Test Duration

35 minsDifficulty Level

Moderate

Questions

- 10 Accounting MCQs

- 5 Excel MCQs

- 5 Finance MCQs

Availability

Ready to useThe financial analyst test evaluates a candidate’s ability to understand financial statements, calculate and interpret financial indicator ratios and predict future results. This pre-employment test helps recruiters identify candidates with strong accounting and compliance backgrounds.

Covered skills:

Test Duration

35 minsDifficulty Level

Moderate

Questions

Availability

Ready to useThe Financial Analyst Test is designed to assist recruiters and hiring managers in identifying promising candidates for financial analyst positions from a large pool of applicants, enabling more objective and informed hiring decisions. This test minimizes the time spent interviewing unsuitable candidates by filtering them out early in the recruitment process, saving time and resources.

This test evaluates a candidate's grasp of Accounting Principles and Bookkeeping fundamentals, their Expertise with Excel, and their skill in interpreting Financial Statements. It further assesses abilities in Budgeting and Forecasting, understanding Financial Ratios, Investment Analysis, Risk Management, Cost of Capital calculations, and Capital Budgeting techniques.

Use Adaface tests trusted by recruitment teams globally. Adaface skill assessments measure on-the-job skills of candidates, providing employers with an accurate tool for screening potential hires.

We have a very high focus on the quality of questions that test for on-the-job skills. Every question is non-googleable and we have a very high bar for the level of subject matter experts we onboard to create these questions. We have crawlers to check if any of the questions are leaked online. If/ when a question gets leaked, we get an alert. We change the question for you & let you know.

How we design questionsThese are just a small sample from our library of 15,000+ questions. The actual questions on this Financial Analyst Test will be non-googleable.

| 🧐 Question | |||||

|---|---|---|---|---|---|

|

Medium

Comprehensive income

|

Solve

|

||||

|

|

|||||

|

Medium

Land Sale

|

Solve

|

||||

|

|

|||||

|

Medium

Sell off long-term investment

|

Solve

|

||||

|

|

|||||

|

Medium

Earnings Per Share

|

Solve

|

||||

|

|

|||||

|

Medium

Net cash receipt on issued bonds

|

Solve

|

||||

|

|

|||||

|

Medium

Return on Capital Employed

|

Solve

|

||||

|

|

|||||

|

Easy

Hedge risk using derivates

|

Solve

|

||||

|

|

|||||

|

Medium

MATCH INDEX LOOKUP

|

Solve

|

||||

|

|

|||||

|

Medium

Organization data

|

Solve

|

||||

|

|

|||||

|

Medium

Student scores

|

Solve

|

||||

|

|

|||||

|

Medium

VLOOKUP blood donor

|

Solve

|

||||

|

|

|||||

| 🧐 Question | 🔧 Skill | ||

|---|---|---|---|

|

Medium

Comprehensive income

|

2 mins Accounting

|

Solve

|

|

|

Medium

Land Sale

|

3 mins Accounting

|

Solve

|

|

|

Medium

Sell off long-term investment

|

3 mins Accounting

|

Solve

|

|

|

Medium

Earnings Per Share

|

3 mins Finance

|

Solve

|

|

|

Medium

Net cash receipt on issued bonds

|

3 mins Finance

|

Solve

|

|

|

Medium

Return on Capital Employed

|

3 mins Finance

|

Solve

|

|

|

Easy

Hedge risk using derivates

|

2 mins Finance

|

Solve

|

|

|

Medium

MATCH INDEX LOOKUP

|

2 mins Excel

|

Solve

|

|

|

Medium

Organization data

|

3 mins Excel

|

Solve

|

|

|

Medium

Student scores

|

2 mins Excel

|

Solve

|

|

|

Medium

VLOOKUP blood donor

|

2 mins Excel

|

Solve

|

| 🧐 Question | 🔧 Skill | 💪 Difficulty | ⌛ Time | ||

|---|---|---|---|---|---|

|

Comprehensive income

|

Accounting

|

Medium | 2 mins |

Solve

|

|

|

Land Sale

|

Accounting

|

Medium | 3 mins |

Solve

|

|

|

Sell off long-term investment

|

Accounting

|

Medium | 3 mins |

Solve

|

|

|

Earnings Per Share

|

Finance

|

Medium | 3 mins |

Solve

|

|

|

Net cash receipt on issued bonds

|

Finance

|

Medium | 3 mins |

Solve

|

|

|

Return on Capital Employed

|

Finance

|

Medium | 3 mins |

Solve

|

|

|

Hedge risk using derivates

|

Finance

|

Easy | 2 mins |

Solve

|

|

|

MATCH INDEX LOOKUP

|

Excel

|

Medium | 2 mins |

Solve

|

|

|

Organization data

|

Excel

|

Medium | 3 mins |

Solve

|

|

|

Student scores

|

Excel

|

Medium | 2 mins |

Solve

|

|

|

VLOOKUP blood donor

|

Excel

|

Medium | 2 mins |

Solve

|

With Adaface, we were able to optimise our initial screening process by upwards of 75%, freeing up precious time for both hiring managers and our talent acquisition team alike!

Brandon Lee, Head of People, Love, Bonito

It's very easy to share assessments with candidates and for candidates to use. We get good feedback from candidates about completing the tests. Adaface are very responsive and friendly to deal with.

Kirsty Wood, Human Resources, WillyWeather

We were able to close 106 positions in a record time of 45 days! Adaface enables us to conduct aptitude and psychometric assessments seamlessly. My hiring managers have never been happier with the quality of candidates shortlisted.

Amit Kataria, CHRO, Hanu

We evaluated several of their competitors and found Adaface to be the most compelling. Great library of questions that are designed to test for fit rather than memorization of algorithms.

Swayam Narain, CTO, Affable

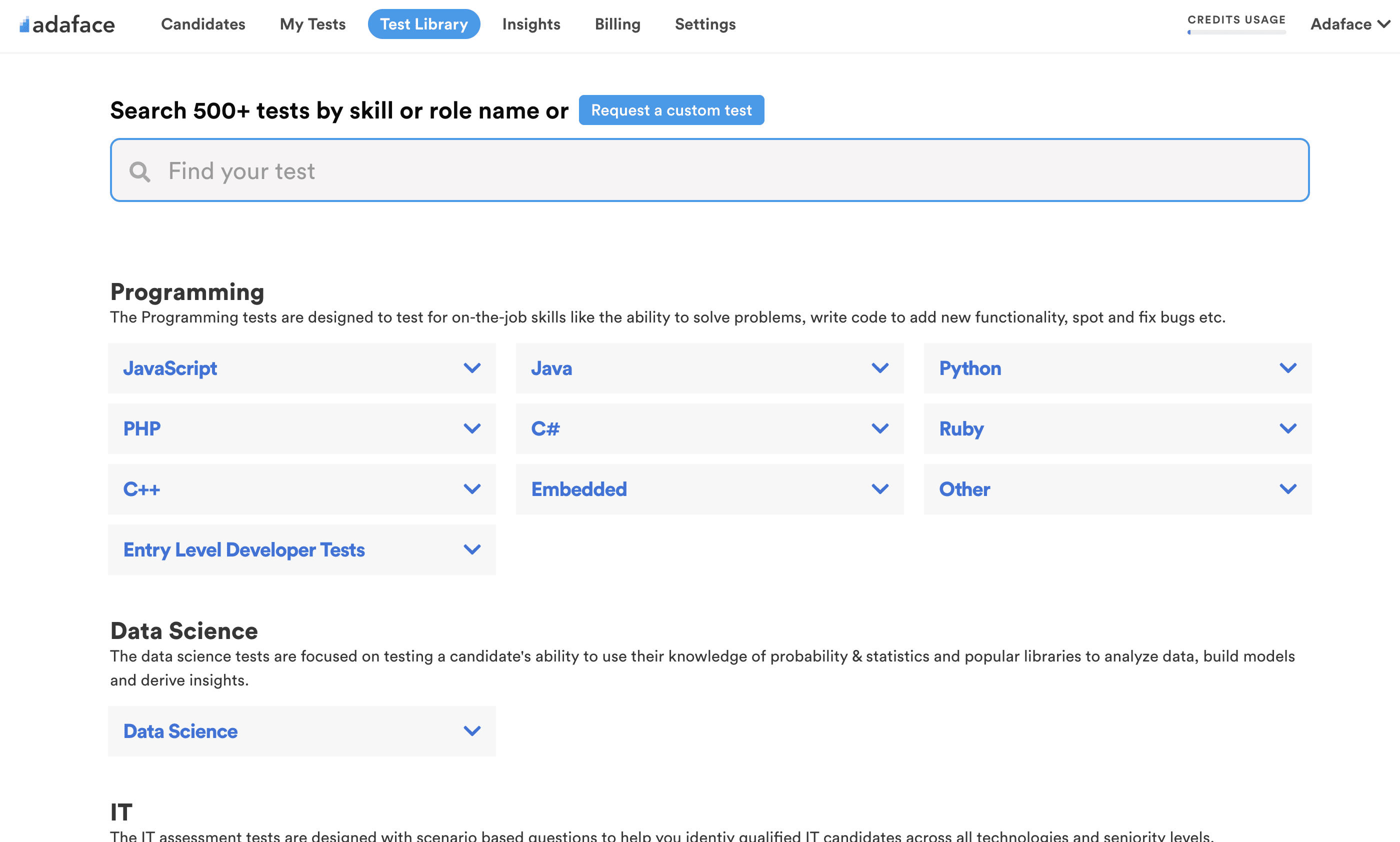

The Adaface test library features 500+ tests to enable you to test candidates on all popular skills- everything from programming languages, software frameworks, devops, logical reasoning, abstract reasoning, critical thinking, fluid intelligence, content marketing, talent acquisition, customer service, accounting, product management, sales and more.

The Financial Analyst Test assesses candidates' knowledge and expertise in financial analysis. It is used by recruiters to evaluate skills in accounting principles, Excel proficiency, financial statements, budgeting, and more.

Yes, recruiters can request a custom test that includes multiple skills from our test library. For example, you can combine the Financial Analyst Test with the Financial Accounting Test.

Senior candidates are evaluated on advanced skills such as implementing advanced accounting principles, mastering Excel functionalities, interpreting complex financial statements, and developing advanced budgeting models.

Use the Financial Analyst Test as a pre-screening tool at the start of your recruitment. Include the test link in your job post or invite candidates via email. It helps identify skilled candidates early on.

The main financial tests are:

Yes, absolutely. Custom assessments are set up based on your job description, and will include questions on all must-have skills you specify. Here's a quick guide on how you can request a custom test.

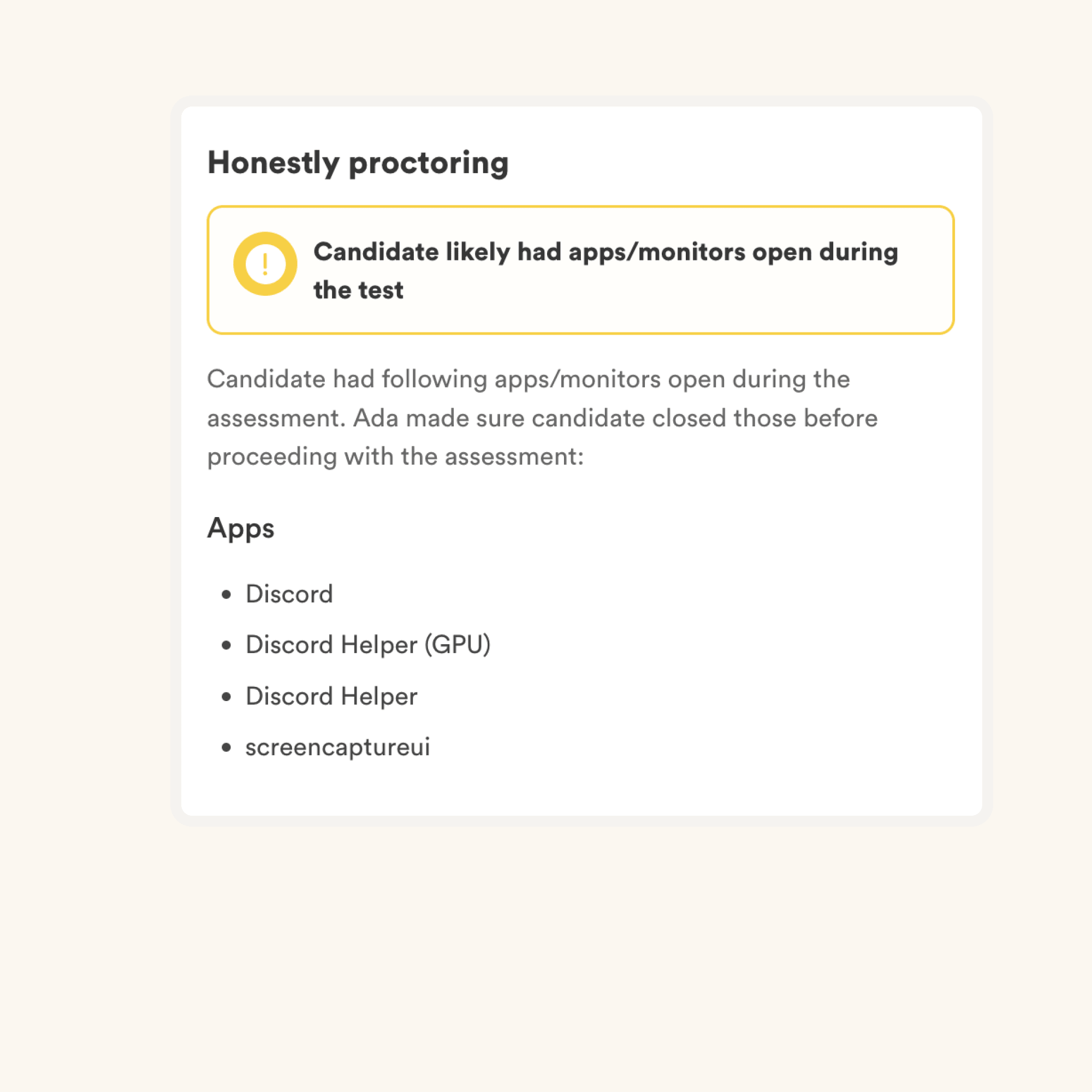

We have the following anti-cheating features in place:

Read more about the proctoring features.

The primary thing to keep in mind is that an assessment is an elimination tool, not a selection tool. A skills assessment is optimized to help you eliminate candidates who are not technically qualified for the role, it is not optimized to help you find the best candidate for the role. So the ideal way to use an assessment is to decide a threshold score (typically 55%, we help you benchmark) and invite all candidates who score above the threshold for the next rounds of interview.

Each Adaface assessment is customized to your job description/ ideal candidate persona (our subject matter experts will pick the right questions for your assessment from our library of 10000+ questions). This assessment can be customized for any experience level.

Yes, it makes it much easier for you to compare candidates. Options for MCQ questions and the order of questions are randomized. We have anti-cheating/ proctoring features in place. In our enterprise plan, we also have the option to create multiple versions of the same assessment with questions of similar difficulty levels.

No. Unfortunately, we do not support practice tests at the moment. However, you can use our sample questions for practice.

You can check out our pricing plans.

Yes, you can sign up for free and preview this test.

Here is a quick guide on how to request a custom assessment on Adaface.