Quantitative traders are at the heart of financial strategies, using complex mathematical models to make decisions about buying and selling financial instruments. Their role is critical in maximizing profits and minimizing risks by analyzing market data and applying quantitative techniques.

Skills required for a quantitative trader include a strong foundation in mathematics and statistics, proficiency in programming languages like Python or C++, and a keen understanding of financial markets. Additionally, they must possess strong analytical and problem-solving abilities.

Candidates can write these abilities in their resumes, but you can’t verify them without on-the-job Quantitative Trader skill tests.

In this post, we will explore 8 essential Quantitative Trader skills, 9 secondary skills and how to assess them so you can make informed hiring decisions.

Table of contents

8 fundamental Quantitative Trader skills and traits

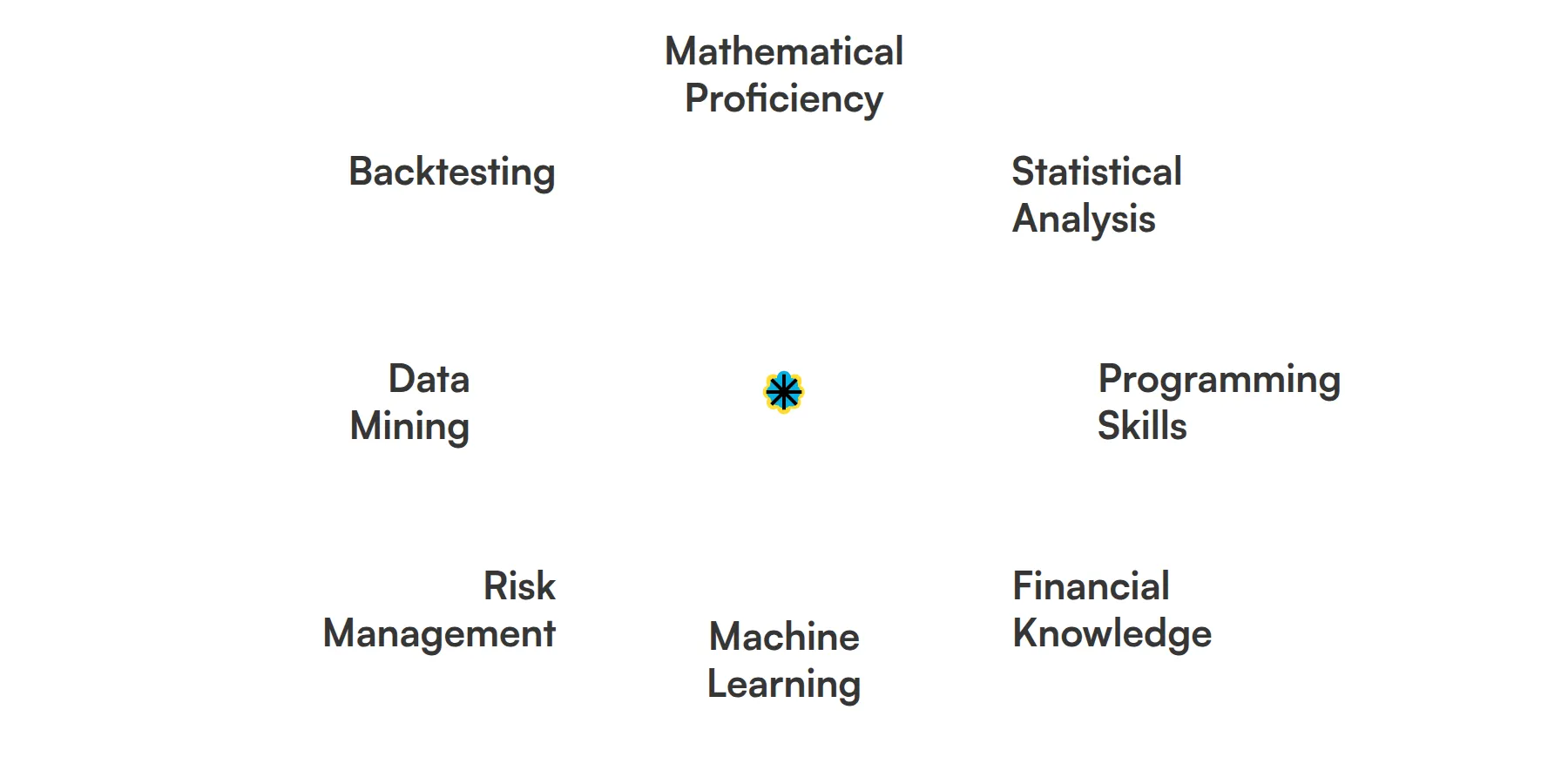

The best skills for Quantitative Traders include Mathematical Proficiency, Statistical Analysis, Programming Skills, Financial Knowledge, Machine Learning, Risk Management, Data Mining and Backtesting.

Let’s dive into the details by examining the 8 essential skills of a Quantitative Trader.

Mathematical Proficiency

Quantitative traders rely heavily on advanced mathematical concepts to develop trading algorithms. This skill is crucial for analyzing financial data and creating models that predict market movements effectively.

Check out our guide for a comprehensive list of interview questions.

Statistical Analysis

A quantitative trader must be adept at using statistical tools to interpret data trends and test the validity of their models. This involves applying statistical tests and confidence intervals to ensure the robustness of trading strategies.

Programming Skills

Proficiency in programming languages such as Python, R, or C++ is essential for implementing complex trading algorithms. The role requires writing efficient code that can process large volumes of data in real time.

Financial Knowledge

Understanding financial markets, instruments, and economic indicators is fundamental for a quantitative trader. This knowledge helps in making informed decisions and adapting strategies based on market conditions.

Machine Learning

Applying machine learning techniques allows quantitative traders to create predictive models and improve existing algorithms. This skill is used to analyze patterns in historical data and forecast future market behaviors.

For more insights, check out our guide to writing a Machine Learning Engineer Job Description.

Risk Management

Effective risk management is necessary to minimize losses and optimize returns. Quantitative traders use mathematical models to assess risk and determine the appropriate trading positions.

Data Mining

Data mining skills enable quantitative traders to extract useful information from vast datasets. This involves cleaning, processing, and analyzing data to uncover actionable insights that inform trading strategies.

Check out our guide for a comprehensive list of interview questions.

Backtesting

Backtesting involves simulating trading strategies on historical data to evaluate their effectiveness. This is a critical step for quantitative traders to refine their algorithms before live deployment.

9 secondary Quantitative Trader skills and traits

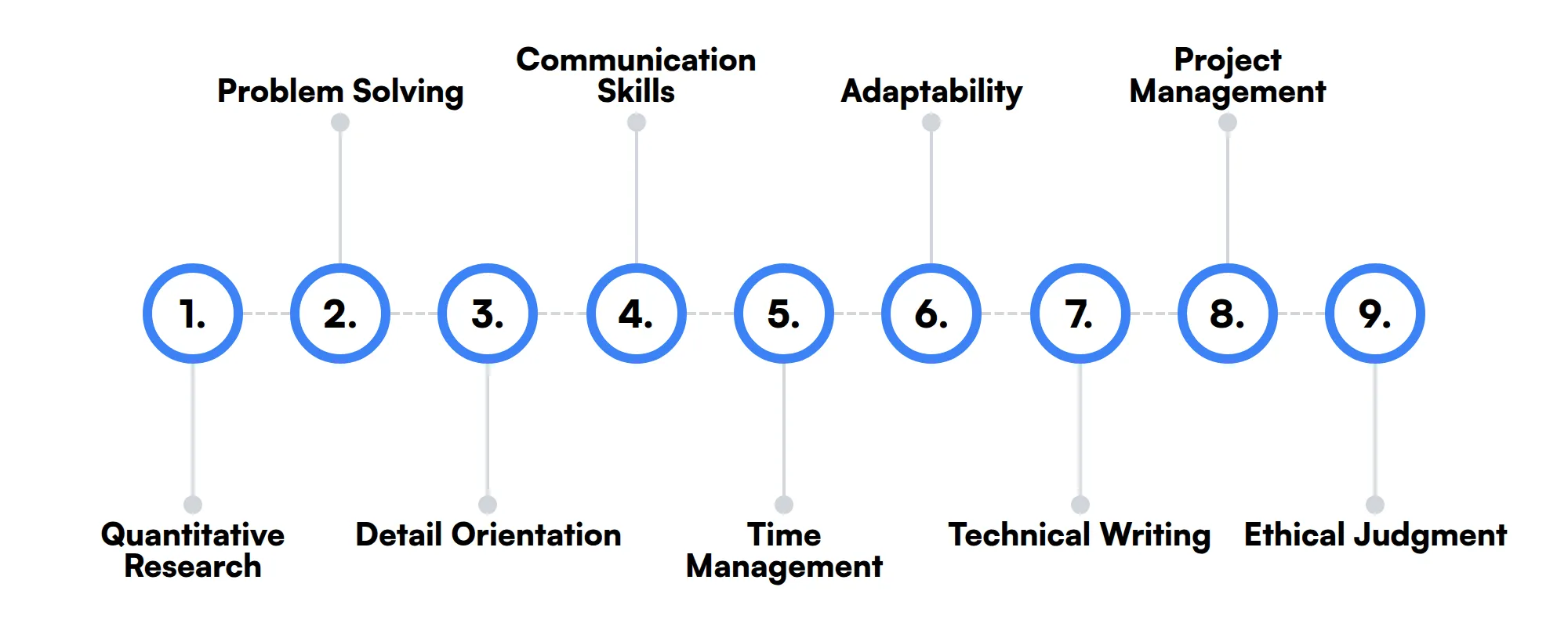

The best skills for Quantitative Traders include Quantitative Research, Problem Solving, Detail Orientation, Communication Skills, Time Management, Adaptability, Technical Writing, Project Management and Ethical Judgment.

Let’s dive into the details by examining the 9 secondary skills of a Quantitative Trader.

Quantitative Research

Research skills are important for staying updated with the latest techniques and technologies in quantitative trading. Continuous learning helps in enhancing the strategies used in trading.

Problem Solving

The ability to quickly identify and solve problems as they arise during trading is crucial. This skill helps in adjusting strategies in real time to avoid significant financial losses.

Detail Orientation

Paying attention to minute details in vast datasets can lead to the discovery of profitable trading opportunities. This skill is particularly important when fine-tuning trading models.

Communication Skills

Effective communication is necessary for collaborating with team members and stakeholders. It ensures that complex strategies are understood and properly implemented.

Time Management

The fast-paced nature of trading requires excellent time management to prioritize tasks and respond swiftly to market changes.

Adaptability

Markets are dynamic, and a quantitative trader must be adaptable to change strategies and approaches swiftly as market conditions evolve.

Technical Writing

Ability to document strategies and models clearly is important for knowledge transfer within teams and for compliance purposes.

Project Management

Managing multiple trading projects and ensuring they align with business goals requires effective project management skills.

Ethical Judgment

Understanding and adhering to ethical standards in trading practices is crucial to maintain integrity and trust in financial markets.

How to assess Quantitative Trader skills and traits

Assessing the skills and traits of a Quantitative Trader can be a challenging task, given the diverse range of expertise required in this field. From mathematical proficiency to risk management, a Quantitative Trader must possess a unique blend of abilities to excel in their role. Understanding how to evaluate these skills effectively is key to identifying the right candidate for your team.

Traditional resumes might highlight a candidate's educational background and past experiences, but they often fall short in demonstrating the practical application of their skills. This is where skills-based assessments come into play, providing a more accurate picture of a candidate's capabilities. By focusing on real-world scenarios and problem-solving tasks, these assessments can reveal a candidate's true potential.

To streamline the hiring process and ensure you are selecting the best candidates, consider using Adaface on-the-job skill tests. These assessments can help you achieve a 2x improved quality of hires and an 85% reduction in screening time. By tailoring the tests to include key skills such as statistical analysis, programming, and financial knowledge, you can confidently assess a candidate's readiness for the role.

Let’s look at how to assess Quantitative Trader skills with these 6 talent assessments.

Business Math Test

Our Business Math Test evaluates a candidate's ability to apply mathematical concepts in business scenarios, covering a wide range of topics from basic arithmetic to complex financial assessments.

The test assesses their understanding of arithmetic, percentages, algebra, statistics, probability, and financial calculations such as interest, discounts, and financial ratios.

Successful candidates demonstrate proficiency in applying these mathematical skills to solve problems related to business operations, cost analysis, and budgeting.

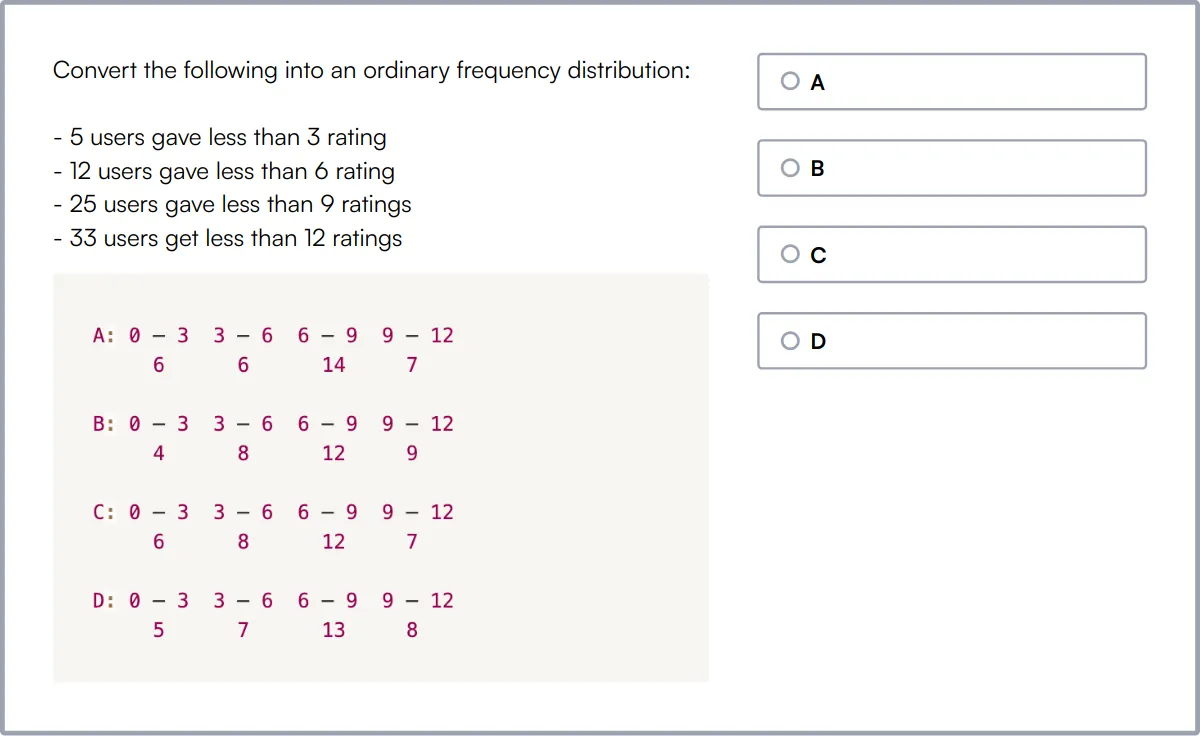

Statistics Test

Our Statistics Test measures a candidate's proficiency in statistical concepts and data analysis, essential for data-driven decision making.

This test evaluates knowledge in statistics fundamentals, inference, regression, sampling distributions, and exploratory data analysis.

Candidates who score well are adept at applying statistical methods to real-world problems, interpreting p-values, confidence intervals, and effectively handling data sampling and analysis.

Basic Computer Skills Test

The Basic Computer Skills Test assesses fundamental computer skills, including data entry, Excel, and system administration, necessary for modern workplace efficiency.

Candidates are tested on their proficiency in basic computer operations, Excel, typing, and system administration skills.

High-scoring individuals show strong capabilities in managing and manipulating data, maintaining systems, and utilizing common office software efficiently.

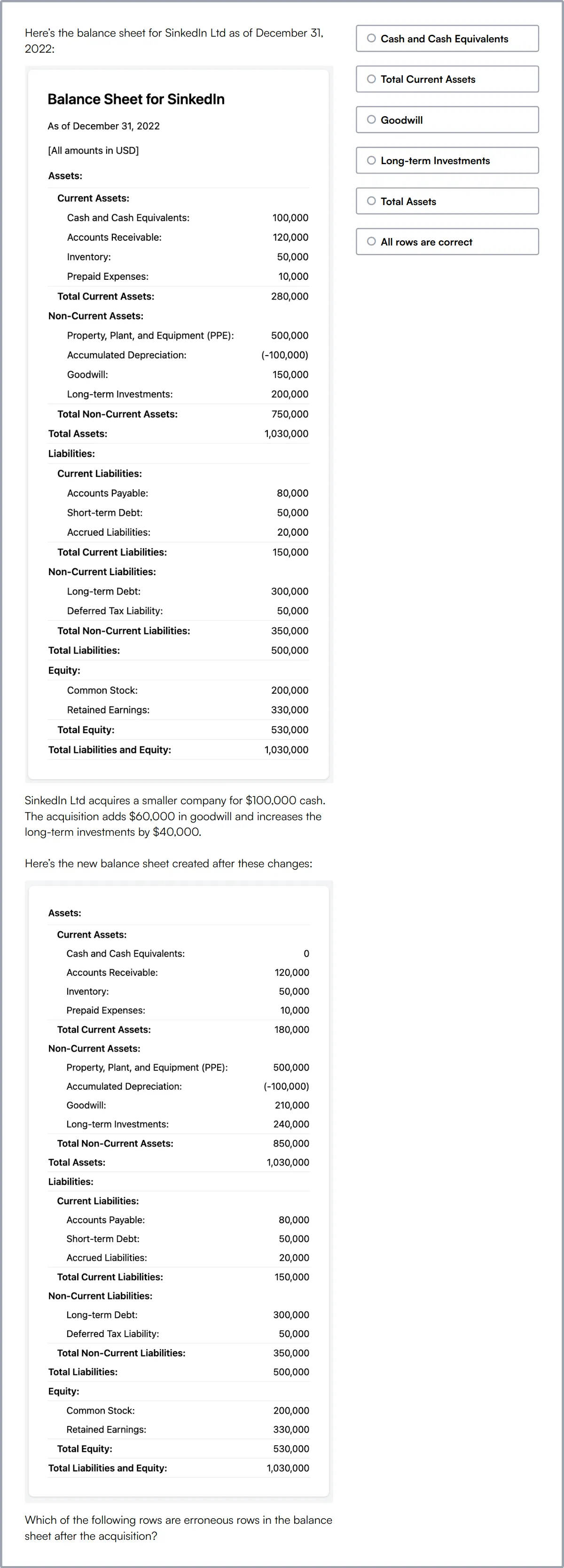

Financial Analyst Test

Our Financial Analyst Test is designed to evaluate a candidate's expertise in financial analysis, from understanding financial statements to investment analysis and risk management.

The test covers accounting principles, expertise with Excel, financial statements analysis, and skills in budgeting, forecasting, and financial ratios.

Candidates excelling in this test demonstrate a deep understanding of financial metrics and are capable of making informed financial decisions and predictions.

Machine Learning in AWS Online Test

The Machine Learning in AWS Online Test assesses a candidate's ability to implement machine learning solutions using AWS, focusing on data science and data analysis.

This test evaluates knowledge in machine learning concepts within the AWS environment, including data science, data analysis, and Kubernetes.

Proficient candidates can leverage AWS services to deploy scalable machine learning models and handle complex data analysis tasks.

Data Mining Test

Our Data Mining Test evaluates candidates on their proficiency in data mining techniques and data preprocessing, crucial for extracting valuable insights from large datasets.

The test challenges candidates with scenarios in data processing, data warehouse technology, data preprocessing, and mining frequent patterns.

Successful candidates demonstrate strong skills in handling complex data sets, performing data cleaning, reduction, and integration to support significant business decisions.

Summary: The 8 key Quantitative Trader skills and how to test for them

| Quantitative Trader skill | How to assess them |

|---|---|

| 1. Mathematical Proficiency | Evaluate candidate's ability to solve complex numerical problems. |

| 2. Statistical Analysis | Assess understanding and application of statistical models and data interpretation. |

| 3. Programming Skills | Test coding ability in relevant programming languages and environments. |

| 4. Financial Knowledge | Check comprehension of financial markets, instruments, and economics. |

| 5. Machine Learning | Review proficiency in building and deploying machine learning models. |

| 6. Risk Management | Examine approaches to identifying, analyzing, and mitigating risks. |

| 7. Data Mining | Assess skills in extracting and analyzing large datasets. |

| 8. Backtesting | Evaluate ability to create and use historical data to test trading strategies. |

Quantitative Aptitude Online Test

Quantitative Trader skills FAQs

What mathematical skills are important for a Quantitative Trader?

Quantitative traders need a strong grasp of calculus, linear algebra, and probability. These skills help in modeling and predicting market behaviors.

How does statistical analysis impact quantitative trading?

Statistical analysis enables traders to interpret data trends and market patterns, aiding in the development of trading strategies and risk assessment.

What programming languages are preferred for quantitative trading?

Python and C++ are commonly used due to their efficiency in handling large datasets and performing complex mathematical computations.

Why is machine learning important for quantitative traders?

Machine learning helps in creating predictive models and algorithms that can learn from and make decisions based on data, enhancing trading strategies.

What is the role of risk management in quantitative trading?

Risk management is key to protecting investments. It involves identifying, analyzing, and mitigating potential losses in trading activities.

How can recruiters assess a candidate's ability in backtesting?

Candidates can be evaluated based on their ability to design and implement historical simulations to test the viability of trading strategies.

What financial knowledge should a quantitative trader possess?

A quantitative trader should understand financial markets, instruments, and economic indicators, as well as how they influence market dynamics.

How important are communication skills for a quantitative trader?

Effective communication is necessary for explaining complex trading strategies and models to team members and stakeholders.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources