PTO payout is a common practice where employers compensate employees for their accrued, unused paid time off. Understanding the nuances of PTO payout, including different types and legal considerations, is important for recruiters.

Recruiters should be aware of how PTO payout policies can impact candidate attraction and employee retention. A well-defined PTO policy can enhance the candidate experience and contribute to a positive employer brand.

Table of contents

What is PTO Payout?

What exactly is a PTO payout? It's simpler than it sounds. PTO payout refers to compensating employees for their accrued, unused paid time off when they leave a company.

Think of it like this: employees earn PTO, like vacation or sick days, over time. If they don't use all of it by the time they depart, a PTO payout converts those days into cash. This is usually part of their final paycheck.

Companies handle PTO payouts differently, based on state laws and their own policies. Some states mandate payouts, while others leave it to the employer's discretion. It's a good idea to familiarize yourself with your local labor laws and company policies to ensure compliance.

Understanding PTO payout is important for both employers and employees. For recruiters and HR, it helps ensure fair and legal offboarding practices. Knowing about PTO and other benefits can also help you improve your employer branding.

Types of PTO Payout

PTO payout comes in various forms, each with its own implications for employers and employees. The most common types include lump sum payouts, accrual-based payouts, and graduated payouts based on tenure.

Lump sum payouts involve paying out all unused PTO at once, typically when an employee leaves the company. This method is straightforward but can be costly for employers if employees have accumulated significant amounts of unused time.

Accrual-based payouts calculate the payout based on the employee's current rate of PTO accrual. This approach can be more equitable, especially for employees who have recently received raises or promotions.

Graduated payouts offer different rates or caps based on an employee's length of service. This method can serve as an incentive for employee retention and reward long-term employees.

Some companies offer partial payouts, allowing employees to cash out a portion of their unused PTO while retaining some for future use. This option provides flexibility for both employers and employees.

Lastly, some organizations implement use-it-or-lose-it policies, where unused PTO expires at the end of the year or within a specific timeframe. While this approach can encourage employees to take time off, it's important to ensure compliance with local labor laws.

Calculating PTO Payout

Calculating PTO payout involves determining the amount of unused paid time off an employee has accrued. This calculation is essential for HR professionals to ensure accurate compensation when an employee leaves the company or during year-end reconciliations.

The first step is to review the company's PTO policy and confirm the employee's accrual rate. Multiply the number of hours worked by the accrual rate to determine the total PTO earned.

Next, subtract any PTO hours the employee has already used from the total earned. The resulting figure represents the unused PTO hours eligible for payout.

To calculate the monetary value, multiply the unused PTO hours by the employee's hourly rate. For salaried employees, divide their annual salary by the number of working hours in a year to determine an hourly equivalent.

Remember to account for any caps on PTO accrual or payout limits set by company policy. Some organizations may have restrictions on the maximum amount of PTO that can be paid out.

Finally, ensure compliance with state laws regarding PTO payout, as regulations can vary. Some states require employers to pay out all accrued PTO, while others allow companies to set their own policies.

Legal Considerations for PTO Payout

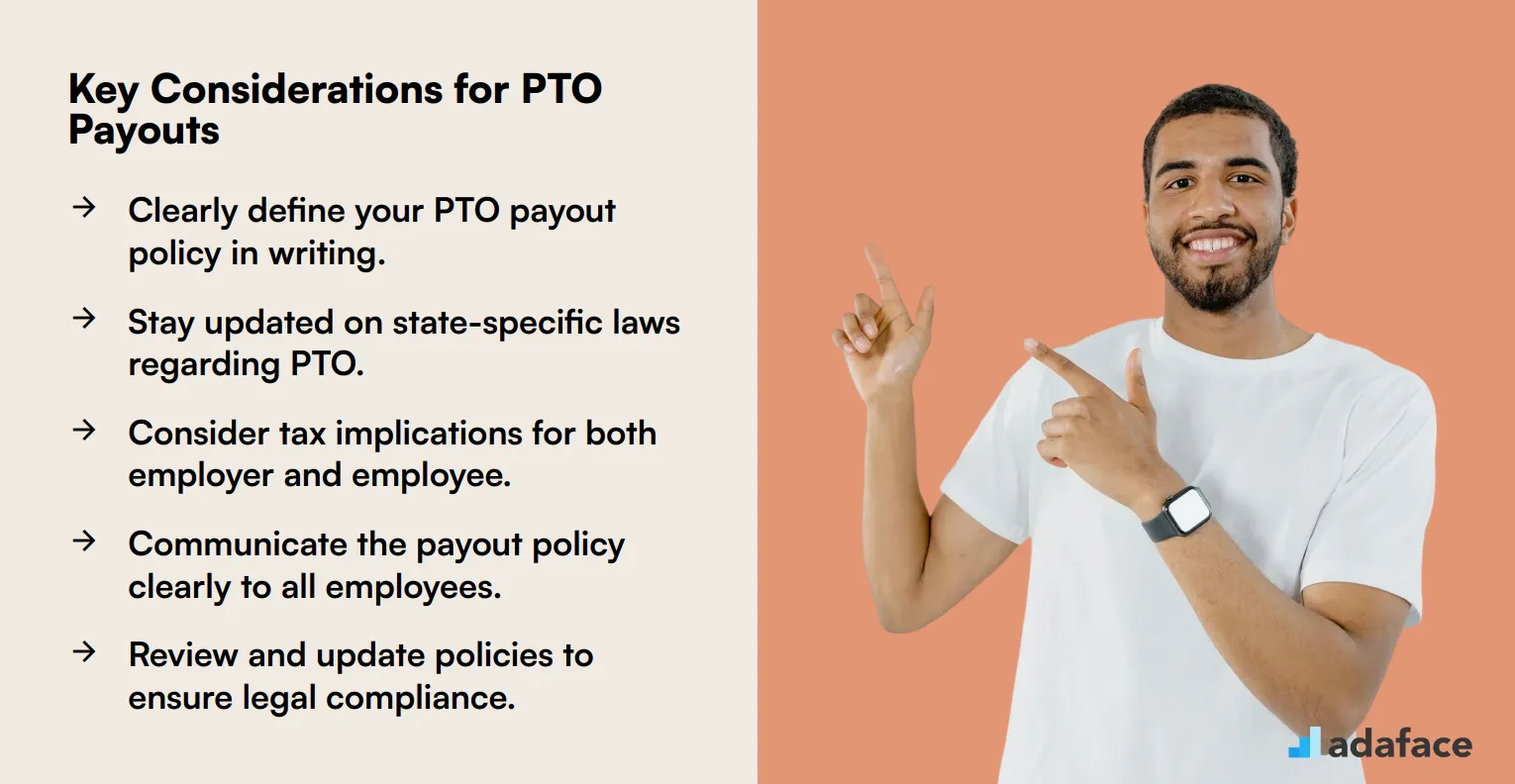

When implementing PTO payout policies, employers must navigate a complex landscape of legal considerations. Federal and state laws, as well as company policies, play a crucial role in determining how and when PTO payouts should be administered.

One key legal aspect is the distinction between earned and awarded PTO. Earned PTO is typically considered wages and must be paid out upon termination in many states, while awarded PTO may not have the same requirement.

Employers should be aware of state-specific laws regarding PTO payouts. Some states mandate that all accrued PTO be paid out upon termination, while others allow employers more flexibility in their policies.

It's essential to have clear, written policies regarding PTO accrual and payout. These policies should be consistently applied to avoid potential discrimination claims or legal disputes.

Employers should also consider the tax implications of PTO payouts. The timing and method of payout can affect both the employer's and employee's tax obligations.

Regular review and updates of PTO policies are necessary to ensure compliance with changing laws and regulations. Consulting with legal professionals can help employers navigate these complex issues and avoid potential legal pitfalls.

PTO Payout Policies: Best Practices

Implementing effective PTO payout policies is crucial for maintaining employee satisfaction and retention. Here are some best practices to consider when developing your company's approach to PTO payouts.

Clearly communicate your PTO payout policy to all employees. This includes specifying when payouts occur, how they're calculated, and any limitations or restrictions that may apply.

Consider offering a partial payout option for unused PTO. This encourages employees to take time off while still providing some compensation for accrued time.

Establish a cap on PTO accrual to manage financial liability. This helps prevent excessive accumulation of unused time and associated payout costs.

Align your PTO payout policy with local and state regulations. Some jurisdictions have specific requirements regarding PTO payouts, so ensure your policy complies with all applicable laws.

Regularly review and update your PTO payout policy. As your company grows and changes, your policy may need adjustments to remain fair and competitive.

PTO Payout vs. Rollover: Pros and Cons

PTO payout and rollover are two common approaches to handling unused paid time off. PTO payout involves compensating employees for their unused vacation days, typically at the end of the year or upon termination, while rollover allows employees to carry over unused days to the next year.

PTO payout offers immediate financial benefits to employees and can boost morale. However, it may encourage employees to skip vacations, potentially leading to burnout and decreased productivity.

Rollover policies provide flexibility and allow employees to accumulate time for longer vacations or emergencies. The downside is that it can lead to large accruals and potential scheduling conflicts when multiple employees want to use their saved time.

Employers should consider their company culture and workforce needs when choosing between payout and rollover. Some organizations opt for a hybrid approach, allowing partial rollover with a cap and paying out the rest.

Implementing clear communication about PTO policies is crucial for both options. This ensures employees understand their benefits and can make informed decisions about using their time off.

Wrapping Up PTO Payout

Understanding PTO payout is important for recruitment and HR professionals to manage employee benefits effectively. By familiarizing yourself with the types, calculations, and legal aspects, you can ensure fair and transparent practices.

Implementing best practices and weighing the pros and cons of PTO payout versus rollover can lead to better employee satisfaction. This knowledge aids in creating policies that align with your organization's goals and employee expectations.

PTO Payout FAQs

Common methods include using the employee's current hourly rate, their rate at the time of accrual, or a fixed rate. The chosen method should be clearly defined in the company's PTO policy.

PTO payout represents a liability on the company's balance sheet. Accrued PTO must be accounted for and paid out, impacting the company's cash flow.

Alternatives include PTO rollover, donation programs (allowing employees to donate PTO to colleagues), or 'cash in' options where employees can exchange a portion of their PTO for cash. Unlimited PTO is also an option, though it comes with its own set of considerations.

Legal considerations vary by state and may include requirements for payout upon termination or specific rules regarding accrual caps. Recruiters should ensure their company's policies comply with all applicable laws.

Highlighting a generous PTO policy, including payout options, can make a job offer more attractive. It signals that the company values work-life balance and employee well-being.

Clear and fair PTO payout policies can boost employee morale. Employees appreciate knowing that their unused time off is valued and will be compensated.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated terms