Phased retirement is gaining traction as a flexible approach to workforce management. It allows experienced employees to gradually reduce their work hours while transitioning into retirement, benefiting both the organization and the individual.

For recruiters, understanding phased retirement can open new avenues for talent retention and knowledge transfer. This guide explores the concept, its benefits, implementation strategies, and legal considerations to help you navigate this evolving workplace trend.

Table of contents

What is phased retirement?

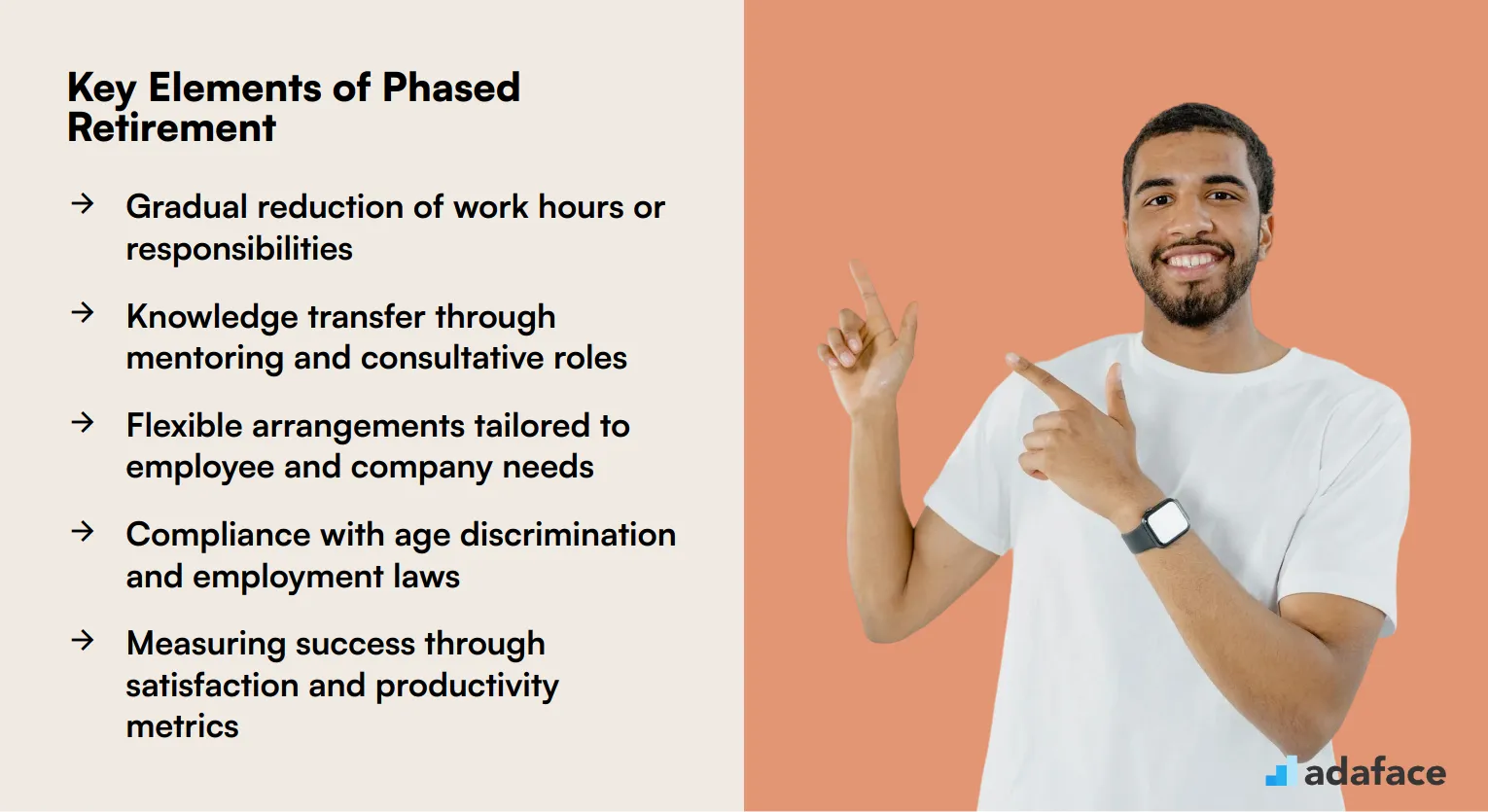

Phased retirement is a flexible approach that allows employees to gradually transition from full-time work to retirement. This arrangement can be beneficial for both employees and employers, as it provides a smoother transition for the retiree while retaining valuable experience within the organization.

Typically, phased retirement involves reducing work hours or responsibilities over a set period. Employees might work part-time, take on consultative roles, or mentor younger colleagues, ensuring that their expertise is not lost abruptly.

For employers, phased retirement can help in workforce planning by managing the transfer of knowledge and skills. It also allows organizations to better handle the succession planning process, reducing the impact of sudden retirements.

Phased retirement can also positively impact employee morale and job satisfaction, as it provides a sense of control over the retirement process. By accommodating the needs of older employees, companies can foster a more inclusive and supportive workplace environment.

Implementing a phased retirement program requires careful planning and clear communication between employers and employees. It is important to establish clear guidelines and expectations to ensure a successful transition for everyone involved.

Benefits of phased retirement for employers

Phased retirement offers several benefits for employers, including the retention of experienced employees who can continue to contribute valuable knowledge and skills. This approach allows companies to maintain stability while planning for future workforce needs.

By implementing phased retirement, employers can reduce turnover costs associated with hiring and training new employees. This is particularly beneficial in industries where expertise and experience are critical to success.

Phased retirement also provides an opportunity for knowledge transfer, as seasoned employees can mentor and train younger staff. This ensures that valuable institutional knowledge is not lost and enhances the overall skill set of the team.

Additionally, phased retirement can improve employee morale and job satisfaction, as it offers a flexible transition into retirement. This can lead to increased productivity and a more positive workplace environment.

Employers who adopt phased retirement plans can also enhance their employer brand, attracting top talent who value work-life balance and flexibility. This approach aligns with inclusive hiring practices, promoting diversity and inclusion within the organization.

Implementing a phased retirement program

Implementing a phased retirement program requires careful planning and execution. The first step is to establish clear eligibility criteria and guidelines for participation in the program.

Next, develop a flexible work schedule that allows employees to gradually reduce their hours while maintaining their responsibilities. This may involve job sharing, part-time work, or project-based assignments.

Communicate the program details to all employees and provide resources for those interested in participating. Offer training and support to managers on how to effectively manage phased retirees and their changing roles.

Create a mentorship component where phased retirees can share their knowledge and experience with younger employees. This ensures valuable skills and institutional knowledge are transferred before full retirement.

Regularly review and adjust the program based on feedback from participants and organizational needs. Be prepared to make modifications to ensure the program remains beneficial for both employees and the company.

Finally, consider the financial implications of the program, including any changes to benefits or compensation structures. Work with HR and finance teams to ensure the program is sustainable and compliant with relevant laws and regulations.

Common phased retirement arrangements

Phased retirement arrangements offer flexible options for employees transitioning from full-time work to retirement. These arrangements can benefit both employees and employers by allowing for a gradual reduction in work hours while maintaining engagement with the company.

One common arrangement is the reduction of work hours, where employees work part-time instead of full-time. This allows them to enjoy more personal time while still contributing to the workplace.

Another option is job sharing, where two employees share the responsibilities of one full-time position. This can help maintain productivity while reducing the workload for each individual.

Some organizations offer mentorship roles as part of phased retirement, allowing experienced employees to pass on their knowledge to younger colleagues. This not only aids in knowledge transfer but also keeps retirees involved in the company's growth.

Employers may also provide consulting opportunities, enabling retirees to work on specific projects or tasks. This keeps their expertise available to the organization while offering retirees a flexible work schedule.

These arrangements can be tailored to fit the needs of both the organization and the employee, ensuring a smooth transition into retirement. Understanding these options can enhance the employee experience and support workforce planning strategies.

Legal considerations for phased retirement

When considering phased retirement, legal considerations play a significant role in shaping the policies and practices that organizations must adhere to. Employers need to be aware of age discrimination laws, as phased retirement often involves older employees transitioning out of full-time work.

The Age Discrimination in Employment Act (ADEA) protects employees aged 40 and above from discrimination based on age. This means that any phased retirement plan must be carefully structured to ensure it does not unintentionally favor or disadvantage employees based on their age.

Additionally, employers must comply with employment status regulations, ensuring that employees' rights and benefits are maintained during their transition. This involves clear communication and documentation of any changes in employment terms.

Employers should also consider the impact of phased retirement on pension plans and benefits. It's crucial to review any existing retirement or pension plans to ensure they align with the phased retirement strategy and comply with legal standards.

Lastly, consulting with legal professionals or HR experts can help organizations navigate these complexities. This ensures that phased retirement plans are legally sound and equitable for all employees involved.

Measuring the success of phased retirement programs

Measuring the success of phased retirement programs is important for organizations to understand their effectiveness and impact. By tracking key metrics such as employee satisfaction, productivity, and retention rates, companies can gauge the program's effectiveness in meeting its goals.

Employee feedback through surveys and interviews can provide insights into the program's impact on their work-life balance and overall job satisfaction. This qualitative data complements quantitative measures and helps organizations make informed decisions about program adjustments.

Analyzing productivity metrics before and after implementing phased retirement can reveal how the program affects employee output. This can help determine if the program enhances or hinders productivity, allowing for necessary adjustments.

Retention rates of employees participating in phased retirement programs can indicate the program's success in retaining valuable talent. High retention rates suggest that employees find the program beneficial and are more likely to stay with the company.

Organizations should also consider the cost-benefit analysis of phased retirement programs. Evaluating the program's financial impact against its benefits in terms of talent retention and productivity can help justify its continuation or expansion.

Conclusion

Phased Retirement FAQs

Phased retirement benefits employers by:

- Retaining experienced talent and institutional knowledge

- Facilitating smoother succession planning

- Reducing full-time payroll costs while maintaining productivity

- Improving employee morale and engagement

Common phased retirement arrangements include:

- Reduced work hours or days per week

- Job sharing between retiring and newer employees

- Seasonal or project-based work

- Consulting or mentoring roles for retiring employees

Key legal considerations for phased retirement include:

- Compliance with age discrimination laws

- Fair treatment in benefits and compensation

- Clear communication of retirement terms and conditions

- Proper handling of pension and retirement account distributions

Employers can measure phased retirement success by tracking:

- Knowledge transfer effectiveness

- Cost savings compared to full-time employment

- Employee satisfaction and engagement levels

- Retention rates of key skills and experience within the organization

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated terms