Hiring a Payroll Director is a significant decision for any organization. This role is crucial because it ensures that payroll processes run smoothly, employees are paid accurately and on time, and compliance with tax regulations is maintained. However, many companies struggle with this hiring process because they don't fully understand the technical intricacies and leadership skills involved in payroll management.

This article will guide you through the entire hiring process for a Payroll Director, from understanding why you need one to screening resumes and crafting effective job descriptions. We'll also explore recommended skills tests and case study assignments to evaluate candidates properly. For more insights on the skills required for a Payroll Director, you can visit our detailed skills guide.

Table of contents

Why Hire a Payroll Director?

Hiring a Payroll Director becomes necessary when your company faces challenges in managing complex payroll operations. For instance, if you're struggling with compliance issues, experiencing frequent payroll errors, or finding it difficult to handle multi-state or international payroll, it's time to consider bringing in a specialist.

A Payroll Director can help streamline processes, implement cost-effective payroll systems, and ensure adherence to ever-changing tax laws and regulations. They can also play a key role in strategic financial planning and improving employee satisfaction through accurate and timely compensation management.

Before committing to a full-time hire, assess your company's size, growth trajectory, and current payroll complexities. For smaller organizations or those testing the waters, working with a payroll consultant might be a good starting point before transitioning to a full-time Payroll Director.

Payroll Director Hiring Process

The hiring process for a Payroll Director typically spans 6-8 weeks. Let's break down the key steps and timeline:

- Post a well-crafted job description on relevant job boards

- Review resumes (1-2 weeks)

- Conduct initial phone screenings (3-5 days)

- Administer skill assessments or case studies (1 week)

- Schedule in-person or video interviews (1-2 weeks)

- Check references and make an offer (3-5 days)

This timeline can vary based on your company's specific needs and the candidate pool. In the following sections, we'll dive deeper into each step, providing you with helpful checklists and materials to streamline your Payroll Director hiring process.

Skills and qualifications to look for in a Payroll Director

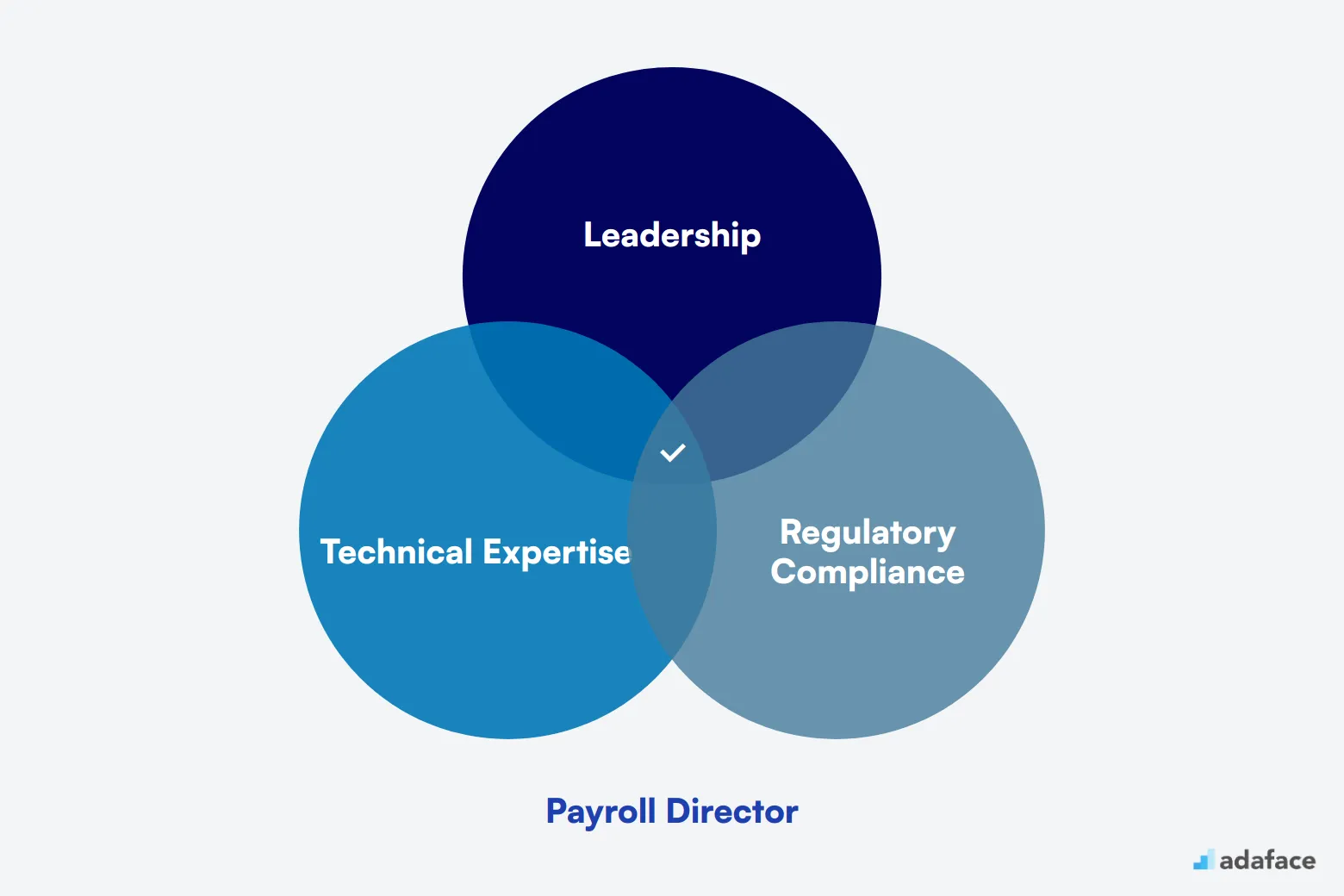

Creating a candidate profile for a Payroll Director requires a careful balance of technical expertise and leadership skills. It's easy to focus solely on payroll knowledge, but overlooking management abilities can lead to hiring challenges. Here's a breakdown of required and preferred qualifications to help you build a well-rounded profile for your next Payroll Director.

Required skills typically include a bachelor's degree in Accounting or Finance, at least 5 years of payroll management experience, and proficiency in payroll software. Strong leadership abilities and a deep understanding of payroll tax regulations are also must-haves.

Preferred qualifications often encompass certifications like Certified Payroll Professional (CPP), experience with multi-state or global payroll, and a track record in process improvement. Knowledge of HR software integration and strong analytical skills can also set candidates apart.

| Required skills and qualifications | Preferred skills and qualifications |

|---|---|

| Bachelor's degree in Accounting, Finance, or related field | Certified Payroll Professional (CPP) certification |

| Minimum of 5 years experience in payroll management | Experience with multi-state and global payroll processing |

| Strong understanding of payroll tax regulations and compliance | Knowledge of HR software and systems integration |

| Excellent leadership and team management skills | Strong analytical and problem-solving skills |

| Proficiency in payroll software such as ADP, Paychex, or similar | Experience in process improvement initiatives |

How to Write a Payroll Director Job Description

A well-crafted Payroll Director job description is key to attracting the right talent. Once you have the candidate profile ready, your next step is to capture that information in the job description to draw in qualified applicants.

- Highlight key responsibilities and impact: Clearly articulate the role's core responsibilities, such as overseeing payroll processing, ensuring compliance with tax regulations, and managing a team. This clarity helps candidates understand the significance of the position and its impact on the organization.

- Balance technical skills with soft skills: While emphasizing proficiency in payroll software and understanding of accounting principles is important, don't overlook soft skills like leadership, communication, and problem-solving. These are just as critical for a successful Payroll Director.

- Showcase unique selling points: Highlight what makes your company and the Payroll Director role unique. Whether it's a supportive work environment, opportunities for career advancement, or pioneering payroll technology, these details can make your job listing stand out.

For a detailed view of what to include, you can refer to the Payroll Director job description to ensure you cover all necessary aspects.

10 Platforms to Hire Payroll Directors

Now that you have a well-crafted job description, the next step is to list the opening on job platforms to find the right candidates. By choosing the right platforms, you increase your chances of reaching skilled Payroll Directors who can meet your organization's needs.

LinkedIn Jobs

Ideal for posting full-time Payroll Director positions and reaching a large network of professionals. Offers robust search features and allows direct communication with potential candidates.

Indeed

Widely used job board suitable for posting full-time Payroll Director roles. Offers a large candidate pool and easy application process.

Glassdoor for Employers

Effective for full-time Payroll Director listings. Provides company reviews and salary information, attracting informed candidates.

For the remaining seven platforms, consider using Monster for its resume database and targeted advertising, and CareerBuilder for its AI-driven candidate matching. Dice is ideal for tech-savvy Payroll Directors, while Upwork offers a global talent pool for freelance opportunities. FlexJobs caters to remote hiring, SHRM Talent Acquisition targets HR professionals, and the American Payroll Association Job Board specializes in experienced payroll professionals. For more tips on attracting the best talent, explore how to attract the best technical talent.

How to Screen Payroll Director Resumes?

Resume screening is a key step in hiring a Payroll Director. It helps filter out applicants who don't meet the basic qualifications, allowing you to focus on candidates who truly fit the job requirements. This step is especially important given the specialized skills required for the role.

When manually screening resumes, look for primary keywords that align with the job description. Important keywords for a Payroll Director might include "Bachelor's degree in Accounting," "5 years of payroll management experience," "payroll tax regulations," and "proficiency in payroll software like ADP or Paychex." Use these keywords to quickly shortlist resumes, ensuring the candidates meet the minimum qualifications before moving them to the next stage.

Consider using AI tools to streamline the resume screening process. Large Language Models (LLMs) like GPT can be useful to filter candidates based on your specified keywords. You can set up a system where you input resumes, and the AI highlights the ones that match your essential criteria, saving you substantial time and effort.

Here's a sample prompt you could use:

TASK: Screen resumes to match job description for Payroll Director role

INPUT: Resumes

OUTPUT: For each resume, provide following information:

- Email id

- Name

- Matching keywords

- Score (out of 10 based on keywords matched)

- Recommendation (detailed recommendation of whether to shortlist this candidate or not)

- Shortlist (Yes, No or Maybe)

RULES:

- If you are unsure about a candidate's fit, put the candidate as Maybe instead of No

- Keep recommendation crisp and to the point.

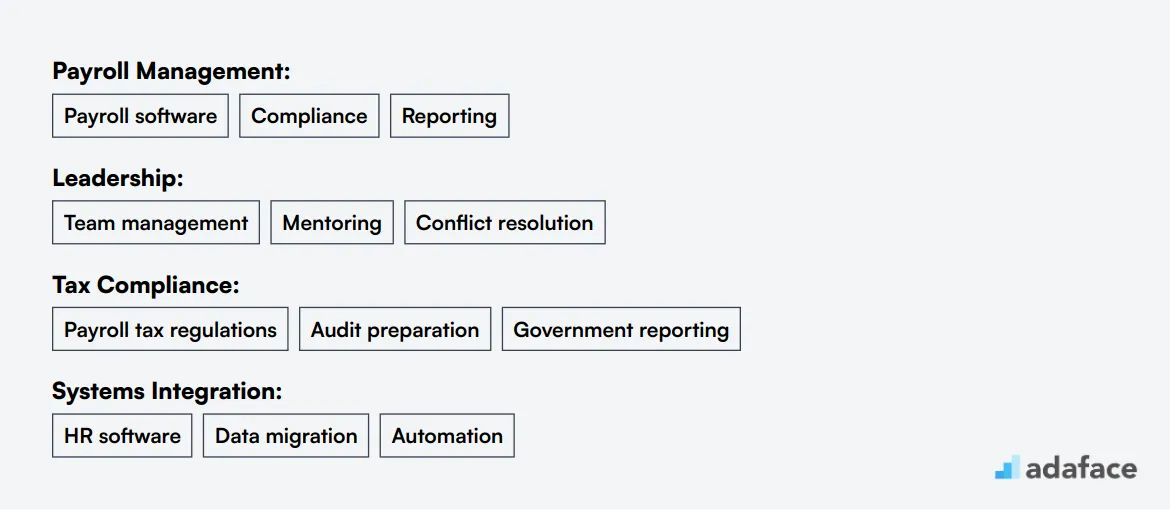

KEYWORDS DATA:

- Leadership (Team management, Mentoring, Conflict resolution)

- Payroll Management (Software like ADP, Compliance, Reporting)

- Tax Compliance (Payroll tax regulations, Audit preparation, Government reporting)

For more insights, you can explore our blog on Payroll Director interview questions and learn about the skills required for a Payroll Director.

Recommended skills tests to screen Payroll Directors

While resumes provide an overview, skills tests are recommended to truly assess a Payroll Director's capabilities. These tests help identify candidates who can manage payroll systems, ensure compliance, and handle financial reporting effectively.

Accounting test: Use this test to evaluate candidates' understanding of accounting principles, which is crucial for managing payroll-related finances accurately. Learn more about accounting tests.

HR test: Payroll Directors often collaborate with HR departments. This test checks candidates' knowledge of HR processes and regulations, ensuring smooth integration between payroll and HR functions. Explore our HR test options.

Financial Accounting test: Assess your candidates' abilities in financial reporting and compliance with this test, which is essential for maintaining accurate payroll records. More details available on the financial accounting test page.

Excel test: Proficiency in Excel is necessary for Payroll Directors to handle large datasets and perform payroll calculations. Test candidates' skills with our Excel test.

Communication test: Strong communication skills are key for Payroll Directors to interact with internal teams and resolve disputes. Discover how this test can help identify capable communicators in your pool of candidates. Visit our communication test page.

Case Study Assignments to Evaluate Payroll Director Candidates

Case study assignments can be valuable tools for assessing Payroll Director candidates. However, they come with drawbacks such as lengthy completion times, lower participation rates, and the risk of losing qualified candidates. Despite these challenges, well-designed case studies can provide deep insights into a candidate's skills and problem-solving abilities.

Payroll System Overhaul: This case study tasks candidates with analyzing an outdated payroll system and proposing a modernization plan. It assesses their ability to evaluate payroll processes, identify inefficiencies, and recommend improvements while considering budget constraints and compliance requirements.

Multi-State Payroll Compliance: Candidates are presented with a scenario where a company is expanding operations across multiple states. They must outline strategies for ensuring payroll compliance with various state regulations, demonstrating their knowledge of tax laws, reporting requirements, and ability to manage complex payroll operations.

Payroll Data Security Breach: This assignment simulates a data security incident affecting payroll information. Candidates must develop an action plan to address the breach, including steps to protect employee data, communicate with stakeholders, and implement measures to prevent future incidents. This case study evaluates crisis management skills and knowledge of data protection practices in payroll operations.

Structuring the Interview Stage for Payroll Director Candidates

After candidates pass initial skills tests, it's time for technical interviews to assess their hard skills in depth. While skills tests help filter out unfit candidates, technical interviews are key to identifying the best fit for the Payroll Director role. Let's look at some sample interview questions to use in this stage.

Consider asking: 'How do you ensure payroll compliance across multiple states or countries?', 'What strategies do you use to manage payroll data security?', 'How would you handle a situation where a major payroll error was discovered after paychecks were issued?', 'What's your approach to streamlining payroll processes?', and 'How do you stay updated on changing payroll laws and regulations?'. These questions help evaluate a candidate's technical knowledge, problem-solving abilities, and leadership skills in payroll management.

What's the difference between a Payroll Director and a Compensation and Benefits Manager?

Though both roles are within the realm of payroll and compensation, Payroll Directors and Compensation and Benefits Managers often get mixed up because they operate closely together in HR functions. They both deal with employee remuneration, yet their focus and responsibilities set them apart.

A Payroll Director's primary focus is on payroll operations and compliance. They manage payroll systems and ensure tax compliance, often reporting directly to the CFO. Their expertise lies in payroll software and understanding tax regulations, handling the payroll budget while working with payroll vendors and tax authorities. Strategic input involves enhancing payroll efficiency and reducing costs.

On the other hand, a Compensation and Benefits Manager designs the overall compensation strategy and benefits programs. Reporting typically to an HR Director, they focus on creating attractive compensation packages and managing benefits programs, using HRIS and benefits administration platforms. They manage the total compensation and benefits budget, working with insurance providers and compensation consultants. Their strategic input is more on talent attraction and retention strategies.

For more information on skills required for these roles, you can explore the skills required for a Payroll Director.

| Payroll Director | Compensation and Benefits Manager | |

|---|---|---|

| Primary Focus | Payroll operations and compliance | Overall compensation strategy and benefits |

| Reporting Structure | Often reports to CFO | Typically reports to HR Director |

| Key Responsibilities | Manage payroll systems, tax compliance | Design compensation packages, manage benefits programs |

| Technical Skills | Payroll software, tax regulations | HRIS, benefits administration platforms |

| Budget Management | Payroll budget | Total compensation and benefits budget |

| Compliance Focus | Payroll taxes, wage laws | ERISA, ACA, FLSA |

| External Partnerships | Payroll vendors, tax authorities | Insurance providers, compensation consultants |

| Strategic Input | Payroll efficiency, cost reduction | Talent attraction, retention strategies |

What are the ranks of Payroll Directors?

Many people often confuse the responsibilities and ranks of payroll directors with other financial roles due to overlapping duties. Understanding the hierarchy within payroll management is essential for recruiters and hiring managers to make informed decisions.

- Payroll Specialist: This entry-level position involves handling the day-to-day payroll processing tasks. Payroll specialists ensure that employees are paid accurately and on time, and they manage payroll-related inquiries from employees.

- Payroll Manager: A payroll manager oversees the payroll department and ensures that all processes run smoothly. They are responsible for compliance with tax regulations and maintaining payroll records. They're the bridge between payroll specialists and the higher management.

- Payroll Director: At the top of the hierarchy, the payroll director manages the entire payroll function and aligns it with the organization's strategic goals. They are responsible for developing payroll policies, overseeing payroll systems, and ensuring compliance with legal requirements.

For a deeper understanding of the responsibilities of a payroll director, you can refer to the payroll director job description.

Hire the Best Payroll Directors for Your Organization

We've covered the key aspects of hiring a Payroll Director, from understanding the role's importance to crafting an effective job description and conducting thorough interviews. The process requires careful consideration of skills, qualifications, and cultural fit to ensure you find the right candidate for your organization.

If there's one key takeaway, it's the importance of using well-crafted job descriptions and skills tests to make your hiring process more accurate. By implementing these strategies, you'll be better equipped to identify and attract top Payroll Director talent that can drive your company's payroll operations forward.

Accounting Assessment Test

FAQs

A Payroll Director oversees the payroll department, ensures accurate and timely payment of salaries, manages payroll systems, complies with tax regulations, and leads payroll staff.

A Payroll Director should have a degree in finance or accounting, extensive experience in payroll management, familiarity with payroll software, and strong leadership skills.

You can assess a candidate's skills by using skills tests such as the payroll management test and conducting technical interviews tailored to payroll scenarios.

A Payroll Director job description should include key responsibilities, required qualifications and skills, experience level, and any specific industry knowledge. You can refer to our job description template.

Qualified Payroll Director candidates can be found on professional networking platforms, job boards, and through recruitment agencies specializing in finance and accounting roles.

A Payroll Director focuses on managing payroll processes and compliance, while a Compensation and Benefits Manager handles overall employee benefits, salary structures, and compensation strategies. More on this topic can be found in the section on 'What's the difference between a Payroll Director and a Compensation and Benefits Manager?' in the article.

Effective interview questions should assess the candidate's technical expertise, problem-solving abilities, and leadership qualities. For inspiration, you can check our interview questions guide.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources