risks not captured by CAPM, such as management quality or regulatory issues. The formula would be: Discount Rate = Risk-Free Rate + Levered Beta * Market Risk Premium + Size Premium + Company-Specific Risk Premium.

Alternatively, one could use the Build-Up Method, which is a simplified approach. It starts with the risk-free rate and adds premiums for equity risk, size, and company-specific factors. This method relies more on subjective judgment than CAPM but can be useful when comparable company data is limited. Both methods require careful consideration and sound judgment to arrive at a reasonable discount rate.

5. Walk me through how to model debt repayments, considering both mandatory and optional prepayments. What complexities arise?

Modeling debt repayments involves tracking scheduled payments and incorporating the impact of optional prepayments. Mandatory repayments follow a predetermined schedule (e.g., fixed monthly payments, amortization schedules). Optional prepayments allow borrowers to pay more than the scheduled amount, reducing the principal balance and future interest expense. The model needs to handle scenarios where prepayments can be made at any time and adjust the remaining payment schedule accordingly, which usually involves recalculating amortization schedules from the point when the prepayment was made.

The complexities include managing various prepayment penalties (if applicable), efficiently updating the remaining loan balance and repayment schedule upon each prepayment (the data structure chosen will affect performance - an array or a linked list representing future payments), and accurately calculating interest accrual based on the changing principal balance. Assumptions around prepayment behavior (e.g., borrowers prepaying when interest rates drop) can significantly impact the model's accuracy. Furthermore, the data structure used to model payments should be performant for large debt portfolios.

6. How would you model a merger or acquisition in a financial model, detailing the key assumptions and integration challenges?

Modeling a merger or acquisition in a financial model involves several key steps. First, you'd project the standalone financials of both the acquirer and the target company. Then, you'd layer in the M&A assumptions, including the purchase price, financing structure (debt/equity mix), deal costs (legal, advisory fees), and synergies. Synergies are critical and should be modeled conservatively; these are typically broken down into revenue synergies (increased sales from cross-selling, market expansion) and cost synergies (operational efficiencies, headcount reduction). You would then consolidate the financials of the combined entity, reflecting the purchase accounting adjustments (e.g., goodwill creation, asset write-ups).

Integration challenges significantly impact the success of the deal. Key challenges include: cultural differences between the organizations, difficulties in integrating IT systems, loss of key personnel, and potential disruptions to existing operations. These factors directly affect the realization of projected synergies, so sensitivity analysis around these assumptions is vital. A robust model should allow you to flex key synergy assumptions and understand the impact on key metrics like EPS accretion/dilution, leverage ratios, and return on invested capital (ROIC).

7. Explain how to handle circular references in a financial model and what techniques you use to resolve them.

Circular references in financial models occur when formulas depend on each other, creating a loop. This can lead to inaccurate or unstable results. Handling these requires careful analysis and often involves breaking the circularity. Techniques include:

- Iteration: Enable iterative calculations in the spreadsheet software (like Excel). This allows the model to recalculate multiple times until the values converge to a stable solution. However, it's crucial to monitor the convergence and set appropriate iteration limits to prevent infinite loops.

- Algebraic solutions: Sometimes, the circularity can be resolved by manually solving the equations algebraically and substituting the result into the model. This removes the dependency loop.

- Using helper columns/variables: Introduce intermediate calculations or variables that break the direct dependency between the cells. For example, instead of directly calculating interest expense based on the final debt balance (which depends on interest expense), calculate it based on the beginning debt balance.

- VBA/Macros (if applicable): If the model is complex, VBA code can be used to perform the iterative calculations or to implement more sophisticated solution algorithms.

8. Describe the steps involved in performing a sensitivity analysis on a financial model. Which variables are most crucial to test?

Sensitivity analysis in financial modeling involves systematically changing input variables to observe their impact on the model's output. The general steps are: 1. Identify key input variables: Determine which assumptions significantly drive the model's results. 2. Define a range of values: Establish a reasonable range (best-case, worst-case, and base-case) for each chosen variable. 3. Run the model with different scenarios: Alter one variable at a time, keeping others constant, and record the output changes. 4. Analyze the results: Evaluate how sensitive the model's output is to each variable's fluctuation and identify which ones have the most significant impact. 5. Document findings: Clearly report the variables tested, the ranges used, and their impact on the financial model.

Crucial variables to test often include revenue growth rate, cost of goods sold (COGS), discount rate (WACC), terminal growth rate (for valuation models), and capital expenditure (CAPEX). Variables impacting revenue (e.g., sales volume, price) and those affecting profitability (e.g., operating expenses) are also key. The specific variables will depend on the model's purpose (e.g., valuation, budgeting, forecasting).

9. How do you model different capital structures (e.g., debt vs. equity financing) and their impact on financial ratios and valuation?

Different capital structures, like debt vs. equity, significantly impact financial ratios and valuation. Debt financing increases financial leverage, affecting ratios like debt-to-equity and interest coverage. Higher debt typically lowers the weighted average cost of capital (WACC) initially, potentially increasing valuation, as the cost of debt is often lower than the cost of equity. However, excessive debt can raise the risk of financial distress, increasing the cost of both debt and equity, ultimately lowering valuation due to a higher WACC and decreased free cash flows (due to higher interest payments). Equity financing, conversely, reduces financial leverage, improving financial ratios related to solvency but can dilute existing shareholders' ownership. It typically increases the WACC (higher cost of equity) if the firm previously utilized cheaper debt financing, potentially reducing valuation unless the equity investment facilitates higher growth or reduces other risks.

To model these effects, you can adjust the capital structure inputs in a discounted cash flow (DCF) model or other valuation frameworks. For example, increasing the debt-to-equity ratio in the model will change the WACC, impacting the present value of future cash flows. Sensitivity analysis can be performed to assess the range of possible valuation outcomes under different capital structure scenarios. Furthermore, the impact on key financial ratios can be directly calculated based on the projected changes in debt and equity levels. Analyzing these ratios will give insights on potential covenants that might be violated.

10. Explain how to model contingent liabilities in a financial model. Provide examples.

Contingent liabilities are potential liabilities that may or may not materialize, depending on the occurrence of a future event. In financial modeling, these are typically modeled using scenario analysis or probability-weighted outcomes. For example, a company facing a lawsuit can model different settlement amounts based on the probability of winning, losing, or settling the case. Each outcome (win, lose, settle) is assigned a probability and a corresponding financial impact (e.g., legal fees, damages). The expected value of the contingent liability is then the sum of the probability-weighted outcomes.

Another approach involves incorporating contingent liabilities as an expense if certain thresholds or conditions are met. For example, a warranty expense might be recognized once the number of claims exceeds a predefined percentage of sales. Other examples include guarantees on debt (modeled as a potential increase in liabilities if the guaranteed party defaults) and environmental remediation costs (modeled as an expense if contamination levels exceed regulatory limits). Sensitivity analysis should also be performed on key assumptions (probabilities, settlement amounts, claim rates) to understand the potential range of outcomes.

11. How would you approach modeling a company with multiple business segments, each with different growth rates and margins?

I would model each business segment separately, forecasting revenue based on its specific growth rate. I'd also model the cost structure and margins unique to each segment. This allows for a more accurate overall company forecast by capturing the nuances of each business. The individual segment forecasts would then be aggregated to produce a consolidated company view. Sensitivity analysis can then be performed on key growth and margin assumptions for each segment to understand the impact on the overall company performance.

Specifically, I would:

- Project revenue for each segment using segment-specific growth rates.

- Calculate cost of goods sold (COGS) for each segment using segment-specific margins.

- Model operating expenses, either at the segment level or allocated from corporate expenses.

- Calculate the profit for each segment.

- Sum the segment profits to arrive at the consolidated profit.

- Perform a sensitivity analysis. For example, I would look into how a 1% change in the segment growth rate affects the overall profit of the company.

12. Discuss how to incorporate the impact of inflation on different line items in a financial model. What are the key considerations?

To incorporate inflation in a financial model, adjust revenue, expenses, and asset/liability values by appropriate inflation rates. For revenue, consider price increases over time. For expenses, factor in rising costs of goods sold (COGS), salaries, and operating expenses. For assets, consider the impact on depreciation (if applicable) and replacement costs. Liabilities might be affected if interest rates are tied to inflation.

Key considerations include: choosing appropriate inflation rates (overall CPI, or specific indices for certain items), determining the sensitivity of different line items to inflation, deciding whether to use nominal or real values (nominal includes inflation, real excludes it), and understanding how inflation impacts debt and investment returns. Consistency in applying inflation assumptions is critical for accurate forecasting.

13. Explain the difference between a top-down and a bottom-up forecasting approach and when each is most appropriate.

A top-down forecasting approach starts with an aggregate forecast for the overall entity (e.g., total sales) and then breaks it down into smaller, more detailed forecasts (e.g., sales by region or product). This method is best when historical data is limited at the granular level, when you need a high-level overview quickly, or when the overall trend strongly influences the individual components. A bottom-up approach, conversely, begins by forecasting individual components (e.g., sales for each product in each store) and then aggregating these forecasts to obtain the overall forecast. This approach is suitable when detailed historical data is available, when the components are relatively independent, and when understanding the individual drivers of each component is important. Bottom-up can be more accurate if the component forecasts are well-informed and the aggregate forecast isn't significantly affected by interdependencies.

14. Describe how you would model the impact of a significant change in tax law on a company's financial statements.

To model the impact of a significant change in tax law on a company's financial statements, I would first identify the specific provisions of the new law that affect the company. This involves analyzing the changes in tax rates, deductions, credits, and other relevant aspects. Next, I would quantify the financial effects of these changes on the income statement, balance sheet, and statement of cash flows. For the income statement, this means recalculating the company's tax expense based on the new rules, which impacts net income. On the balance sheet, deferred tax assets and liabilities would need to be adjusted to reflect the future tax consequences of temporary differences under the new tax law. Finally, the statement of cash flows would reflect the changes in cash paid for taxes. Scenario analysis with different assumptions about future profitability and tax planning strategies would help to understand the range of potential outcomes and inform decision-making. This analysis needs to ensure compliance with accounting standards related to income taxes (e.g., ASC 740 in the US).