Hiring a Risk Analyst is a critical task for many organizations, yet it's often mishandled. Companies frequently underestimate the complexity of the role, leading to mismatches between candidate skills and job requirements. A top-notch Risk Analyst can significantly impact an organization's decision-making process and financial health, making it crucial to get this hire right.

This comprehensive guide will walk you through the process of hiring a Risk Analyst, from identifying key skills to structuring interviews. We'll cover everything you need to know to find the ideal Risk Analyst for your team.

Table of contents

Skills and qualifications to look for in a Risk Analyst

Crafting the right candidate profile for a Risk Analyst can be tricky, as it requires balancing technical skills with industry knowledge. It's important to distinguish between required and preferred skills to streamline the hiring process. While certain qualifications might be non-negotiable, others can be more flexible based on your organization's specific needs.

When evaluating candidates, you'll want to ensure they have a solid foundation in risk analysis along with strong analytical and problem-solving skills. Proficiency in statistical analysis and risk modeling techniques is a must. Equally important are excellent communication and reporting skills to effectively convey risk assessments to stakeholders. For more insights on skills-based hiring, consider exploring Adaface's resources.

| Required skills and qualifications | Preferred skills and qualifications |

|---|---|

| Bachelor's degree in Finance, Economics, Mathematics, or related field | Master's degree in Finance, Risk Management, or related field |

| 3+ years of experience in risk analysis or related financial role | Professional certifications (e.g., FRM, PRM, CFA) |

| Proficiency in statistical analysis and risk modeling techniques | Experience with regulatory compliance (e.g., Basel III, Dodd-Frank) |

| Strong analytical and problem-solving skills | Knowledge of machine learning and AI applications in risk management |

| Excellent communication and reporting skills | Familiarity with programming languages (e.g., Python, R) |

How to write a Risk Analyst job description?

Once you have a clear candidate profile for your Risk Analyst role, the next step is to effectively capture that information in the job description to attract the right talent. A well-crafted job description is your first opportunity to engage potential candidates.

• Highlight key responsibilities and impact: Clearly outline the responsibilities associated with the Risk Analyst position, such as risk assessment and reporting. Emphasizing how their work contributes to the organization's overall risk management strategy will attract candidates who are looking to make a meaningful impact.

• Balance technical skills with soft skills: While it's important to list technical requirements like familiarity with risk management software and data analysis tools, don't overlook the soft skills necessary for the role. Skills such as analytical thinking, communication, and teamwork are vital for collaborating with different departments and stakeholders.

• Showcase your company's unique value: Include what makes your organization and this role stand out. Whether it's opportunities for professional development, a diverse work environment, or involvement in innovative projects, these aspects can help attract top candidates who resonate with your company culture. For example, you can refer to a detailed Risk Analyst job description to get a clearer idea of how to frame this.

Top Platforms to Source Risk Analysts

Now that you have crafted a compelling job description for a Risk Analyst, it's time to position it on job listing platforms to attract the right candidates. These platforms will help you reach a broad audience and connect with potential hires whose skills align with your requirements.

LinkedIn Jobs

Ideal for finding full-time Risk Analyst positions in established companies. Offers extensive networking opportunities and detailed company profiles.

Indeed

Versatile platform for all types of Risk Analyst roles. Aggregates listings from multiple sources and offers easy application processes.

Glassdoor Jobs

Excellent for full-time Risk Analyst positions with added benefit of company reviews and salary insights.

Beyond the initial listings, several other platforms can aid in finding the right Risk Analyst for your team. Dice is ideal for tech-centric roles, especially in fintech or IT risk management. Upwork provides access to freelance Risk Analysts for short-term projects. Monster and CareerBuilder offer diverse job listings spanning across various industries. Robert Half specializes in finance roles, providing both temporary and permanent placement services. ZipRecruiter uses AI technology to match candidates with job postings, which can be beneficial for niche positions. Lastly, AngelList Talent is a fantastic platform for sourcing Risk Analysts for startups or innovative companies. Discover more about optimizing your recruitment process with enterprise recruitment software.

Keywords to Look for in Risk Analyst Resumes

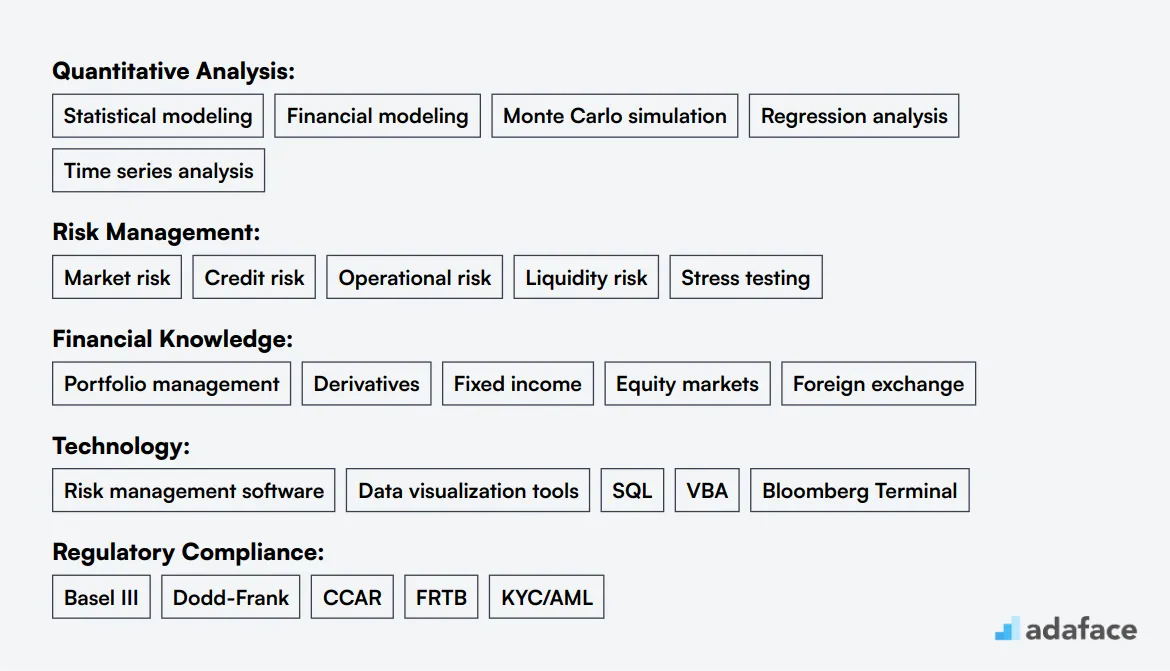

Resume screening is a crucial step in hiring Risk Analysts. It helps you quickly identify candidates with the right skills and experience before investing time in interviews.

When manually screening resumes, focus on key terms related to risk management, financial analysis, and regulatory compliance. Look for candidates with experience in statistical modeling, market risk assessment, and financial forecasting.

To streamline the process, consider using AI-powered tools or language models. These can help you quickly scan multiple resumes and highlight relevant skills and experiences based on your specific criteria.

Here's a sample prompt for AI-assisted resume screening:

TASK: Screen resumes for Risk Analyst role

INPUT: Resumes

OUTPUT: For each resume, provide:

- Email

- Name

- Matching keywords

- Score (out of 10)

- Recommendation

- Shortlist (Yes, No, Maybe)

KEYWORDS:

- Risk Management (Market, Credit, Operational)

- Financial Analysis

- Statistical Modeling

- Regulatory Compliance (Basel III, Dodd-Frank)

- [Data Analysis](https://www.adaface.com/assessment-test/data-analysis-test)

- Risk Modeling Software

Recommended Skills Tests for Assessing Risk Analysts

Skills tests are a great way to evaluate Risk Analysts beyond their resumes. They provide objective insights into a candidate's abilities and help you make informed hiring decisions. Here are some key tests to consider when assessing Risk Analysts:

Financial Analyst Test: This test evaluates a candidate's understanding of financial concepts, risk assessment techniques, and ability to analyze financial data. It's useful for gauging their capacity to identify and mitigate financial risks.

Data Analysis Test: Risk Analysts need strong data analysis skills. A Data Analysis test can assess their ability to interpret complex datasets, identify patterns, and draw meaningful conclusions relevant to risk management.

Business Intelligence Analyst Test: This test evaluates a candidate's ability to analyze business data and provide insights. It's valuable for assessing how well they can identify potential risks and opportunities within an organization.

Financial Modeling Test: Financial modeling skills are important for Risk Analysts to forecast potential scenarios and their impacts. This test assesses their ability to create and interpret financial models for risk assessment.

Cognitive Ability Test: Risk analysis requires strong problem-solving and critical thinking skills. A cognitive ability test can help evaluate a candidate's logical reasoning and decision-making capabilities in complex situations.

How to Structure the Interview Stage for Hiring Risk Analysts

After candidates pass the initial skills tests, it's time for technical interviews to assess their hard skills in-depth. While skills tests are great for initial screening, technical interviews are key to finding the best fit for your Risk Analyst role. Let's look at some sample interview questions to help you evaluate candidates effectively.

Consider asking: 1) 'How do you approach quantifying and measuring risk?' 2) 'Can you explain Value at Risk (VaR) and its limitations?' 3) 'What risk management frameworks are you familiar with?' 4) 'How would you handle a situation where management disagrees with your risk assessment?' 5) 'Can you describe a time when you used Excel to model financial risk?' These questions help assess the candidate's technical knowledge, problem-solving skills, and real-world experience in risk analysis.

What is the Cost of Hiring a Risk Analyst?

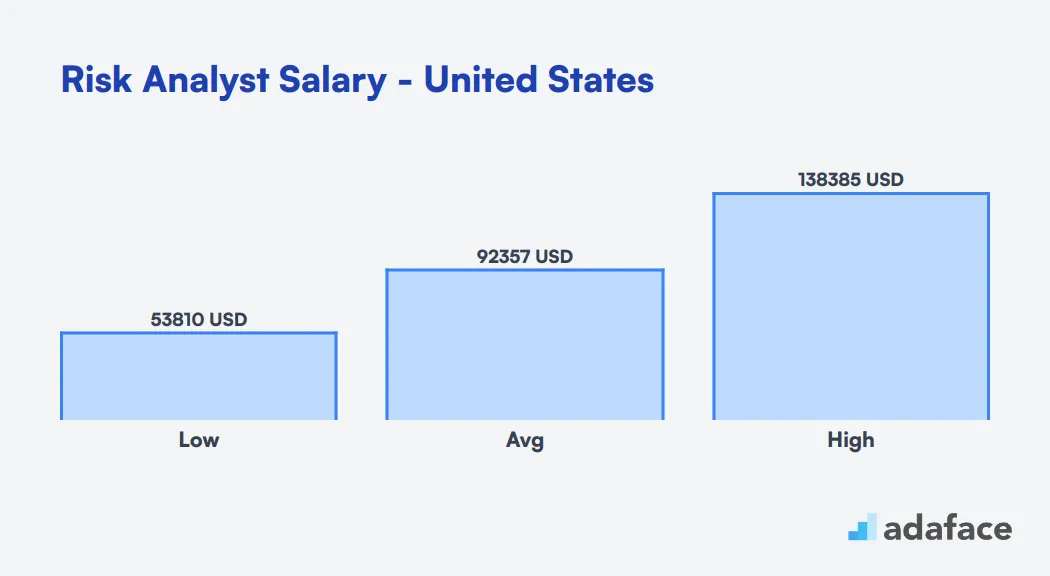

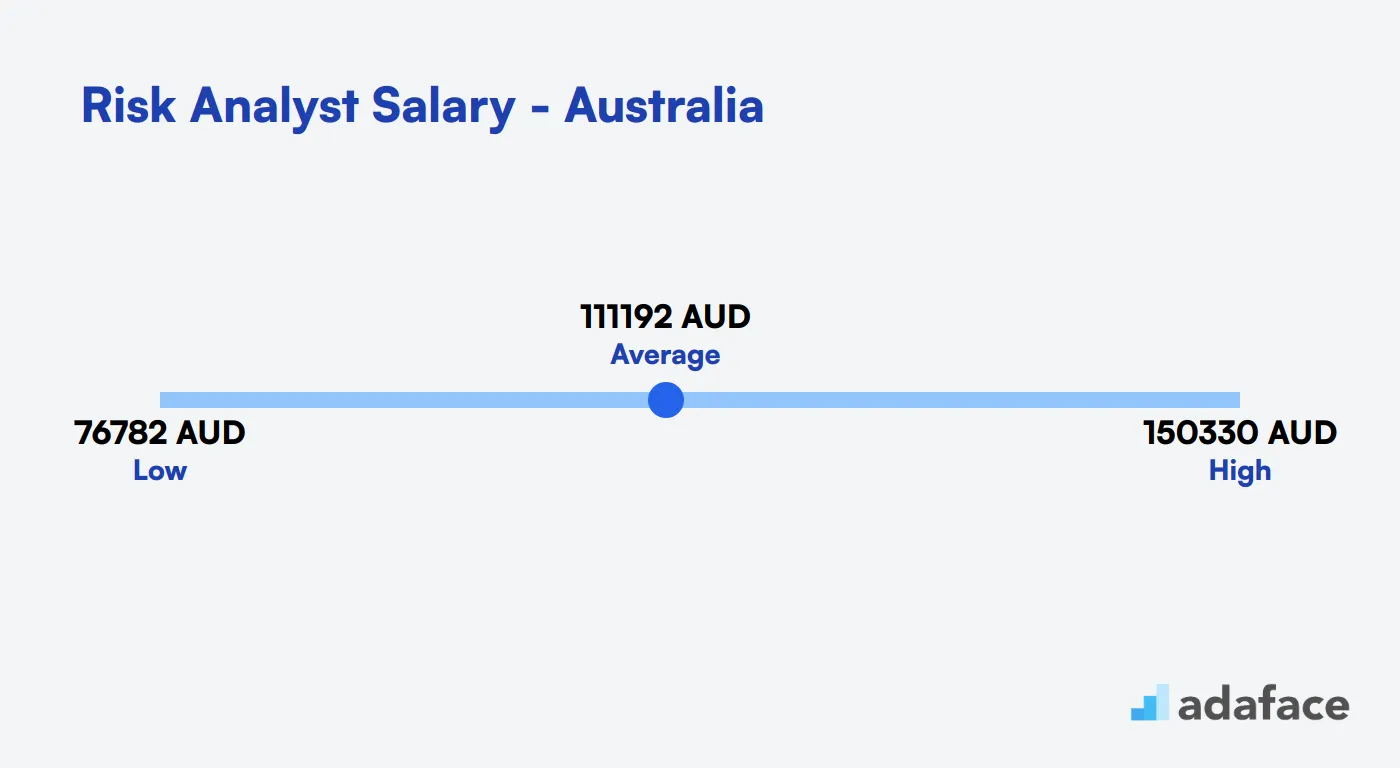

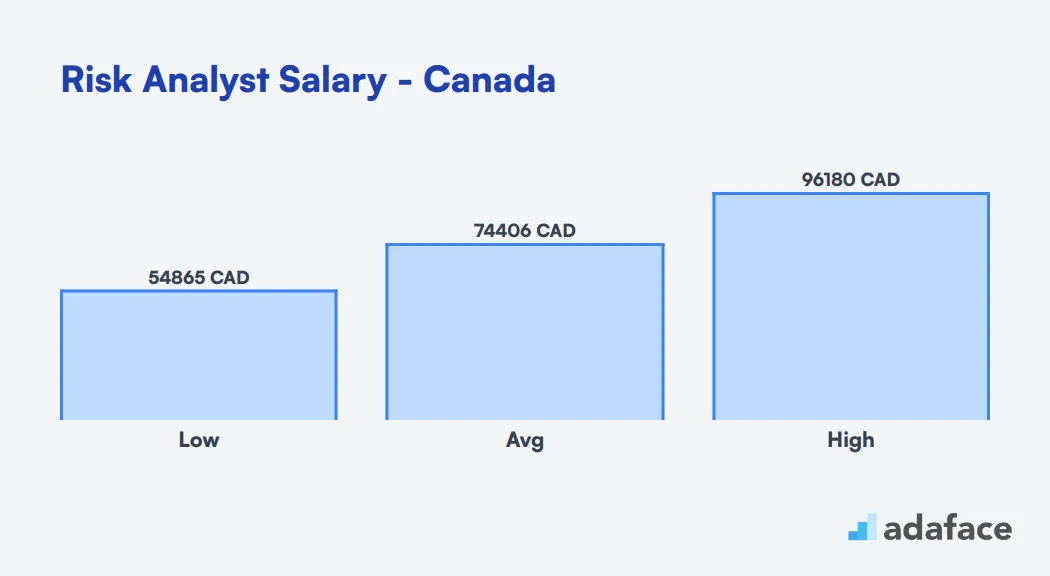

Hiring a Risk Analyst can vary significantly in cost based on location and experience. In the U.S., the average salary is around $92,357, with a range from $53,811 to $138,386. In other countries like Australia and Canada, average salaries are AUD 111,192 and CAD 74,406 respectively, reflecting diverse market conditions.

Risk Analyst Salary in the United States

The average salary for a Risk Analyst in the United States is approximately $92,357. Salaries can vary significantly based on location, with a range from $53,811 to $138,386. For instance, in cities like San Francisco, the average salary is around $98,025, while in Raleigh, it drops to about $83,803.

Risk Analyst Salary United Kingdom

In the United Kingdom, Risk Analysts earn an average salary ranging between £30,000 and £55,000 annually. Entry-level positions typically start at around £30,000, whereas experienced professionals can command salaries upwards of £55,000. These figures may vary depending on factors such as location, industry, and the candidate's experience level.

Risk Analyst Salary in Australia

In Australia, Risk Analysts earn an average salary of AUD 111,192 per year. The salary range typically falls between AUD 76,782 and AUD 150,330, with the median being AUD 107,436.

Location plays a significant role in determining salaries. Melbourne offers the highest average at AUD 151,666, followed by Macquarie Park at AUD 148,003. Adelaide has the lowest average at AUD 75,571.

Risk Analyst Salary Canada

The average salary for a Risk Analyst in Canada is approximately CAD 74,406 annually. Salaries range from a low of CAD 54,866 to a high of CAD 96,180, depending on the location and experience. In cities like Montréal and Toronto, salaries tend to be on the higher side, with averages over CAD 100,000.

Streamline Your Risk Analyst Hiring Process

We've covered the key aspects of hiring Risk Analysts, from identifying essential skills to crafting effective job descriptions and conducting structured interviews. By following these steps, you can significantly improve your chances of finding the right candidate for your organization.

Remember, the most effective way to assess a candidate's skills is through targeted testing. Using financial analyst tests can help you objectively evaluate a candidate's analytical abilities and risk assessment skills. This approach, combined with a well-crafted job description and a structured interview process, will set you on the path to hiring top-notch Risk Analysts.

Financial Analyst Test

FAQs

Key skills for a Risk Analyst include strong analytical abilities, proficiency in statistical analysis, knowledge of risk management frameworks, excellent communication skills, and familiarity with relevant industry regulations.

You can assess a Risk Analyst's technical skills through skills assessment tests, case studies, and technical interviews focusing on risk modeling, data analysis, and financial concepts.

Qualified Risk Analyst candidates can be found on professional networking sites like LinkedIn, industry-specific job boards, finance and risk management forums, and through referrals from industry professionals.

A Risk Analyst job description should include required qualifications, key responsibilities, expected technical skills, soft skills like communication and problem-solving, and an overview of the company's risk management approach.

The hiring process for a Risk Analyst typically takes 4-6 weeks, including initial screening, technical assessments, multiple rounds of interviews, and final decision-making.

Ask a mix of behavioral, situational, and technical questions. Focus on their experience with risk assessment methodologies, problem-solving skills, and how they've handled complex risk scenarios in the past.

To ensure cultural fit, include team members in the interview process, ask questions about work style and values, and consider a trial period or project to see how the candidate interacts with the team.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources