Imputed income can be a complex topic for recruiters, but understanding it is important for managing employee benefits. It refers to the value of non-cash benefits provided to employees, which must be reported as taxable income.

Recruiters should be aware of imputed income scenarios, as they impact employee compensation packages and tax liabilities. This knowledge helps in structuring competitive offers and maintaining compliance with tax regulations.

Table of contents

What is Imputed Income?

Imputed income refers to the value of non-cash benefits or services provided by an employer that are considered taxable income. These benefits, although not received as direct monetary compensation, are treated as if the employee had received cash equivalent to their fair market value.

Common examples of imputed income include employer-provided life insurance coverage exceeding $50,000, personal use of a company car, or certain educational assistance programs. When these benefits are provided, their value must be calculated and added to the employee's taxable income for reporting purposes.

It's important for HR professionals and recruiters to understand imputed income when discussing compensation packages with potential hires. Accurately explaining the total compensation including both cash and non-cash benefits can help candidates make informed decisions about job offers.

Employers are responsible for calculating and reporting imputed income on employees' W-2 forms. This ensures compliance with tax regulations and helps employees understand their true total compensation.

While imputed income can increase an employee's taxable income, it often represents valuable benefits that enhance the overall employment package. Understanding and communicating these benefits effectively can be a key factor in attracting and retaining top talent.

Imputed Income Examples

Imputed income can be a bit tricky to understand, but it's essentially the value of any benefits or perks an employee receives from their employer that aren't part of their regular salary. These benefits can be anything from a company car to a gym membership, and they often have tax implications.

One common example of imputed income is when an employer provides a company car for personal use. The value of using that car for personal trips is considered imputed income and must be reported for tax purposes.

Another example is employer-paid life insurance that exceeds a certain amount. If the coverage is over $50,000, the cost of the excess coverage is considered imputed income and subject to taxes.

Gym memberships paid by the employer can also count as imputed income. If the membership is not directly related to the employee's job, its value is added to the employee's taxable income.

Lastly, let's consider relocation expenses covered by the employer. If an employee moves for a new job and the company pays for moving costs, those payments may be treated as imputed income, affecting the employee's tax obligations.

Understanding imputed income is important for both employers and employees, especially when discussing compensation packages. Knowing what counts as imputed income helps in accurately reporting taxes and avoiding any surprises during tax season.

Why Should HR and Recruiters Care About Imputed Income?

HR professionals and recruiters should care about imputed income because it directly impacts employee compensation and tax reporting. Understanding imputed income is crucial for maintaining compliance with tax laws and ensuring fair compensation practices within the organization.

Imputed income can affect an employee's total taxable income, potentially altering their tax bracket and take-home pay. By being aware of imputed income, HR and recruiters can accurately communicate the full value of compensation packages to potential hires and current employees.

Proper handling of imputed income is essential for maintaining accurate payroll records and financial reporting. Mismanagement of imputed income can lead to tax discrepancies, legal issues, and potential penalties for both the company and employees.

Understanding imputed income allows HR professionals to design more competitive and attractive benefits packages. By considering the tax implications of various perks and benefits, recruiters can create offers that maximize value for candidates while minimizing tax burdens.

Knowledge of imputed income helps HR teams educate employees about their total compensation and the value of non-monetary benefits. This awareness can improve employee satisfaction and retention by highlighting the full scope of their compensation package beyond just their base salary.

Imputed Income: Common Scenarios in HR

Imputed income scenarios are common in various HR situations. Let's explore some typical instances where imputed income comes into play in the workplace.

Company-provided vehicles often result in imputed income for employees. When an employee uses a company car for personal purposes, the fair market value of that personal use is considered taxable income.

Group term life insurance coverage exceeding $50,000 is another common scenario. The cost of coverage above this threshold is considered imputed income and must be reported on the employee's W-2 form.

Employer-paid moving expenses can also lead to imputed income. If the company covers relocation costs that are not tax-deductible, those amounts may be treated as taxable income for the employee.

Domestic partner benefits frequently involve imputed income considerations. When an employer provides health insurance for an employee's domestic partner who doesn't qualify as a tax dependent, the value of that coverage is typically considered imputed income.

Employee discounts beyond certain thresholds can trigger imputed income. If the discount exceeds the limits set by the IRS, the excess amount may be treated as taxable compensation.

How is Imputed Income Calculated?

Calculating imputed income involves identifying non-cash benefits provided by an employer and determining their fair market value. These benefits can include things like group-term life insurance exceeding $50,000, personal use of a company car, or employer-provided housing.

To calculate the imputed income, the fair market value of the benefit is added to the employee's gross income. This amount is then subject to income tax, Social Security, and Medicare taxes, similar to regular wages.

Employers often use specific valuation methods to determine the fair market value, such as the lease value rule for vehicles. It's important to understand these methods to ensure accurate reporting and compliance with tax regulations.

Recruiters and hiring managers should be aware of how imputed income can affect an employee's overall compensation package. This knowledge can help in explaining compensation details to candidates during the hiring process.

Understanding imputed income is also crucial for maintaining transparency and avoiding potential disputes with employees over their compensation. It ensures that all parties have a clear understanding of the total value of the compensation offered.

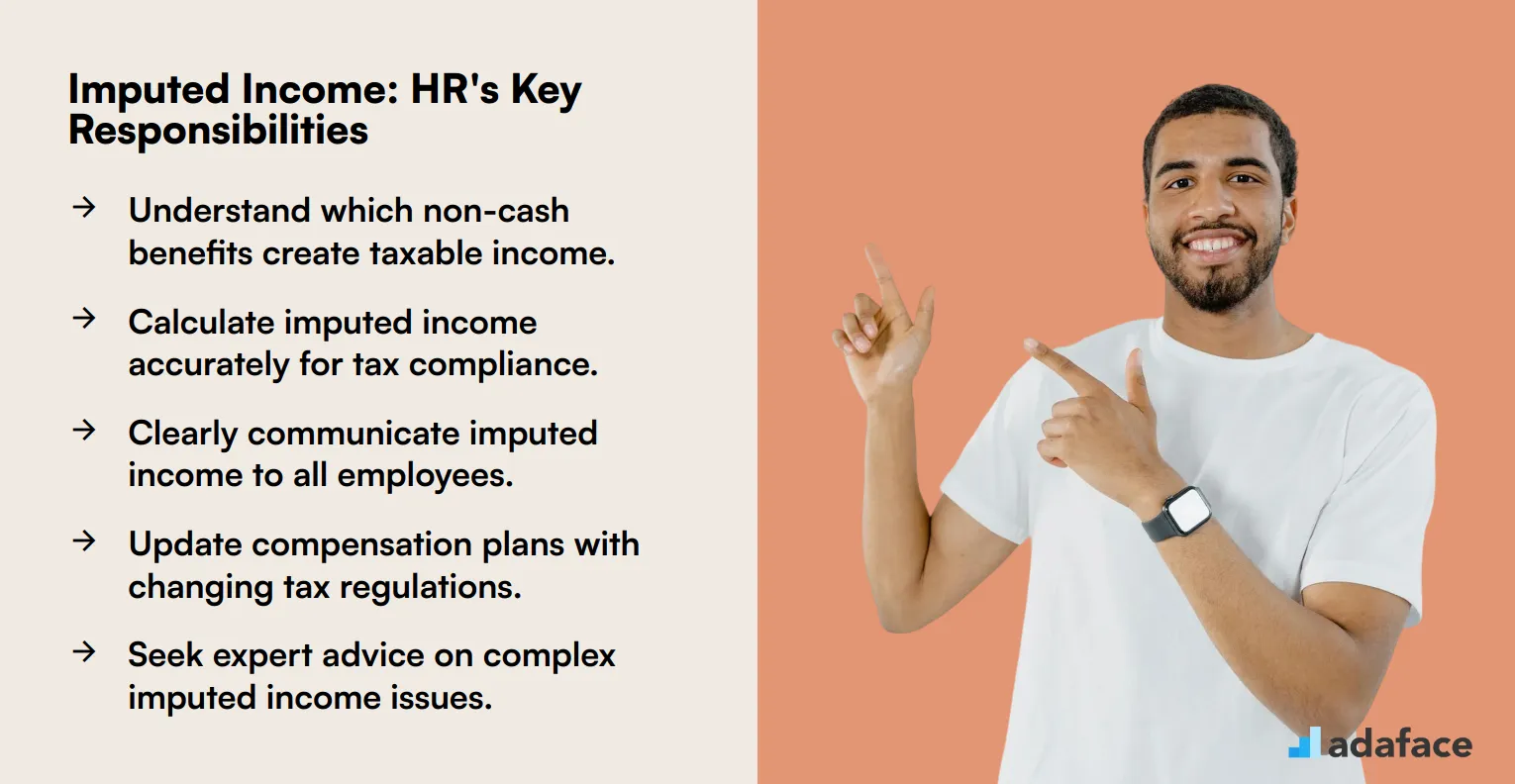

Imputed Income: Key Takeaways for HR

Understanding imputed income is important for HR professionals as it impacts employee compensation and benefits. It refers to the value of non-cash benefits provided by employers, which are taxable under certain conditions.

HR teams need to be aware of how imputed income can affect an employee's overall tax liability. This awareness helps in designing compensation packages that are attractive yet compliant with tax regulations.

Imputed income can include benefits like company cars, gym memberships, or housing allowances. Knowing these details aids in effective employee assessment and ensures transparency in the recruitment process.

HR professionals should communicate clearly with employees about their imputed income to avoid misunderstandings. This communication is key in maintaining trust and satisfaction within the workforce.

Staying informed about changes in tax laws related to imputed income is crucial for HR teams. It allows for timely adjustments in compensation strategies, aligning with corporate goals and legal requirements.

Wrapping Up: Imputed Income for HR Professionals

Understanding imputed income is important for HR professionals to ensure compliance and accurate compensation reporting. By grasping the concept, HR teams can better communicate with employees and avoid potential misunderstandings.

The examples and scenarios discussed highlight where imputed income might arise in everyday HR activities. With this knowledge, HR professionals can confidently navigate the complexities of employee compensation.

Remember, accurate calculation and reporting of imputed income maintain transparency and trust within the organization. Stay informed, and you'll be well-equipped to handle any imputed income challenges that come your way.

Imputed Income FAQs

Imputed income is the value of non-cash benefits provided to employees, which must be reported as taxable income. It includes benefits like company cars and health insurance.

Recruiters need to understand imputed income to structure competitive compensation packages and ensure compliance with tax laws, impacting overall recruitment strategies.

Imputed income is calculated based on the fair market value of the non-cash benefits provided to employees. This value is then added to the employee's taxable income.

Common examples include the personal use of a company car, employer-paid life insurance exceeding $50,000, and gym memberships. These benefits are considered taxable income.

Recruiters can manage imputed income by staying informed about tax regulations, communicating clearly with employees, and incorporating imputed income into compensation discussions.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated terms