Hiring the right accounts receivable specialist is important to maintaining a healthy cash flow and reducing financial risks. It can be challenging to find candidates who not only possess the required accounting knowledge but also the soft skills necessary for effective communication and problem-solving.

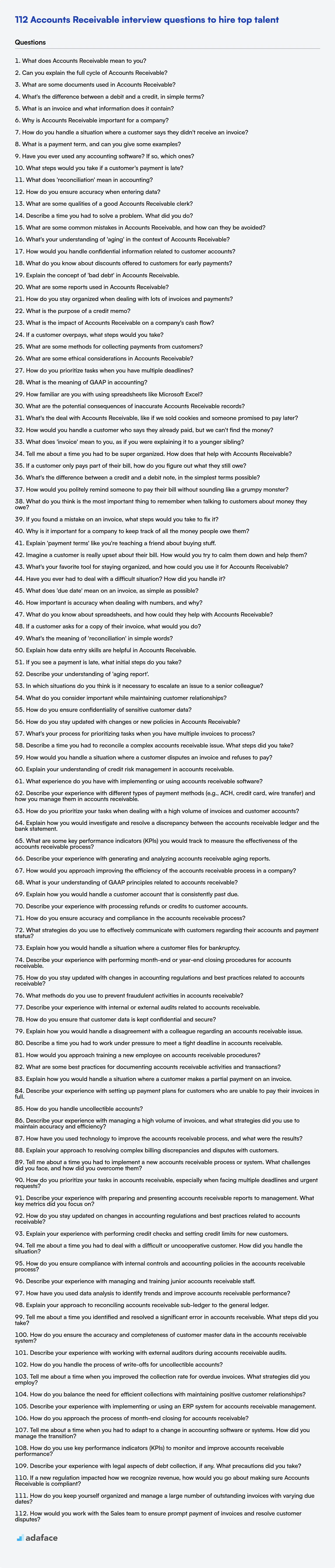

This blog post provides a curated list of accounts receivable interview questions, designed for recruiters and hiring managers. We've categorized these questions by experience level, from freshers to experienced professionals, including multiple-choice questions to assess knowledge depth.

By using these questions, you can identify candidates with the accounting skills and aptitude needed to excel in the role; consider using our accounting test to objectively evaluate candidates before the interview stage.

Table of contents

Accounts Receivable interview questions for freshers

1. What does Accounts Receivable mean to you?

Accounts Receivable (AR) represents the money owed to a company by its customers for goods or services that have been delivered or used but not yet paid for. It's essentially an IOU from customers.

Managing AR effectively is crucial for maintaining healthy cash flow. Tracking outstanding invoices, following up on overdue payments, and implementing credit policies are important aspects of AR management. Poor AR management can lead to cash flow problems and even bad debts.

2. Can you explain the full cycle of Accounts Receivable?

The accounts receivable (AR) cycle begins with a sale or service provided on credit. This generates an invoice which is sent to the customer. The invoice outlines the goods or services provided, the amount due, and the payment terms. Next comes tracking the receivable, which involves recording the invoice in the accounting system and monitoring payment due dates. The goal is to ensure timely collection.

Once the customer pays, the payment is applied to the corresponding invoice, reducing the accounts receivable balance. If payment is not received by the due date, collection efforts begin, which may involve sending reminders, making phone calls, or even involving a collection agency. Finally, uncollectible accounts are written off as bad debt.

3. What are some documents used in Accounts Receivable?

In Accounts Receivable, several key documents are used to manage and track the money owed to a company. These documents facilitate the process from initial sale to payment collection. Some common documents include:

- Invoices: These are formal requests for payment issued to customers, detailing the products or services provided, the amount due, and the payment terms.

- Credit Memos: Issued to reduce the amount a customer owes, typically due to returns, allowances, or errors on the original invoice.

- Customer Statements: Periodic summaries sent to customers, showing all outstanding invoices, payments, and credits.

- Remittance Advices: Documents sent by customers along with their payments, indicating which invoices are being paid.

- Aging Reports: These categorize outstanding invoices by the length of time they have been outstanding, helping to prioritize collection efforts.

4. What's the difference between a debit and a credit, in simple terms?

A debit increases asset or expense accounts and decreases liability, owner's equity, or revenue accounts. Think of it as putting money into an asset account (like your checking account) or increasing an expense. Conversely, a credit increases liability, owner's equity, or revenue accounts and decreases asset or expense accounts. It's like money leaving an asset account or increasing revenue.

Simply put, in the context of accounting, they're opposite sides of a transaction. Every transaction has at least one debit and at least one credit, and the total debits must always equal the total credits to keep the accounting equation balanced (Assets = Liabilities + Equity).

5. What is an invoice and what information does it contain?

An invoice is a commercial document that itemizes and records a transaction between a buyer and a seller. It's essentially a bill outlining what was purchased, the quantity, and the agreed-upon price.

Typically, an invoice contains the following information:

- Invoice Number: A unique identifier for the invoice.

- Date: The date the invoice was issued.

- Seller Information: Name, address, and contact details of the seller.

- Buyer Information: Name, address, and contact details of the buyer.

- Description of Goods/Services: A clear description of what was sold.

- Quantity: The number of units or hours provided.

- Unit Price: The price per unit or hour.

- Total Amount Due: The sum of all charges, including taxes and discounts.

- Payment Terms: Instructions on how and when to pay (e.g., due date, payment methods).

6. Why is Accounts Receivable important for a company?

Accounts Receivable (AR) is important because it represents money owed to the company for goods or services already provided. Effectively managing AR ensures a healthy cash flow, which is vital for covering operational expenses, investing in growth, and meeting financial obligations.

Poor AR management can lead to cash flow problems, increased borrowing costs, and even potential losses due to uncollectible debts. Efficient AR processes, including timely invoicing, diligent follow-up, and effective credit policies, contribute to a company's financial stability and overall success.

7. How do you handle a situation where a customer says they didn't receive an invoice?

First, I'd apologize for the inconvenience and assure the customer I'll look into it immediately. I'd then verify their contact information (email and mailing address) to ensure the invoice was sent to the correct place. I would check our system to confirm if the invoice was generated and sent, and if there were any delivery issues or bounce-backs. If the invoice was sent correctly and the customer still hasn't received it, I'd resend the invoice via email and offer to mail a physical copy. I would also offer to review their account to ensure all contact details are up to date to prevent future issues. I might also suggest whitelisting our email address to avoid it going to spam. Finally, I'd follow up to confirm they received the invoice.

8. What is a payment term, and can you give some examples?

A payment term outlines the timeframe within which a buyer is expected to pay a seller for goods or services rendered. It specifies the allowed delay between the invoice date and the due date for payment.

Examples include:

- Net 30: Payment is due 30 days after the invoice date.

- Net 60: Payment is due 60 days after the invoice date.

- 2/10, Net 30: A 2% discount is offered if the invoice is paid within 10 days; otherwise, the full amount is due in 30 days.

- Cash on Delivery (COD): Payment is due upon delivery of the goods.

- Due Upon Receipt: Payment is due immediately upon receiving the invoice.

9. Have you ever used any accounting software? If so, which ones?

Yes, I have experience using several accounting software packages. I'm familiar with both cloud-based and desktop solutions. Specifically, I've worked with QuickBooks Online and Xero for small to medium-sized businesses, and I have some experience with SAP for larger enterprises.

My experience includes tasks such as setting up company files, managing chart of accounts, processing invoices and payments, reconciling bank statements, and generating financial reports. I am also comfortable with using features like budgeting, inventory management, and payroll within these platforms. I can adapt quickly to new accounting software as needed.

10. What steps would you take if a customer's payment is late?

If a customer's payment is late, I would first review the payment terms and the customer's payment history. Then, I would send a polite reminder email or call, clearly stating the overdue amount and the due date, while also inquiring if there were any issues preventing the payment.

If there's no response or the payment remains outstanding, I would escalate the communication, potentially involving a more formal letter or phone call. I would also explore offering flexible payment options or a payment plan, if appropriate, always while adhering to company policy and documenting all communication.

11. What does 'reconciliation' mean in accounting?

Reconciliation in accounting is the process of comparing two sets of records to ensure they are in agreement. This is done to identify any discrepancies or errors between the records, and to correct them so that the records accurately reflect the financial position of the business.

For example, a common reconciliation is comparing the cash balance in a company's accounting records with the corresponding bank statement balance. If there are differences, the company investigates the reasons for the differences (e.g., outstanding checks, deposits in transit, bank fees) and makes adjustments to reconcile the two balances.

12. How do you ensure accuracy when entering data?

To ensure accuracy when entering data, I use several techniques. First, I double-check all entries against the source document or information. I pay close attention to detail and look for common errors like transposed numbers or misspelled names. I also use data validation rules whenever possible, especially in spreadsheets or databases, to restrict the type and range of values that can be entered.

Furthermore, I implement verification steps. For instance, if entering a large dataset, I periodically review a sample of the entered data against the source to identify and correct any systematic errors. If working with structured data, I leverage automated tools and scripts where possible to compare data against known standards or reference datasets. Finally, I understand the importance of clear communication; if something is unclear, I always ask for clarification.

13. What are some qualities of a good Accounts Receivable clerk?

A good Accounts Receivable clerk possesses several key qualities. They are detail-oriented and accurate, ensuring invoices are processed correctly and payments are applied promptly. Strong organizational skills are crucial for managing a large volume of data and maintaining accurate records. They must be proficient with accounting software and have basic bookkeeping knowledge. Excellent communication skills are also important for interacting with customers to resolve payment issues and answer inquiries.

Furthermore, a successful AR clerk exhibits problem-solving skills to investigate discrepancies and find solutions. They are persistent in following up on outstanding payments and maintain a professional and courteous demeanor even in challenging situations. Time management is also important to ensure all tasks are completed within deadlines.

14. Describe a time you had to solve a problem. What did you do?

In my previous role, we encountered a critical performance bottleneck in our e-commerce platform's checkout process. Order processing times had increased significantly, leading to customer frustration and cart abandonment. I took the initiative to investigate the root cause. First, I used profiling tools to identify the slowest parts of the code. This pointed to a complex database query used to calculate shipping costs. Then, I analyzed the query execution plan and found several opportunities for optimization, including adding indexes to relevant columns and rewriting the query to reduce the amount of data scanned.

After implementing these changes, we saw a substantial improvement in query performance, reducing order processing times by over 50%. This significantly improved the customer experience and reduced cart abandonment rates. I documented the changes and shared them with the team to prevent similar issues in the future.

15. What are some common mistakes in Accounts Receivable, and how can they be avoided?

Common mistakes in Accounts Receivable (AR) include inaccurate invoicing, leading to disputes and delays. This can happen from manual data entry errors, incorrect pricing, or failing to apply discounts or taxes correctly. Another frequent issue is poor credit management, extending credit to customers with a high risk of default. Also, neglecting timely follow-up on overdue invoices and a lack of a clear collections process hurts cash flow.

To avoid these mistakes, implement automated invoicing systems to reduce manual errors. Regularly review and update customer credit limits based on payment history. Enforce a strict collections process with automated reminders and escalation procedures for overdue accounts. Reconcile accounts receivable on a regular basis, perhaps weekly or monthly, to identify and resolve discrepancies promptly. Finally, clearly define the terms of payment to avoid later disputes.

16. What's your understanding of 'aging' in the context of Accounts Receivable?

In Accounts Receivable (AR), 'aging' refers to the process of categorizing outstanding invoices or debts based on the length of time they've been outstanding. It's a way to analyze the composition of receivables and identify invoices that are at risk of not being paid.

Typically, AR aging is presented in a table format, grouping invoices into buckets like 'Current (0-30 days)', '31-60 days', '61-90 days', and 'Over 90 days'. This helps businesses prioritize collection efforts, assess credit risk, and estimate potential bad debt write-offs. A higher proportion of receivables in the older aging buckets generally indicates a greater risk of non-payment.

17. How would you handle confidential information related to customer accounts?

I would handle confidential customer account information with utmost care and diligence, adhering to strict security protocols and company policies. This includes using secure systems and encrypted communication channels for storage and transmission. Access would be limited to authorized personnel only, based on a need-to-know basis and role-based access controls would be used.

Furthermore, I would ensure compliance with data privacy regulations like GDPR or CCPA, depending on the customer's location. Data masking and anonymization techniques would be employed whenever possible. If any suspected data breach or unauthorized access is detected, I would immediately report it to the appropriate security team and follow the incident response plan.

18. What do you know about discounts offered to customers for early payments?

Discounts for early payment, often called "early payment discounts", are incentives offered to customers to pay their invoices before the standard due date. For example, terms like "2/10 net 30" mean a 2% discount if the invoice is paid within 10 days; otherwise, the full amount is due in 30 days.

These discounts benefit the seller by improving cash flow and reducing the risk of late or non-payment. While the buyer forgoes some potential interest earned by holding onto the money longer, they receive an immediate price reduction. Businesses consider several factors when deciding whether to offer or take advantage of such discounts, weighing the cost of capital against the benefits of faster payment or reduced expenses. These calculations should be done systematically.

19. Explain the concept of 'bad debt' in Accounts Receivable.

Bad debt in Accounts Receivable refers to the portion of outstanding customer balances that a company deems uncollectible. This typically happens when customers are unable or unwilling to pay their debts due to financial difficulties, bankruptcy, or disputes over goods or services. It represents a loss for the company.

Companies typically use methods like the allowance method or the direct write-off method to account for bad debt. The allowance method estimates bad debt expense and sets aside a reserve, while the direct write-off method recognizes bad debt expense only when a specific account is deemed uncollectible. Recognizing and properly accounting for bad debt is crucial for accurate financial reporting and assessing a company's financial health.

20. What are some reports used in Accounts Receivable?

Accounts Receivable (AR) reports provide insights into outstanding invoices and payment trends. Common AR reports include:

- Aged Receivables Report: This report categorizes outstanding invoices by age (e.g., 30, 60, 90 days past due), helping prioritize collection efforts.

- Customer Statements: Summarizes a customer's outstanding balance and transaction history.

- Sales by Customer Report: Shows sales revenue generated by each customer, which can be useful in identifying high-value customers.

- Collection Reports: Tracks collection activities, such as phone calls and emails, and their outcomes.

- Invoice Register: A comprehensive list of all invoices issued, including details like invoice number, date, customer, and amount.

- Cash Receipts Journal: Records all cash receipts and their allocation to specific invoices.

21. How do you stay organized when dealing with lots of invoices and payments?

I stay organized when dealing with invoices and payments by using a multi-faceted approach. Firstly, I implement a clear digital filing system, organizing invoices by vendor, date, and payment status in clearly named folders. I also use a spreadsheet or accounting software (like QuickBooks or Xero) to track invoice details, due dates, payment amounts, and payment methods. This allows for easy sorting, filtering, and reporting.

Secondly, I establish a consistent schedule for processing invoices and payments, setting reminders for upcoming due dates to avoid late fees. Finally, I reconcile bank statements regularly against my invoice tracking system to ensure accuracy and identify any discrepancies promptly. Using these methods, I can efficiently manage a large volume of invoices and payments.

22. What is the purpose of a credit memo?

A credit memo (or credit memorandum) is a document issued by a seller to a buyer, reducing the amount the buyer owes to the seller under the terms of an earlier invoice. It's essentially a refund or discount applied after the original invoice has been issued.

The purpose is to correct errors on an invoice, provide allowances for damaged goods, or to reflect returned items. It avoids having to void the original invoice and create a new one, simplifying the accounting process.

23. What is the impact of Accounts Receivable on a company's cash flow?

Accounts Receivable (AR) significantly impacts a company's cash flow. AR represents money owed to the company by its customers for goods or services already delivered. A large AR balance means the company has made sales but hasn't yet received the cash, leading to a strain on immediate cash availability. This can impact the company's ability to pay its own bills, invest in growth, or handle unexpected expenses.

Effective AR management is crucial. Prompt invoicing, efficient collection processes, and offering appropriate credit terms can help minimize the time it takes to convert AR into cash. Conversely, poor AR management (e.g., lenient credit policies, slow invoicing) can lead to increased bad debts (uncollectible receivables) and further worsen the cash flow situation.

24. If a customer overpays, what steps would you take?

First, I'd verify the overpayment by checking the original invoice amount against the payment received. Then, I would contact the customer immediately to inform them of the overpayment and offer a few options: a refund of the overpaid amount, applying the credit to their next invoice, or holding the credit on their account for future use. I'd document the customer's chosen preference and process it accordingly. Finally, I'd send a confirmation email to the customer detailing the resolution.

25. What are some methods for collecting payments from customers?

Several methods exist for collecting payments from customers. These include:

- Credit/Debit Cards: Accepting payments via Visa, Mastercard, American Express, etc., either online or in person. This often involves using a payment gateway.

- Digital Wallets: Platforms like PayPal, Apple Pay, and Google Pay offer convenient and secure payment options.

- Bank Transfers: Customers can directly transfer funds from their bank account to yours.

- ACH Transfers: Primarily used in the US, ACH (Automated Clearing House) transfers are another form of direct bank transfer.

- Checks: Although less common now, paper checks are still used by some businesses and individuals.

- Mobile Payments: Using mobile apps and platforms for payment processing. Example, Square.

- Cryptocurrency: Accepting payments in cryptocurrencies like Bitcoin, Ethereum, etc. This requires a crypto payment gateway.

- Cash: Accepting physical currency, especially common for in-person transactions.

- Buy Now, Pay Later (BNPL): Offering customers the option to pay in installments through services like Affirm or Klarna.

26. What are some ethical considerations in Accounts Receivable?

Ethical considerations in Accounts Receivable (A/R) are crucial for maintaining trust and fairness in financial transactions. One key area is accurate and transparent billing practices. This means avoiding hidden fees, providing clear explanations of charges, and ensuring invoices are free of errors. Another consideration is fair and respectful debt collection. A/R professionals should avoid harassing or threatening debtors, and they must comply with all relevant laws and regulations regarding debt collection practices. Data privacy is also paramount, safeguarding customer financial information and avoiding unauthorized disclosure.

Furthermore, consistent and unbiased treatment of customers is important. Applying credit policies fairly, regardless of a customer's background or status, avoids discrimination. A/R teams should also prioritize open communication and be responsive to customer inquiries and disputes. Finally, it's ethical to report financial information accurately and honestly, without manipulating A/R metrics to present a misleading picture of the company's financial health. This ensures transparency for stakeholders and avoids potential legal issues.

27. How do you prioritize tasks when you have multiple deadlines?

When facing multiple deadlines, I prioritize tasks based on a combination of urgency, importance, and impact. First, I assess the hard deadlines and identify tasks with the closest due dates. Then, I evaluate the importance of each task in relation to overall goals or project success. Tasks that are both urgent and highly important take precedence.

I also consider the impact of not completing a task on time. If a delayed task significantly hinders progress or affects other team members, I give it higher priority. I often use a simple matrix (Urgent/Important) or a similar prioritization technique (like MoSCoW: Must have, Should have, Could have, Won't have) to visualize and rank tasks. Regular reassessment is key, as priorities can shift as new information becomes available.

28. What is the meaning of GAAP in accounting?

GAAP stands for Generally Accepted Accounting Principles. It represents a common set of accounting rules, standards, and procedures issued by accounting standard setters like the FASB (Financial Accounting Standards Board). Companies use GAAP when compiling their financial statements.

GAAP aims to ensure consistency, comparability, and transparency in financial reporting. This makes it easier for investors and other stakeholders to understand and analyze a company's financial performance.

29. How familiar are you with using spreadsheets like Microsoft Excel?

I have a solid working knowledge of spreadsheet software like Microsoft Excel. I'm comfortable with basic data entry, formatting, and using common formulas and functions such as SUM, AVERAGE, VLOOKUP, and IF statements. I've used Excel for data analysis, creating charts and graphs, and generating reports. While I may not be an expert in advanced features like VBA scripting or complex statistical analysis, I am confident in my ability to quickly learn and adapt to new spreadsheet tasks and functionalities as needed.

30. What are the potential consequences of inaccurate Accounts Receivable records?

Inaccurate Accounts Receivable (AR) records can lead to several detrimental consequences for a business. One major consequence is impaired cash flow. If AR records are inaccurate, the business may not be aware of outstanding invoices, delaying collection efforts and reducing the available cash. This can result in difficulties in meeting short-term obligations like payroll and supplier payments. It can also skew financial reporting, leading to incorrect assessments of the company's financial health by investors or lenders.

Further consequences include: increased bad debt expenses due to uncollectible accounts not being properly tracked; inefficient resource allocation as efforts are misdirected based on faulty data; damaged customer relationships if incorrect balances lead to disputes or overbilling; and regulatory penalties if financial statements are materially misstated due to the AR errors. Maintaining accurate AR records is crucial for effective financial management and decision-making.

Accounts Receivable interview questions for juniors

1. What's the deal with Accounts Receivable, like if we sold cookies and someone promised to pay later?

Accounts Receivable (AR) represents money owed to your business by customers for goods or services delivered but not yet paid for. Think of it as a short-term IOU. In your cookie example, if you sold cookies on credit (promise to pay later), the total amount due from those customers is your Accounts Receivable. It's an asset on your balance sheet because it represents future income.

Managing AR is crucial for cash flow. You want to collect payments promptly. If your AR grows too large or stays unpaid for too long, it can strain your finances. Businesses track AR using accounting software to send invoices, monitor payment deadlines, and follow up on overdue amounts. Good AR management practices include clear payment terms and efficient collection processes.

2. How would you handle a customer who says they already paid, but we can't find the money?

First, I would express empathy and apologize for the inconvenience. I would assure the customer that I want to resolve the issue quickly. I'd ask for details about the payment:

- Date of payment

- Payment method (e.g., credit card, bank transfer)

- Amount paid

- Any transaction or reference number

Then, I'd check our systems thoroughly using the information provided. This might include checking payment gateways, bank statements, and internal transaction logs. If still unable to locate the payment, I'd politely ask the customer to provide proof of payment (e.g., bank statement, transaction receipt). While waiting for the proof, I would explain the next steps, including potential timelines for resolution. Finally, I would keep the customer informed throughout the process and work to find a mutually acceptable solution, which might include temporarily crediting their account pending further investigation, if appropriate, or working out a payment plan.

3. What does 'invoice' mean to you, as if you were explaining it to a younger sibling?

Imagine you did some chores for your friend, like mowing their lawn or walking their dog. An invoice is like a bill you give them for doing those chores. It shows what you did, how much each thing costs, and the total amount they owe you.

It's basically a written record of a transaction. Businesses use invoices all the time to get paid for goods or services they provide. It helps everyone keep track of what was bought, sold, and how much money is involved. Think of it as a receipt, but given before you get paid, not after.

4. Tell me about a time you had to be super organized. How does that help with Accounts Receivable?

In my previous role as a project coordinator, I managed multiple projects simultaneously, each with varying deadlines and resource requirements. To stay on top of everything, I created a centralized system using a spreadsheet and project management software. I meticulously tracked tasks, deadlines, responsible parties, and project status. I also set up automated reminders for upcoming deadlines and proactively communicated with team members to address potential roadblocks. This level of organization was crucial for ensuring all projects were completed on time and within budget.

Being highly organized directly benefits Accounts Receivable by ensuring accurate and timely invoicing. It helps track outstanding invoices, manage payment schedules, identify overdue accounts quickly, and maintain clear communication with clients regarding their payments. This results in faster payment collection, reduced bad debt, and improved cash flow.

5. If a customer only pays part of their bill, how do you figure out what they still owe?

To determine the remaining balance, subtract the partial payment from the total bill amount. For example, if the total bill is $100 and the customer pays $60, the remaining balance is $40 ($100 - $60 = $40).

It's important to also consider any applicable late fees or interest charges that may have accrued since the original bill date. If late fees/interest apply, add them to the initial remaining balance to get the final amount owed.

6. What's the difference between a credit and a debit note, in the simplest terms possible?

A debit note increases the amount a customer owes you, while a credit note decreases it. Think of it like this: a debit note is like adding to an invoice, and a credit note is like subtracting from it.

7. How would you politely remind someone to pay their bill without sounding like a grumpy monster?

Subject: Friendly Reminder about Your Account

Hi [Name],

Hope you're having a great week! This is just a friendly reminder that your payment of [Amount] for invoice [Invoice Number] is due on [Due Date]. You can easily pay online here: [Link to Payment Portal].

If you've already made the payment, please disregard this email. If you have any questions or need to arrange an alternative payment plan, please don't hesitate to reach out. We're happy to help!

Thanks, [Your Name/Company Name]

8. What do you think is the most important thing to remember when talking to customers about money they owe?

Empathy and respect. Remember that owing money can be a stressful and sensitive situation for customers. Approach the conversation with understanding and a willingness to help them find a solution.

It's crucial to remain professional and avoid accusatory language. Focus on clear communication, outlining the amount owed, the reason for the debt, and available payment options. Being patient and offering support can significantly improve the interaction and increase the likelihood of a positive resolution.

9. If you found a mistake on an invoice, what steps would you take to fix it?

First, I would carefully review the invoice and identify the exact nature of the mistake (e.g., incorrect price, quantity, or tax amount). Then, I would immediately notify the relevant party (e.g., the vendor if it's an invoice we received, or the customer if it's an invoice we sent). This communication should be clear, concise, and professional, explaining the error and suggesting a solution.

Next, I'd work with the relevant teams (accounting, sales, etc.) to issue a corrected invoice or a credit memo, depending on the nature of the error and the company's established procedures. Accurate record-keeping is crucial, so all communications and corrections should be properly documented. Finally, I'd follow up to ensure the corrected invoice is processed and the error is resolved to everyone's satisfaction.

10. Why is it important for a company to keep track of all the money people owe them?

Tracking outstanding payments is crucial for a company's financial health. It allows the company to manage its cash flow effectively by forecasting incoming revenue and identifying potential shortfalls. Without this tracking, a company risks overspending, missing investment opportunities, and potentially facing insolvency.

Furthermore, monitoring accounts receivable helps in assessing credit risk and identifying slow-paying or non-paying customers. This enables the company to take proactive measures like adjusting credit terms, implementing stricter collection policies, or pursuing legal action to recover debts. Ultimately, effective tracking of money owed protects a company's profitability and long-term sustainability.

11. Explain 'payment terms' like you're teaching a friend about buying stuff.

Imagine you're buying a new phone from a store. 'Payment terms' are simply the rules about when and how you need to pay for it. It's the agreement between you and the store about the payment schedule.

For example, the terms might be "Net 30", meaning you have 30 days from the invoice date to pay the full amount. Or it could be "2/10, Net 30", meaning you get a 2% discount if you pay within 10 days, otherwise the full amount is due in 30 days. They define the payment schedule, any discounts, and penalties for late payment. So, before buying anything, always check the payment terms!

12. Imagine a customer is really upset about their bill. How would you try to calm them down and help them?

I would first listen attentively and empathetically to the customer's concerns, allowing them to fully express their frustration without interruption (unless the language becomes abusive). I would acknowledge their feelings by saying something like, "I understand you're upset about the bill, and I'm here to help resolve this for you."

Next, I would carefully review the bill with the customer, explaining each charge in detail and addressing any specific questions they have. If there's an error, I would immediately apologize and take steps to correct it. If the charges are accurate but unexpected, I would work with the customer to find a solution, such as offering a payment plan or exploring options for reducing future bills. Throughout the interaction, I would remain calm, patient, and professional, assuring the customer that I am committed to finding a fair and satisfactory resolution.

13. What's your favorite tool for staying organized, and how could you use it for Accounts Receivable?

My favorite tool for staying organized is Todoist. It's a versatile task management app that I use for everything from daily errands to long-term projects. For Accounts Receivable, I could create projects for each client or aging bucket. Within those projects, I'd create tasks for sending invoices, following up on overdue payments, and reconciling accounts. I can set reminders, due dates, and priority levels to ensure timely action.

I can also use Todoist's labels and filters to categorize tasks by invoice number, payment status, or contact person. This would allow me to quickly find and manage specific receivables. Recurring tasks would be set up for regular invoice sending or payment reminders, ensuring nothing slips through the cracks. The ability to add notes and attachments is also useful for documenting communication and storing relevant documents directly within each task.

14. Have you ever had to deal with a difficult situation? How did you handle it?

Yes, I once had to manage a project where a key team member was consistently missing deadlines and not communicating effectively. This was putting the entire project at risk. I first scheduled a private meeting with the team member to understand the root cause of the issues. I learned they were struggling with a new technology and felt overwhelmed.

To address this, I worked with the team member to break down their tasks into smaller, more manageable steps. I also paired them with a more experienced colleague for mentorship and provided additional training resources. We established clear communication protocols and regular check-ins to monitor progress. This approach helped the team member regain confidence, meet deadlines, and improve their communication, ultimately getting the project back on track.

15. What does 'due date' mean on an invoice, as simple as possible?

The 'due date' on an invoice is the date by which the payment for the goods or services listed on the invoice must be received by the seller or service provider. It's essentially the payment deadline.

Think of it as the last day you can pay without being considered late or incurring late fees.

16. How important is accuracy when dealing with numbers, and why?

Accuracy is paramount when dealing with numbers because even small errors can propagate and lead to significant, and potentially damaging, consequences. Inaccurate calculations can result in incorrect financial reports, flawed scientific research, or even critical system failures. For example, in programming, a rounding error in a complex calculation could lead to a miscalculation of interest rates or an incorrect trajectory for a spacecraft.

Depending on the field, the level of acceptable error varies, but striving for the highest possible accuracy is generally crucial. This requires using appropriate data types, algorithms, and error-handling techniques. Ensuring accuracy also involves careful data validation and testing to identify and correct any errors early in the process.

17. What do you know about spreadsheets, and how could they help with Accounts Receivable?

Spreadsheets (like Google Sheets or Microsoft Excel) are powerful tools for organizing, analyzing, and manipulating data in rows and columns. They allow for calculations, charting, and data visualization. Formulas enable automated calculations based on cell values, and features like sorting and filtering facilitate data analysis.

In Accounts Receivable (AR), spreadsheets can be used to track invoices, payments, and outstanding balances. For example, you could create a sheet to list all invoices sent, their due dates, amounts, customer information, and payment status. Using formulas, you can automatically calculate total outstanding receivables, aging of invoices (how long invoices are overdue), and generate reports. Conditional formatting can highlight overdue invoices for quick follow-up. Spreadsheets enable AR departments to efficiently monitor cash flow, identify potential payment issues, and improve collection efforts.

18. If a customer asks for a copy of their invoice, what would you do?

I would first verify the customer's identity to ensure I'm providing the invoice to the correct person. This might involve confirming their account details or other identifying information.

Once verified, I would locate the invoice using information like the invoice number, date of purchase, or customer account. I would then provide the customer with a copy of the invoice, either electronically (e.g., via email) or through another preferred method. If they request a printed copy, I would arrange for that as well, following company procedures.

19. What's the meaning of 'reconciliation' in simple words?

Reconciliation, in simple terms, means comparing two sets of data to make sure they match and resolving any discrepancies. It's about finding and fixing differences to bring things into agreement.

Think of it like balancing your checkbook. You compare your records with the bank's records and investigate any differences to make them align. The goal is to ensure accuracy and consistency between different systems or data sources.

20. Explain how data entry skills are helpful in Accounts Receivable.

Data entry skills are crucial in Accounts Receivable (AR) for accurately recording financial transactions. AR involves tracking invoices, payments, and customer accounts, all of which require meticulous data input. Accurate data entry ensures that records are up-to-date, minimizing errors and discrepancies in financial statements.

Specifically, good data entry enables efficiency and accuracy in tasks like invoice processing, payment posting, credit memo application, and reconciliation. Poor data entry can lead to delayed payments, inaccurate financial reporting, and ultimately, damage customer relationships. Efficient and accurate data entry is vital for maintaining a healthy cash flow and ensuring the overall financial health of the organization.

21. If you see a payment is late, what initial steps do you take?

First, I would immediately verify the payment due date and method. I'd check our internal systems for any processing errors or delays on our end. Next, I'd reach out to the customer with a polite and professional notification about the overdue payment. The message would include the original due date, the amount due, and instructions on how to make a payment. I'd also inquire if they've already made the payment and if so, request proof of payment to help resolve the issue quickly. Keeping the communication open and solution-oriented is key.

22. Describe your understanding of 'aging report'.

An aging report, often used in accounts receivable, is a summary that categorizes outstanding invoices or debts based on how long they have been outstanding. It typically groups receivables into buckets like 'Current' (0-30 days past due), '31-60 days past due', '61-90 days past due', and 'Over 90 days past due'. This provides a clear view of which customers are late on payments and the total amount of overdue receivables for each time period.

The primary purpose of an aging report is to help businesses manage their cash flow and assess credit risk. By identifying invoices that are significantly overdue, businesses can take proactive steps to collect payments, such as sending reminder notices, initiating collection calls, or adjusting credit terms. The report also allows a business to evaluate the effectiveness of its credit and collection policies and make informed decisions about extending credit to new customers or modifying existing credit limits.

23. In which situations do you think is it necessary to escalate an issue to a senior colleague?

Escalation to a senior colleague is necessary when I lack the knowledge, skills, or authority to resolve an issue effectively and promptly. This includes situations where I've exhausted my troubleshooting steps, encountered a critical bug I can't fix, or the issue's impact is beyond my responsibility (e.g., a security vulnerability or a major system outage).

Specifically, I would escalate when:

- The issue involves complex technical concepts I don't fully grasp.

- I've spent a significant amount of time trying to resolve the issue without success.

- The issue is impacting multiple users or critical systems.

- The issue requires access or permissions I don't have.

- The issue involves a conflict of interest or ethical concerns.

24. What do you consider important while maintaining customer relationships?

Maintaining strong customer relationships hinges on consistent and transparent communication. This includes promptly addressing inquiries, actively listening to feedback, and providing proactive updates. Building trust through reliability and exceeding expectations is crucial.

Key aspects are:

- Empathy: Understand their needs and pain points.

- Personalization: Tailor interactions to their specific circumstances.

- Follow-up: Ensure issues are resolved and satisfaction is achieved.

- Honesty: Be upfront and transparent, even when delivering difficult news.

25. How do you ensure confidentiality of sensitive customer data?

To ensure confidentiality of sensitive customer data, I would implement a multi-layered approach including: data encryption both in transit and at rest, utilizing strong access controls and authentication mechanisms, regularly auditing data access logs, and ensuring compliance with relevant data protection regulations such as GDPR or CCPA. Additionally, I would advocate for data minimization principles, collecting only the data that is absolutely necessary for the intended purpose.

Furthermore, employee training on data privacy and security best practices is essential. This includes awareness of phishing attacks, secure password management, and the importance of reporting any potential security breaches immediately. Regular security assessments and penetration testing can also help identify and address vulnerabilities in our systems and processes.

26. How do you stay updated with changes or new policies in Accounts Receivable?

I stay updated on changes and new policies in Accounts Receivable through a combination of proactive and reactive methods. Proactively, I regularly review industry publications, subscribe to relevant newsletters from organizations like the Credit Research Foundation, and participate in online forums and communities dedicated to AR professionals. I also attend webinars and industry conferences when possible.

Reactively, I pay close attention to internal communications from my company's finance and compliance departments. These communications often detail specific changes to policies and procedures. Additionally, I actively seek clarification from my manager or subject matter experts when encountering unfamiliar situations or ambiguities in existing policies. This collaborative approach ensures I remain informed and compliant with current regulations and best practices.

27. What's your process for prioritizing tasks when you have multiple invoices to process?

When prioritizing invoices for processing, I typically consider a few key factors. First, I prioritize based on due dates to avoid late payment penalties and maintain good vendor relationships. Invoices with approaching deadlines receive immediate attention. Secondly, I look at invoice amounts. Larger invoices might be prioritized due to their potential impact on cash flow. Finally, I consider vendor importance/relationship. Strategic suppliers or those with critical service agreements might get priority processing to ensure uninterrupted operations.

Accounts Receivable intermediate interview questions

1. Describe a time you had to reconcile a complex accounts receivable issue. What steps did you take?

In my previous role at [Previous Company], we encountered a significant discrepancy in a client's account. The client claimed they had overpaid by $10,000, but our records showed a balance outstanding. To reconcile this, I first gathered all relevant documentation, including invoices, payment records, and correspondence. I then meticulously reviewed each transaction, cross-referencing the client's records with our accounting system, NetSuite.

I discovered that a payment had been incorrectly applied to the wrong customer account. To correct this, I created a journal entry to move the payment to the correct account. I then contacted the client, explained the error, and provided them with an updated statement. The issue was resolved quickly, and the client appreciated the transparency and thoroughness of the investigation.

2. How would you handle a situation where a customer disputes an invoice and refuses to pay?

When a customer disputes an invoice and refuses to pay, my initial approach involves active listening and empathy. I would first strive to understand the customer's perspective by carefully reviewing the reasons for the dispute. I will review the invoice details, relevant contracts, and any supporting documentation to assess the validity of the claim.

Next, I would communicate transparently and professionally with the customer. My goal would be to find a mutually agreeable solution. This may involve negotiating payment terms, adjusting the invoice if warranted, or providing additional clarification or documentation. If a resolution cannot be reached through negotiation, I would escalate the issue to the appropriate internal team or manager, providing them with all the relevant information and documentation to facilitate a fair and efficient resolution.

3. Explain your understanding of credit risk management in accounts receivable.

Credit risk management in accounts receivable is the process of identifying, measuring, and mitigating the risk of customers failing to pay their invoices on time or at all. This involves assessing the creditworthiness of customers before extending credit, setting appropriate credit limits, and monitoring payment behavior.

Key aspects include establishing credit policies, performing credit checks, regularly reviewing outstanding receivables, and implementing collection strategies. Effective credit risk management helps to minimize bad debt losses and maintain healthy cash flow, ultimately safeguarding the financial health of the business. Actions like obtaining credit insurance or factoring receivables are also considered part of credit risk management.

4. What experience do you have with implementing or using accounts receivable software?

I have experience using and implementing accounts receivable (AR) software in a few different contexts. In my previous role at Acme Corp, I was a key user of NetSuite's AR module, responsible for generating invoices, applying payments, and reconciling AR balances. I also assisted with the implementation of a new automated collections workflow within NetSuite, which involved configuring dunning letters and setting up automated payment reminders.

Additionally, at a smaller startup, I evaluated several AR software options, including Xero and QuickBooks Online, before ultimately recommending and helping to implement Zoho Books. My experience includes data migration, user training, and customizing reports to track key AR metrics like days sales outstanding (DSO).

5. Describe your experience with different types of payment methods (e.g., ACH, credit card, wire transfer) and how you manage them in accounts receivable.

I have experience managing various payment methods within accounts receivable. This includes ACH transfers, credit card payments, and wire transfers. For ACH, I ensure proper bank account verification and maintain accurate records of transactions to reconcile payments. With credit card payments, I'm familiar with processing transactions through payment gateways and adhering to PCI DSS compliance for data security. Wire transfers involve careful tracking of incoming funds and matching them to corresponding invoices, often requiring coordination with the treasury department for international transactions.

To manage these methods effectively, I utilize accounting software features for payment processing and reconciliation. I also document and maintain clear procedures for each payment type to ensure accuracy and consistency. Discrepancies are investigated promptly, and I work with customers and internal teams to resolve any issues related to payment posting or reconciliation. I always ensure compliance with company policies and relevant regulations for each payment method.

6. How do you prioritize your tasks when dealing with a high volume of invoices and customer accounts?

When handling a high volume of invoices and customer accounts, I prioritize using a system based on urgency and impact. First, I identify any invoices that are past due or accounts with impending deadlines for payment or action. These are addressed immediately. Next, I categorize invoices and accounts by value or potential risk, focusing on high-value items or those posing significant financial risk to the company. This might involve using an 'aging report' for accounts receivable to quickly spot overdue invoices.

Beyond urgency and value, I look for opportunities to batch similar tasks. For example, processing all invoices from a specific vendor at once or reconciling multiple accounts within the same customer profile. This streamlines the workflow and reduces context switching. Tools like automated invoice processing software or CRM systems can further enhance efficiency by flagging urgent items and providing a centralized view of customer accounts.

7. Explain how you would investigate and resolve a discrepancy between the accounts receivable ledger and the bank statement.

To investigate a discrepancy between the accounts receivable (AR) ledger and the bank statement, I would first verify the bank statement balance against the bank's records to rule out any bank errors. Then, I'd reconcile the AR ledger by comparing individual deposits listed on the bank statement to the corresponding entries in the AR ledger, looking for any unmatched or misapplied payments.

Specifically, I would:

- Double-check the bank statement balance.

- Compare deposits on the bank statement to the AR ledger, noting dates, amounts, and payer information.

- Investigate any outstanding checks or electronic payments not yet cleared by the bank.

- Look for errors such as incorrect customer postings, transposition errors, or deposits posted to the wrong accounts.

- If the discrepancy persists, I would review supporting documentation like invoices and remittance advices to identify the source of the error.

8. What are some key performance indicators (KPIs) you would track to measure the effectiveness of the accounts receivable process?

Key KPIs to track the effectiveness of the accounts receivable (AR) process include: Days Sales Outstanding (DSO), which measures the average number of days it takes to collect payment after a sale; a lower DSO indicates a more efficient process. Collection Effectiveness Index (CEI), representing the percentage of receivables collected compared to the total receivables available for collection. Percentage of invoices paid on time, which reflects how reliably customers are adhering to payment terms. Bad Debt Expense as a Percentage of Revenue, revealing the amount of uncollectible receivables relative to total sales.

Other important metrics include: Average Days Delinquent (ADD), showing how late payments are on average; Number of Invoices Past Due, reflecting the sheer volume of overdue invoices; and AR Turnover Ratio, indicating how often receivables are collected during a period. Monitoring these KPIs helps identify bottlenecks, optimize collection strategies, and improve overall cash flow.

9. Describe your experience with generating and analyzing accounts receivable aging reports.

I have extensive experience generating and analyzing accounts receivable (AR) aging reports. I've used various accounting software, including QuickBooks and SAP, to generate these reports, configuring parameters like aging periods (30, 60, 90+ days) and customer segmentation. My analysis focuses on identifying overdue invoices, spotting trends in payment behavior, and assessing overall credit risk.

Analyzing these reports helps me understand which customers are consistently late payers, which invoices are at the highest risk of not being paid, and where our credit policies may need adjustment. I use this information to prioritize collection efforts, negotiate payment plans, and recommend adjustments to credit limits, ultimately improving cash flow and reducing bad debt expense. I also used this information to perform cohort analysis to understand payment patterns over time.

10. How would you approach improving the efficiency of the accounts receivable process in a company?

To improve accounts receivable efficiency, I'd focus on automation and process optimization. First, I'd implement automated invoicing and payment reminders to reduce manual effort and speed up collections. This could include integrating accounting software with CRM and payment gateways. A comprehensive system could automatically generate and send invoices, track payment statuses, and trigger reminders based on predefined timelines. Secondly, I would streamline the credit approval process and create clear payment terms to minimize disputes and delays. This could involve establishing standardized credit scoring criteria, clearly communicating payment expectations upfront, and offering multiple payment options.

11. What is your understanding of GAAP principles related to accounts receivable?

Generally Accepted Accounting Principles (GAAP) regarding accounts receivable focus on accurately representing the value of what a company expects to collect from its customers. Key principles include recognizing revenue when it is earned and realizable, which affects when accounts receivable are recorded. The allowance for doubtful accounts is crucial; companies must estimate and record potential uncollectible accounts, reducing the net realizable value of accounts receivable on the balance sheet. This is typically based on historical data, current economic conditions, and specific customer circumstances.

Further, GAAP requires proper disclosure of accounting policies related to accounts receivable, including the methods used to estimate the allowance for doubtful accounts and any significant concentrations of credit risk. Accounts receivable should be presented at their net realizable value (gross accounts receivable less the allowance for doubtful accounts). The aging of accounts receivable may also be disclosed to provide further insight into the likelihood of collection. Impairment testing is necessary to ensure that the recorded value aligns with the recoverable amount.

12. Explain how you would handle a customer account that is consistently past due.

My approach to a consistently past due customer account involves a multi-stage process that prioritizes communication and finding a mutually agreeable solution. First, I'd proactively reach out to the customer with a friendly reminder, inquiring if there are any issues preventing timely payments. This initial contact focuses on understanding their perspective and offering assistance. If the problem persists, I'd escalate to a more direct conversation, outlining the payment history and outlining the potential consequences of continued late payments, such as service suspension. We would then work with the customer to set up a payment plan or explore alternative payment arrangements.

If these steps prove unsuccessful, I would proceed according to company policy, which might involve suspending the account or referring it to collections. Throughout the process, maintaining a professional and respectful demeanor is crucial. Documentation of all communication is also important for tracking and future reference.

13. Describe your experience with processing refunds or credits to customer accounts.

In my previous roles, I've handled refunds and credits to customer accounts in various scenarios, including processing returns of defective products, addressing service issues, and rectifying billing errors. The process typically involved verifying the customer's claim, reviewing transaction history, and confirming eligibility based on company policy. I've used CRM systems like Salesforce and Zendesk to manage these requests, document interactions, and initiate the refund or credit.

Specifically, I was responsible for issuing refunds via the payment gateway, ensuring the correct amount was credited back to the customer's original payment method. I also handled instances where store credit was issued instead, tracking the issuance and redemption of these credits within the customer's account. I am familiar with different refund workflows and the importance of accurate record-keeping for accounting and auditing purposes. I also have experience resolving disputes related to refunds by working with the customer service and finance teams.

14. How do you ensure accuracy and compliance in the accounts receivable process?

To ensure accuracy and compliance in the accounts receivable process, I would implement several key controls. These include: regular reconciliation of accounts receivable sub-ledger to the general ledger, implementing segregation of duties (e.g., separating invoice creation from cash receipt processing), and routinely reviewing aging reports to identify and address delinquent accounts promptly. Furthermore, I would establish clear credit policies and procedures, documented and enforced, for approving new customers and managing credit limits. I would also leverage technology like automated invoice processing and payment reminders to minimize errors and ensure timely collections.

Adherence to compliance involves staying updated on relevant accounting standards (e.g., GAAP or IFRS) and tax regulations. Documenting all procedures and controls is crucial, as is performing regular internal audits to assess effectiveness and identify areas for improvement. Employee training on policies, procedures, and ethical considerations is also important.

15. What strategies do you use to effectively communicate with customers regarding their accounts and payment status?

I prioritize clear, concise, and proactive communication. I use a multi-channel approach, including email, phone calls, and sometimes SMS, to reach customers based on their preferences. When discussing accounts and payment status, I always use professional language, explain balances and due dates clearly, and offer options for payment arrangements when needed.

Specifically, I might send automated email reminders a week before a payment is due. If a payment is missed, I'll follow up with a phone call to understand the situation and explore potential solutions. I document all communication meticulously in the customer's account record for future reference and to ensure consistency across interactions. If appropriate, I also proactively communicate about any upcoming changes to their account terms or billing cycles.

16. Explain how you would handle a situation where a customer files for bankruptcy.

When a customer files for bankruptcy, the first step is to immediately cease all collection activities. This includes stopping invoices, phone calls, and any legal proceedings. We'd then need to gather all relevant documentation related to the customer's account, such as contracts, invoices, and payment history, and provide it to our legal team or designated bankruptcy specialist.

The next step involves filing a proof of claim with the bankruptcy court to assert our right to be considered a creditor. We then monitor the bankruptcy proceedings and work with the trustee and our legal counsel to determine the potential for recovering any outstanding debt. Depending on the type of bankruptcy and the assets available, recovery may be partial or nonexistent. We'll adhere to all court orders and deadlines throughout the process.

17. Describe your experience with performing month-end or year-end closing procedures for accounts receivable.

My experience with month-end accounts receivable closing includes generating and reviewing the aged trial balance to identify past due invoices. I reconcile the AR subledger to the general ledger, investigating and resolving any discrepancies. A key task is ensuring all invoices are accurately recorded and posted in the correct period, and performing bad debt expense calculations. I've also assisted in preparing supporting documentation for audits.

In year-end closing, I've focused on validating the accuracy of the AR balance for financial reporting. This involves more rigorous reconciliation procedures and working closely with the audit team to provide requested documentation and explanations. Experience includes assisting with analysis on accounts receivable turnover and days sales outstanding to assess collection efficiency and identify potential areas for improvement.

18. How do you stay updated with changes in accounting regulations and best practices related to accounts receivable?

I stay updated through several channels. I regularly read publications from organizations like the AICPA and FASB to understand new standards and interpretations. I also subscribe to industry newsletters and blogs focused on accounts receivable and credit management to learn about emerging best practices.

Additionally, I participate in continuing professional education (CPE) courses and webinars that specifically address accounting for receivables and related topics. Networking with other accounting professionals and attending industry conferences also provide valuable insights into current trends and challenges.

19. What methods do you use to prevent fraudulent activities in accounts receivable?

To prevent fraudulent activities in accounts receivable, I would implement several key controls. These include segregation of duties (separating invoice creation, payment posting, and reconciliation), regularly reviewing and reconciling accounts receivable aging reports to identify discrepancies or unusual balances, and verifying customer information and creditworthiness before extending credit. I'd also implement strong password policies and access controls to limit unauthorized access to accounting systems.

Further preventative measures involve automated invoice processing with validation rules, using data analytics to identify suspicious patterns (e.g., duplicate invoices, unusual payment amounts or destinations), and performing regular internal audits to test the effectiveness of controls. In addition, I would train staff to recognize and report potential fraud indicators.

20. Describe your experience with internal or external audits related to accounts receivable.

During my time at [Previous Company Name], I actively participated in both internal and external audits focusing on accounts receivable. I assisted in preparing documentation, such as aged trial balances, invoices, and payment records, to support the balances and transactions under review. I worked closely with auditors to address their inquiries, explain processes, and provide any additional information required for their assessment. Specifically, I assisted in verifying the accuracy of customer credit limits, payment application, and the reconciliation of sub-ledgers to the general ledger.

My responsibilities included tracking down supporting documentation for selected transactions, confirming outstanding balances with customers, and investigating any discrepancies identified during the audit process. Through these experiences, I gained a solid understanding of audit procedures related to accounts receivable, including testing controls around revenue recognition, assessing the adequacy of allowance for doubtful accounts, and ensuring compliance with relevant accounting standards.

21. How do you ensure that customer data is kept confidential and secure?

I ensure customer data confidentiality and security through a multi-layered approach. First, I strictly adhere to data privacy regulations like GDPR and CCPA, understanding the legal requirements for data handling. Access control is crucial, implementing the principle of least privilege, granting only necessary access to data based on roles and responsibilities. Data encryption, both at rest and in transit using protocols like TLS/SSL, safeguards data from unauthorized access.

Furthermore, regular security audits and penetration testing identify and address potential vulnerabilities. We implement strong authentication mechanisms like multi-factor authentication (MFA). Data loss prevention (DLP) tools monitor and prevent sensitive data from leaving the organization's control. Finally, comprehensive training programs educate employees about data security best practices and policies, fostering a security-conscious culture.

22. Explain how you would handle a disagreement with a colleague regarding an accounts receivable issue.

If I disagreed with a colleague about an accounts receivable issue, my first step would be to ensure I fully understand their perspective. I would actively listen to their reasoning and ask clarifying questions to ensure I grasp their understanding of the situation, relevant policies, and supporting documentation. It's crucial to approach the conversation with an open mind, acknowledging that there might be information or a different angle I haven't considered.

Next, I would calmly and respectfully present my viewpoint, backing it up with specific data, relevant company policies, or accounting principles. If possible, I would prefer to review the supporting documentation or system records together. If we still disagree, I would suggest escalating the issue to a supervisor or a more experienced colleague who can provide guidance and help us reach a mutually agreeable solution. It's important to prioritize resolving the issue correctly and maintain a positive working relationship, even when disagreements arise.

23. Describe a time you had to work under pressure to meet a tight deadline in accounts receivable.

In my previous role at [Previous Company], we were implementing a new ERP system. Due to unforeseen technical difficulties, the go-live date was pushed back, but the month-end reporting deadline remained the same. This meant we had significantly less time to reconcile accounts receivable using both the old and new systems. I took the initiative to create a detailed plan, breaking down the reconciliation process into smaller, manageable tasks and delegating responsibilities within the team. I also worked extended hours, focusing on critical discrepancies and prioritizing tasks based on their impact on the financial statements.

To expedite the process, I leveraged advanced Excel functions like VLOOKUP and pivot tables to quickly identify and resolve discrepancies between the two systems. By communicating proactively with the IT department to address data migration issues and closely monitoring our progress against the plan, we successfully completed the month-end reconciliation within the tight deadline, ensuring accurate and timely financial reporting. This experience taught me the importance of proactive planning, efficient delegation, and effective communication under pressure.

24. How would you approach training a new employee on accounts receivable procedures?

My approach to training a new employee on accounts receivable (AR) procedures would involve a structured and progressive learning process. First, I'd start with an overview of AR's role within the company's financial operations, emphasizing its importance in maintaining cash flow and profitability. I'd explain key concepts like invoicing, payment terms, credit policies, and the aging of receivables. Next, I would provide hands-on training on specific tasks such as:

- Invoicing: Creating and sending accurate invoices.

- Payment Processing: Recording payments received.

- Collections: Contacting customers with overdue payments.

- Reconciliations: Matching AR balances with bank statements.

I'd use real-world examples, shadowing opportunities, and practice exercises. Throughout the training, I would encourage questions and provide regular feedback, tailoring my approach to the individual's learning style. Finally, I would assess their understanding through quizzes or practical simulations to ensure they're ready to perform the tasks independently.

25. What are some best practices for documenting accounts receivable activities and transactions?

- Maintain a detailed accounts receivable ledger, recording every invoice, payment, and adjustment. This includes the invoice number, customer name, date, amount, and due date.

- Implement a consistent naming convention for documents and digital files related to AR, making them easily searchable and retrievable. Use clear and descriptive names. Examples:

Invoice_CustomerID_Date.pdforPayment_CustomerID_Date.xlsx. - Document all communication with customers regarding outstanding invoices, including phone calls, emails, and letters. Note the date, time, person spoken to, and the outcome of the conversation. Store this documentation centrally.

- Reconcile the AR ledger with the general ledger regularly (e.g., monthly) to ensure accuracy. Any discrepancies should be investigated and resolved promptly.

- Establish a clear audit trail for all AR transactions. This means ensuring that every transaction can be traced back to its origin and that all changes are properly documented with timestamps and user identification.

- For adjustments (e.g., discounts, write-offs), maintain supporting documentation explaining the reason for the adjustment and the authorization for it. This documentation is crucial for auditing purposes.

- Use accounting software or dedicated AR management systems to automate documentation and reporting where possible. These systems typically provide built-in audit trails and reporting capabilities.

26. Explain how you would handle a situation where a customer makes a partial payment on an invoice.

When a customer makes a partial payment on an invoice, I would first record the payment accurately in the accounting system, noting the amount paid, the date, and the invoice number. I would then update the invoice status to reflect the remaining balance due. A clear record of this partial payment is essential for reconciliation.

Next, I would communicate with the customer to acknowledge the partial payment and confirm the remaining balance and due date. Depending on the company's policy and the customer's circumstances, I might discuss payment arrangements or offer a revised payment schedule. It is important to maintain open communication and strive for a mutually agreeable solution. The goal is to secure the full payment while maintaining a positive customer relationship.

27. Describe your experience with setting up payment plans for customers who are unable to pay their invoices in full.

In my previous role, I frequently worked with customers who needed payment plans. My approach involved first understanding the customer's financial situation and why they couldn't pay the invoice in full. This often included a conversation to determine their ability to make consistent payments over time.

Next, I'd create a customized payment plan that worked for both the customer and the company. This involved determining an appropriate payment amount and frequency, based on the customer's budget, and a reasonable timeframe for repayment. I ensured that all payment plans were documented clearly, including the payment schedule, any applicable interest or fees (if permitted), and the consequences of missed payments. Clear communication and flexibility were key to the success of these arrangements.

28. How do you handle uncollectible accounts?

Uncollectible accounts, often called bad debts, are handled through write-offs. There are primarily two methods: the direct write-off method and the allowance method.

The direct write-off method recognizes the bad debt expense when an account is deemed uncollectible. The allowance method estimates uncollectible accounts and creates an allowance for doubtful accounts (a contra-asset account) which is then used to write off specific uncollectible accounts as they arise. The allowance method adheres to the matching principle better than the direct write-off method.

Accounts Receivable interview questions for experienced

1. Describe your experience with managing a high volume of invoices, and what strategies did you use to maintain accuracy and efficiency?

In my previous role, I regularly managed a high volume of invoices, often exceeding hundreds per week. To maintain accuracy, I implemented a multi-faceted approach. Firstly, I established a standardized process for invoice receipt, data entry, and verification. This included utilizing OCR software for automated data extraction, followed by manual review to ensure accuracy. Secondly, I implemented a three-way matching system, comparing invoice details with purchase orders and receiving reports to identify discrepancies before processing payments. Finally, I regularly reconciled accounts payable to identify and resolve any outstanding issues.

To enhance efficiency, I prioritized automation wherever possible. I used macros in Excel to automate repetitive tasks like data validation and report generation. I also collaborated with the IT department to optimize our accounting software, implementing features like automated routing and approval workflows. Regular training sessions were conducted for the team to ensure everyone was proficient with the processes and tools. I also regularly reviewed key performance indicators (KPIs) such as invoice processing time and error rates to identify areas for further improvement.

2. How have you used technology to improve the accounts receivable process, and what were the results?

In my previous role, I automated several aspects of the accounts receivable process using Python and SQL. Specifically, I developed a script that automatically matched incoming payments with outstanding invoices by parsing bank statements and comparing data against our accounting system. This drastically reduced the manual reconciliation time, freeing up the AR team to focus on more complex issues like delinquent accounts. Furthermore, I implemented an automated email reminder system using a combination of our CRM API and a templating engine. This system sent out payment reminders at various intervals before and after the invoice due date.

The results were significant. We saw a 20% decrease in overdue invoices within the first quarter of implementation and a significant reduction in the time spent on manual reconciliation, saving the company an estimated 40 hours per week. The improved efficiency also allowed us to identify and address potential payment issues earlier, leading to a better overall cash flow.

3. Explain your approach to resolving complex billing discrepancies and disputes with customers.

When resolving complex billing discrepancies and disputes, I prioritize clear communication and thorough investigation. I start by actively listening to the customer's concerns and gathering all relevant information, including account details, billing statements, and any supporting documentation they can provide. I then meticulously examine the billing records to identify any potential errors, system glitches, or misunderstandings regarding service usage or contract terms.