Navigating contractor compliance is a critical task for recruiters. With ever-evolving regulations, understanding the nuances of compliance can be daunting. It's important to hire individuals who can adapt to these changes efficiently.

Recruiters must stay informed about key regulations to manage contractor compliance effectively. By implementing best practices and leveraging the right tools, HR can play a vital role in ensuring compliance.

Table of contents

Understanding Contractor Compliance

Understanding contractor compliance is key for recruiters and hiring managers who work with independent contractors. Compliance ensures that both parties adhere to legal and regulatory standards, minimizing risks and potential liabilities.

Contractor compliance involves verifying that the contractor is classified correctly under labor laws. Misclassification can lead to legal issues, fines, and damage to the company's reputation.

It is important to have a clear contract that outlines the scope of work, payment terms, and other critical details. This helps prevent misunderstandings and ensures that both parties are on the same page.

Recruiters should also be aware of the specific tax obligations that contractors have, which differ from those of regular employees. Ensuring compliance in this area protects the company from potential tax penalties.

By understanding these aspects of contractor compliance, recruiters can effectively manage their talent pipeline. This approach not only safeguards the company but also fosters a professional relationship with contractors.

Key Regulations for Contractors

Understanding key regulations for contractors is crucial for recruiters and hiring managers. These regulations ensure that contractors are treated fairly and that businesses comply with legal standards.

One of the primary regulations is the classification of workers as either independent contractors or employees. Misclassification can lead to legal issues, including fines and back taxes.

Another important regulation involves ensuring fair payment and working conditions for contractors. This includes adhering to minimum wage laws and providing safe working environments.

Contractors are also subject to tax regulations, which require businesses to report payments and withhold appropriate taxes. Failure to comply can result in penalties and interest charges.

Additionally, non-discrimination laws apply to contractors, ensuring they receive equal treatment regardless of race, gender, or other protected characteristics. This is essential for maintaining a diverse and inclusive workplace.

Understanding these regulations helps in avoiding unfair hiring practices. It also contributes to building a positive reputation and fostering trust with contractors.

Common Challenges in Contractor Compliance

Contractor compliance presents several challenges for recruitment and HR professionals. Navigating legal requirements and ensuring adherence to labor laws can be complex. Misclassification of contractors as employees is a common issue, leading to potential legal and financial repercussions. This misclassification can arise due to a lack of understanding of the employment status.

Another challenge is maintaining consistent communication and managing expectations with contractors. Since contractors are not full-time employees, they may not be as integrated into the company culture or processes. This can lead to misunderstandings and misaligned objectives, impacting project outcomes.

Tracking contractor performance and ensuring they meet contractual obligations can also be difficult. Without proper oversight, there's a risk of contractors not delivering on time or up to the expected standards. Implementing structured vs unstructured interviews can help in selecting the right contractors from the start.

Lastly, managing the financial aspects of contractor compliance, such as timely payments and tax obligations, requires meticulous attention. Failure to do so can result in financial penalties and strained relationships with contractors. It's essential to have a robust system in place to handle these financial intricacies efficiently.

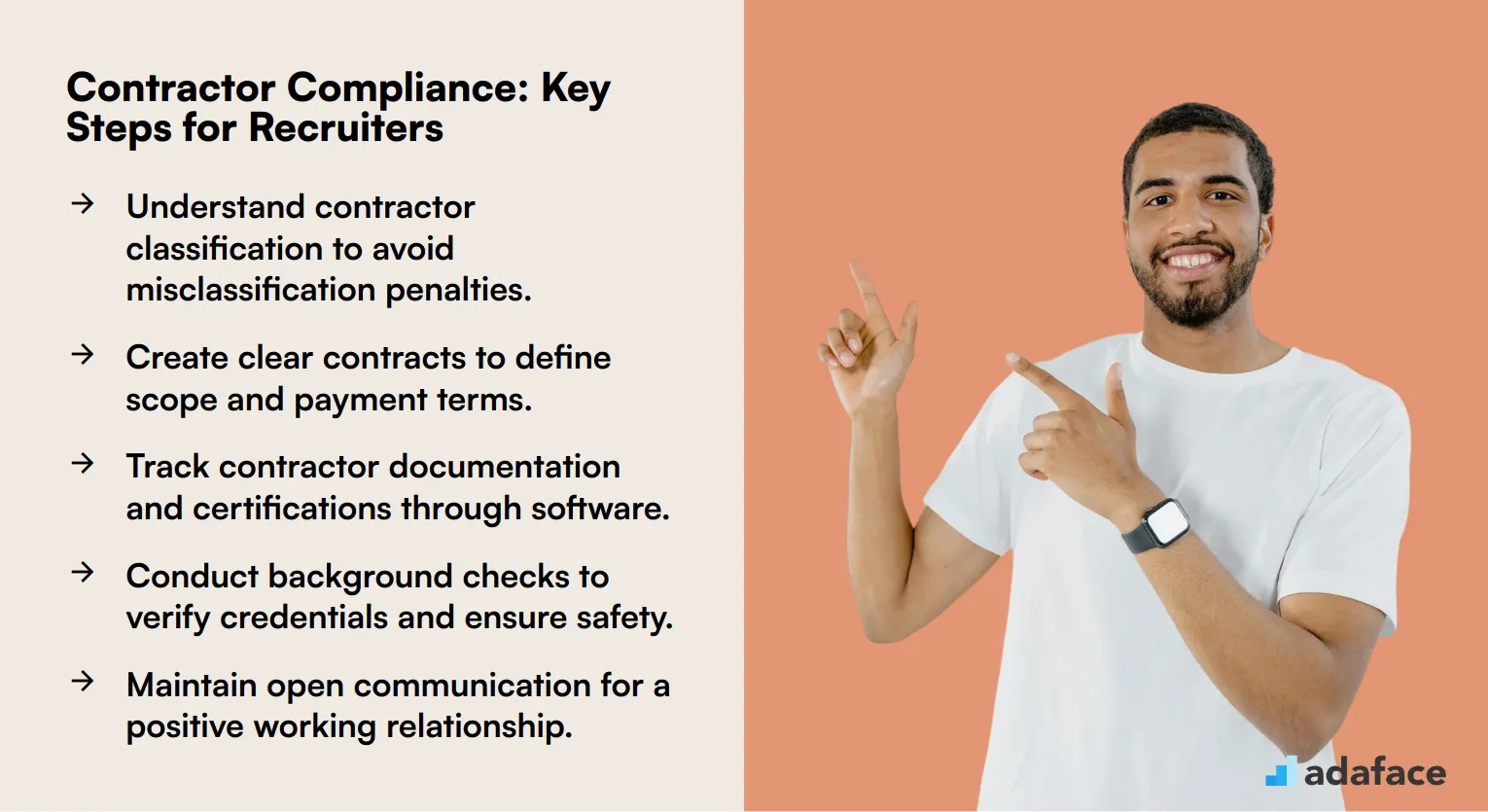

Best Practices for Managing Contractor Compliance

Managing contractor compliance effectively involves several best practices that ensure both legal adherence and smooth operations. First, establish clear contracts that outline the terms, responsibilities, and expectations for both parties. This minimizes misunderstandings and sets a strong foundation for compliance. Regular audits and reviews of contractor work help maintain standards and address any issues promptly. These audits can be part of a broader employee assessment strategy.

Communication is key, so maintain open lines with contractors to address concerns and provide feedback. This not only fosters a collaborative environment but also ensures that any compliance issues are swiftly resolved. Training sessions on company policies and industry regulations can further enhance compliance. These sessions can be integrated into your onboarding process for new contractors.

Utilize technology to streamline compliance management by employing tools that track and document contractor activities. This documentation is crucial during audits and helps in maintaining transparency. Finally, stay updated on legal requirements and adjust your compliance strategies accordingly. This proactive approach ensures that your organization remains compliant amidst changing regulations.

Tools and Resources for Ensuring Compliance

Ensuring contractor compliance requires the right tools and resources. Here are some essential tools to help recruiters and HR professionals manage contractor compliance effectively:

Compliance management software: These platforms streamline the process of tracking contractor documentation and certifications. They often include features for automated reminders, document expiration alerts, and reporting capabilities.

Background check services: Thorough background checks are crucial for verifying contractor credentials and ensuring workplace safety. Many services offer comprehensive screening packages tailored for contractor vetting.

E-signature solutions: Digital signature tools facilitate quick and secure document signing for contracts and compliance forms. This speeds up the onboarding process and ensures all necessary paperwork is completed promptly.

Training and certification tracking systems: These tools help monitor contractor training completion and certification status. They can automatically flag when refresher courses or recertification is needed.

Time and attendance software: Accurate time tracking is essential for contractor management and compliance with labor laws. Modern solutions offer features like geofencing and biometric verification for added security.

Contractor management portals: These centralized platforms allow easy communication between the company and contractors. They often include features for document sharing, project tracking, and performance evaluation.

The Role of HR in Contractor Compliance

Human Resources (HR) plays a significant role in ensuring contractor compliance within an organization. They are responsible for establishing clear guidelines and policies that contractors must adhere to, ensuring that all legal and organizational requirements are met.

HR professionals also manage the onboarding process, ensuring that contractors are aware of their responsibilities and the organization's expectations. This involves conducting thorough background checks and verifying that all necessary documentation is in place, such as contracts and work permits.

Monitoring contractor performance and compliance is another critical task for HR. They must regularly assess whether contractors are meeting their obligations and address any issues that arise promptly.

HR must also stay updated with the latest regulations and industry standards to ensure that the organization remains compliant. This involves collaborating with legal teams and other departments to mitigate any risks associated with contractor engagement.

By maintaining open communication channels, HR can effectively manage contractor relationships and address any concerns that may arise. This proactive approach helps in fostering a positive work environment and ensuring that the organization operates smoothly.

Incorporating best practices in contractor management can significantly enhance team dynamics and contribute to the overall success of the organization.

Wrapping Up Contractor Compliance

Contractor Compliance FAQs

Key regulations include tax obligations, labor laws, and industry-specific compliance standards. Staying updated on these regulations is essential for managing contractor compliance effectively.

Recruiters can manage challenges by staying informed, using compliance management tools, and implementing best practices. Regular training and audits can also help in overcoming compliance issues.

HR plays a crucial role in ensuring contractor compliance by developing policies, conducting training, and monitoring compliance through regular audits and evaluations.

Tools like compliance management software, automated tracking systems, and regular audits can help ensure contractor compliance. These tools streamline processes and reduce the risk of non-compliance.

Contractor compliance is important to avoid legal issues, maintain a good reputation, and ensure smooth operations. It helps in building trust with clients and contractors alike.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated terms