Hiring the right Accounting Manager is crucial for maintaining financial accuracy and strategic growth in any organization. A well-crafted set of interview questions can help you identify candidates with the necessary skills, experience, and leadership qualities to excel in this role.

This blog post provides a comprehensive list of Accounting Manager interview questions, categorized by experience level and specific areas of expertise. From basic questions for assessing junior applicants to situational queries for top-tier managers, we've got you covered with over 80 questions to help you make informed hiring decisions.

By using these interview questions, you can gain valuable insights into candidates' technical knowledge, problem-solving abilities, and leadership potential. Consider complementing your interview process with a targeted accounting skills assessment to ensure a thorough evaluation of your potential hires.

Table of contents

10 basic Accounting Manager interview questions and answers to assess applicants

Finding the perfect Accounting Manager for your team can feel like a treasure hunt. To make it easier, we've compiled a list of interview questions that dig deep into candidates' understanding and skills. Use these questions to explore candidates' managerial abilities and accounting expertise, ensuring they can lead your finance team to success.

1. How do you handle tight deadlines when multiple projects are due at once?

When facing tight deadlines, an effective strategy is to prioritize tasks based on urgency and impact. I start by listing all the projects and then identify which ones require immediate attention. I also communicate with team members to delegate tasks efficiently, ensuring that everyone is focused on their respective priorities.

A good response from a candidate should highlight their ability to stay organized, communicate effectively with their team, and adapt to changing circumstances. Look for candidates who demonstrate a proactive approach to managing workload and keeping projects on track.

2. Can you describe a time when you identified a significant error in the financial statements? How did you handle it?

In one instance, I found a discrepancy in the financial statements that resulted from misclassified transactions. I immediately conducted a thorough review of the transactions to pinpoint the source of the error. After identifying and correcting the mistake, I updated the stakeholders on the adjustments and implemented additional checks to prevent future occurrences.

Ideal candidates should showcase their problem-solving skills and attention to detail. They should also emphasize the importance of transparency and communication when handling errors in financial statements.

3. How do you stay updated on changes in accounting regulations and standards?

To stay informed about the latest changes in accounting regulations, I regularly attend industry webinars, subscribe to accounting journals, and participate in professional networks. These activities allow me to gain insights into evolving standards and best practices.

Candidates who actively engage in continued learning and professional development will be better prepared to adapt to regulatory changes. Look for individuals who demonstrate a commitment to staying current in their field.

4. What strategies do you use to ensure accurate budgeting and forecasting?

Accurate budgeting and forecasting require a combination of historical data analysis and market trend evaluation. I work closely with department heads to gather insights and ensure that our projections reflect realistic goals. Regular reviews and adjustments are also crucial to accommodate any unforeseen changes.

Strong candidates should be able to articulate their approach to data analysis and collaboration with team members. Their strategies should reflect a balance of data-driven insights and adaptability.

5. How do you manage conflicts within your team?

When conflicts arise, I approach them with an open mind and listen to all parties involved. I encourage team members to express their concerns and work towards a resolution that respects everyone's perspectives. Facilitating open communication and finding common ground are key to maintaining a harmonious work environment.

An effective leader should be able to demonstrate their conflict resolution skills and emphasize the importance of maintaining team cohesion. Look for candidates who prioritize empathy and active listening.

6. Describe your experience with financial audits. What role have you played?

In my previous roles, I have been responsible for preparing financial documents and supporting external auditors in their review process. My role involved ensuring audit readiness by maintaining complete and accurate records, which helped streamline the auditing process.

Candidates should demonstrate familiarity with audit procedures and highlight their proactive approach in collaborating with auditors. Look for those who can detail their contributions to successful audits.

7. How do you ensure data accuracy and integrity in your financial reports?

Ensuring data accuracy starts with implementing robust internal controls and regular reconciliation processes. I also emphasize the importance of training team members on best practices for data entry and validation to minimize errors.

Candidates should convey their commitment to accuracy and integrity in financial reporting. Look for responses that include practical measures for maintaining high standards in data management.

8. What accounting software and tools are you proficient in?

I am proficient in several accounting software platforms, including QuickBooks, SAP, and Oracle. These tools help streamline processes and enhance reporting capabilities, allowing for more efficient financial management.

Look for candidates who can demonstrate proficiency in widely-used accounting software and who have experience integrating technology into their accounting practices.

9. How do you approach training and developing your team?

I believe in fostering a culture of continuous learning by providing regular training sessions and encouraging team members to pursue relevant certifications. I also mentor team members by offering constructive feedback and supporting their professional growth.

Strong candidates should emphasize their commitment to team development and continuous improvement. Look for those who have a structured approach to training and mentoring.

10. Can you explain how you handle discrepancies in financial reports?

When I encounter discrepancies, I conduct a detailed investigation to trace the root cause. This involves checking data entries, verifying supporting documents, and collaborating with relevant team members to resolve the issue. I document the findings and implement corrective actions to prevent recurrence.

Candidates should demonstrate their ability to systematically address discrepancies and emphasize their attention to detail. Look for those who can clearly outline their problem-solving methodology.

20 Accounting Manager interview questions to ask junior managers

To effectively assess the capabilities of junior accounting managers, consider asking them some of these targeted interview questions. These questions are designed to gauge their practical knowledge and skills, helping you identify candidates who can handle the responsibilities outlined in an accounting manager job description.

- Can you give an example of how you have improved a financial process in your previous role?

- How do you prioritize tasks when managing an extensive workload?

- Describe a time when you had to explain financial information to someone without a financial background.

- What is your approach to handling sensitive financial data?

- How do you ensure compliance with accounting regulations in your work?

- Can you discuss a challenging financial decision you had to make and how you approached it?

- How do you keep your team motivated during busy periods?

- What is your method for reviewing and approving financial reports?

- Have you ever implemented a cost-saving strategy? What was the outcome?

- How do you handle feedback on your financial reports?

- Describe a situation where you had to manage a budget overrun.

- What strategies do you employ to maintain a good relationship with stakeholders?

- How do you manage stress during peak financial periods?

- Can you explain a time when you had to adapt quickly to a change in accounting policy?

- How do you verify the accuracy of financial data submitted by your team?

- What key performance indicators do you focus on to measure financial success?

- How do you handle situations where financial targets are not met?

- What steps do you take to prepare for a financial audit?

- How do you ensure that financial reports are delivered on time?

- Can you describe your experience with financial modeling and analysis?

10 intermediate Accounting Manager interview questions and answers to ask mid-tier managers.

Ready to take your Accounting Manager interviews up a notch? These intermediate questions are perfect for assessing mid-tier candidates who've got some experience under their belt. They'll help you dig deeper into a candidate's financial acumen and management style. Remember, the best interviews feel like conversations, so use these as springboards for deeper discussions!

1. How do you approach implementing new accounting software or systems in your department?

An effective answer should outline a structured approach to implementing new software:

- Assess current needs and pain points

- Research and select appropriate software

- Create an implementation timeline

- Provide comprehensive training for the team

- Run parallel systems during transition

- Gather feedback and make necessary adjustments

- Fully transition and monitor for issues

Look for candidates who emphasize change management, team communication, and a focus on minimizing disruption to daily operations. Strong answers will also mention the importance of post-implementation review and continuous improvement.

2. Can you describe a time when you had to present complex financial information to non-financial stakeholders? How did you approach this?

A strong answer might include:

- Identifying the key points that matter most to the audience

- Using visual aids like graphs or charts to illustrate trends

- Avoiding jargon and explaining concepts in simple terms

- Providing context and real-world examples

- Encouraging questions and fostering dialogue

Pay attention to candidates who demonstrate an ability to tailor their communication style to their audience. The best responses will show a knack for translating financial data into actionable insights for decision-makers.

3. How do you ensure your team stays current with evolving accounting standards and regulations?

An ideal response might include strategies such as:

- Regular team training sessions or workshops

- Subscribing to industry publications and sharing key updates

- Attending professional conferences and seminars

- Encouraging pursuit of additional certifications

- Implementing a mentorship program within the team

- Creating a knowledge-sharing culture through regular team discussions

Look for candidates who emphasize the importance of continuous learning and demonstrate a proactive approach to keeping their team's skills sharp. Strong answers will also mention how they personally stay informed and lead by example.

4. How would you handle a situation where you disagree with a superior about a significant accounting treatment?

A mature response should outline a professional approach:

- Thoroughly research the issue and gather supporting evidence

- Prepare a clear, concise explanation of the concern

- Schedule a private meeting to discuss the matter

- Present the alternative viewpoint respectfully, focusing on potential risks or benefits

- Listen actively to the superior's perspective

- Work collaboratively to reach a resolution or compromise

- Document the discussion and final decision for future reference

Look for candidates who demonstrate diplomacy, respect for authority, and a commitment to ethical standards. The best answers will balance assertiveness with professionalism and show a willingness to learn from differing viewpoints.

5. What strategies do you use to improve efficiency and reduce costs in your accounting department?

Strong candidates might mention:

- Automating routine tasks through software solutions

- Standardizing processes and creating clear documentation

- Regular review and elimination of unnecessary steps or reports

- Cross-training team members for better workflow flexibility

- Implementing lean accounting principles

- Leveraging cloud-based solutions for better collaboration

- Conducting regular team brainstorming sessions for improvement ideas

Look for answers that demonstrate a balance between cost-cutting and maintaining quality. The best responses will show an understanding of both the financial and human aspects of efficiency improvements.

6. How do you approach creating and managing budgets for multiple departments or projects simultaneously?

An effective answer might include:

- Meeting with department heads to understand their needs and goals

- Analyzing historical data and industry benchmarks

- Using budgeting software for accurate forecasting and tracking

- Implementing a standardized budgeting process across departments

- Regular review and adjustment of budgets based on actual performance

- Clear communication of budget constraints and expectations

Look for candidates who demonstrate strong organizational skills, attention to detail, and the ability to see the big picture while managing multiple budgets. The best answers will also touch on how they handle conflicts or competing priorities between departments.

7. Can you describe your experience with financial risk management? How do you identify and mitigate potential risks?

A comprehensive answer might include:

- Conducting regular risk assessments

- Implementing internal controls and segregation of duties

- Monitoring key financial ratios and performance indicators

- Staying informed about economic trends and regulatory changes

- Using scenario planning and stress testing

- Developing contingency plans for identified risks

- Regularly reviewing and updating risk management strategies

Look for candidates who demonstrate a proactive approach to risk management and an understanding of both internal and external risk factors. Strong answers will also mention the importance of creating a risk-aware culture within the team.

8. How do you ensure the confidentiality and security of sensitive financial information?

A strong response might include:

- Implementing strict access controls and user authentication

- Regular security audits and vulnerability assessments

- Encrypting sensitive data both in transit and at rest

- Training staff on data security best practices and phishing awareness

- Establishing clear policies for handling confidential information

- Using secure file sharing and collaboration tools

- Regular backups and disaster recovery planning

Look for candidates who demonstrate a thorough understanding of both technological and human factors in data security. The best answers will show awareness of current threats and a commitment to staying updated on security best practices.

9. How do you approach mentoring and developing junior team members?

An effective mentoring approach might include:

- Setting clear expectations and goals for growth

- Regular one-on-one meetings to discuss progress and challenges

- Providing stretch assignments to build new skills

- Encouraging participation in professional development activities

- Offering constructive feedback and recognition

- Leading by example and sharing personal experiences

- Creating a supportive environment that encourages questions and learning

Look for candidates who show genuine interest in developing others and recognize the value of building a strong team. The best answers will demonstrate patience, good communication skills, and the ability to adapt their mentoring style to different individuals.

10. How do you handle situations where actual financial results significantly deviate from forecasts or budgets?

A strong approach might include:

- Quickly identifying and analyzing the root causes of the deviation

- Communicating transparently with stakeholders about the situation

- Developing a corrective action plan with specific, measurable steps

- Adjusting forecasts and budgets as necessary

- Implementing more frequent monitoring and reporting

- Conducting a post-mortem analysis to improve future forecasting accuracy

Look for candidates who demonstrate the ability to stay calm under pressure and take decisive action. The best answers will show a balance between addressing immediate concerns and implementing long-term improvements to prevent similar issues in the future.

12 Accounting Manager interview questions about technical definitions

To assess an Accounting Manager's technical knowledge, use these questions to probe their understanding of key accounting concepts and terminology. These questions will help you evaluate the candidate's grasp of fundamental principles crucial for effective financial management and reporting.

- Can you explain the difference between accrual and cash basis accounting?

- What is the purpose of a trial balance in the accounting cycle?

- How would you define working capital, and why is it important?

- Can you explain what EBITDA means and when it's typically used?

- What's the difference between a balance sheet and an income statement?

- Can you describe what a general ledger is and its role in accounting?

- What is the matching principle in accounting?

- How would you explain the concept of depreciation to a non-accountant?

- What is the difference between LIFO and FIFO inventory methods?

- Can you explain what a contra account is and provide an example?

- What is the purpose of a bank reconciliation statement?

- How would you define internal controls in accounting?

8 Accounting Manager interview questions and answers related to financial reporting

To assess whether candidates have a firm grip on financial reporting essentials, consider these insightful interview questions. They’re designed to help you explore an applicant’s proficiency in financial reporting and their ability to communicate complex concepts clearly.

1. How do you ensure consistency in financial statements across reporting periods?

Ensuring consistency in financial statements involves adhering to standard accounting principles and guidelines. This includes using the same accounting methods, such as accrual or cash basis, and maintaining uniformity in how transactions are recorded.

Candidates should highlight their experience in setting up and following standardized processes, including detailed documentation and regular reviews. They might also mention the importance of internal audits to identify discrepancies early on.

Look for candidates who emphasize attention to detail and a systematic approach to tracking changes in financial policies or systems. Their response should demonstrate a proactive stance in maintaining consistency.

2. Can you explain your approach to preparing financial reports for non-financial stakeholders?

When preparing financial reports for non-financial stakeholders, it's crucial to simplify complex data into easily digestible information. This often involves using visual aids like graphs and charts to illustrate key metrics and trends.

Effective communication is key. Candidates might mention their ability to distill financial jargon into plain language, ensuring stakeholders understand the financial health and performance of the organization without getting lost in technical details.

An ideal candidate will demonstrate strong communication skills and an understanding of the audience's needs. They should be able to tailor their presentation style to fit different stakeholders, linking their response to skills required for a financial analyst.

3. How do you handle discrepancies found in financial statements during the review process?

Handling discrepancies involves a systematic review process to identify the root cause of the error. This could mean tracing back through transaction logs, consulting with team members responsible for the entries, and checking for any recent changes in accounting policies.

It's important to document findings and corrective measures taken. This transparency helps prevent similar issues in the future and strengthens the accuracy of financial reporting.

Candidates who display a methodical approach to problem-solving and a commitment to maintaining accuracy in financial reporting will likely excel in this area. Their answers should reflect a balance between technical expertise and collaborative problem-solving.

4. What steps do you take to ensure compliance with financial reporting standards?

Compliance with financial reporting standards involves staying updated on the latest regulations and accounting standards, whether they are international or specific to the country of operation. Regular training sessions and workshops are effective ways to keep the team informed.

Candidates might also discuss the implementation of internal control systems and regular audits to ensure adherence to standards. This includes a thorough review of financial documents against compliance checklists.

An ideal response will demonstrate a candidate's proactive approach to learning and adapting to new standards, reflecting skills necessary for an auditor. Their ability to lead compliance efforts and foster a culture of continuous improvement will be crucial.

5. Describe a time when you had to deliver a financial report under tight deadlines. How did you manage it?

Delivering a financial report under tight deadlines requires excellent time management and prioritization skills. Candidates might describe breaking down the report into manageable sections and delegating tasks effectively among team members.

They could also mention utilizing financial software to streamline processes and ensure accuracy, as well as conducting a quick preliminary review before the final submission to catch any glaring errors.

Look for candidates who demonstrate the ability to work under pressure without compromising on quality. Their response should highlight organizational skills and a capacity for clear communication, ensuring all team members are aligned and focused on the task.

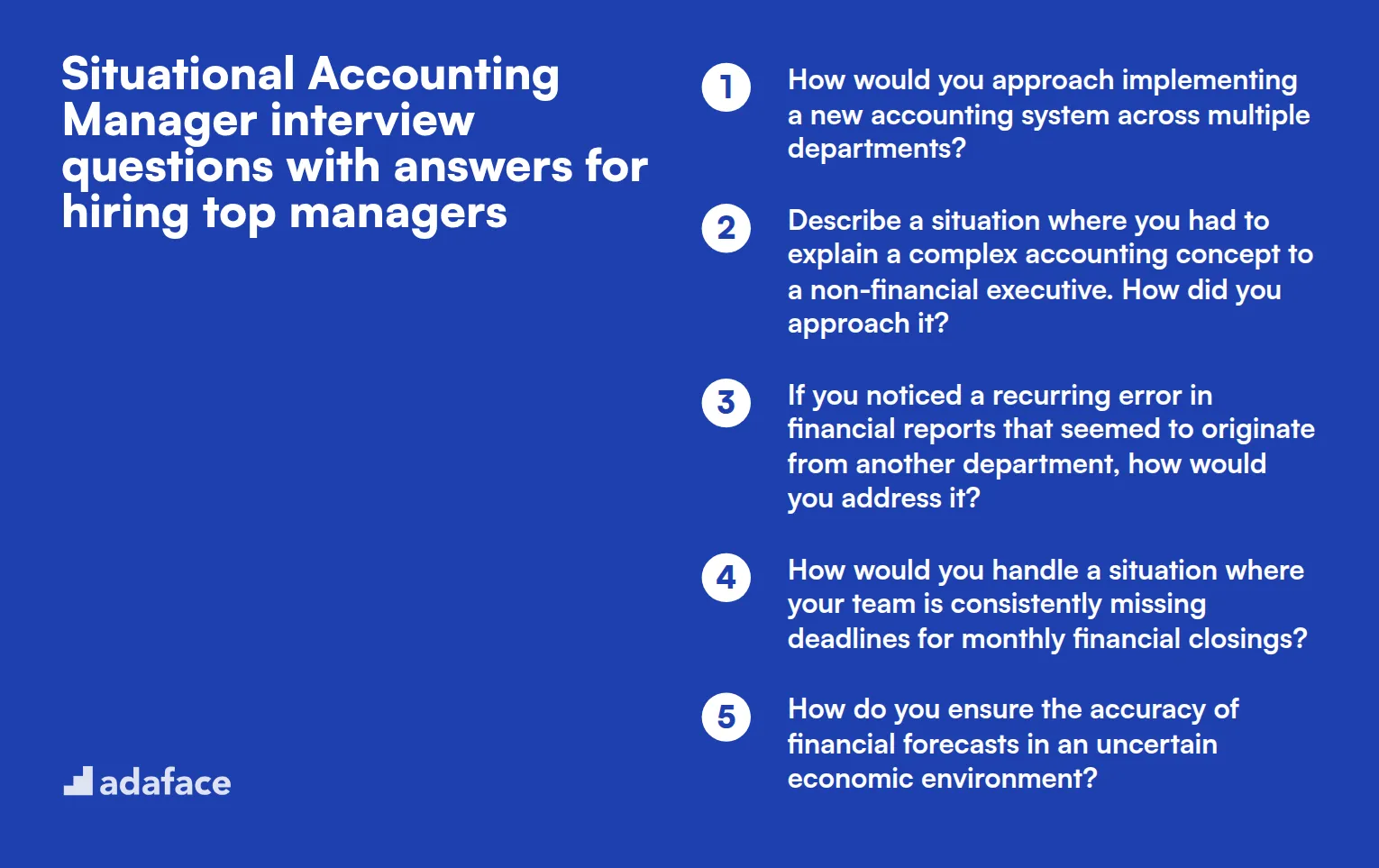

9 situational Accounting Manager interview questions with answers for hiring top managers

Ready to put your Accounting Manager candidates through their paces? These situational interview questions will help you uncover how they'd handle real-world scenarios. Use this list to assess their problem-solving skills, leadership abilities, and financial acumen. Remember, the best answers will showcase both technical know-how and soft skills.

1. How would you approach implementing a new accounting system across multiple departments?

A strong candidate should outline a structured approach to implementing a new accounting system. They might describe steps such as:

- Conducting a needs assessment across all departments

- Researching and selecting the most suitable system

- Creating a detailed implementation plan with timelines

- Forming a cross-functional team to oversee the transition

- Providing comprehensive training for all users

- Establishing a phased rollout strategy

- Setting up a support system for troubleshooting

Look for answers that emphasize clear communication, change management strategies, and a focus on minimizing disruption to daily operations. The ideal candidate should also mention the importance of post-implementation review and continuous improvement.

2. Describe a situation where you had to explain a complex accounting concept to a non-financial executive. How did you approach it?

An effective response should demonstrate the candidate's ability to simplify complex information and tailor their communication style to their audience. They might describe:

- Using analogies or real-world examples to illustrate the concept

- Creating visual aids like charts or diagrams

- Breaking down the information into smaller, digestible parts

- Relating the concept to the executive's area of expertise or business goals

- Encouraging questions and providing patient, clear explanations

Look for candidates who show empathy, patience, and creativity in their approach. The ability to communicate effectively with non-financial stakeholders is crucial for an Accounting Manager.

3. If you noticed a recurring error in financial reports that seemed to originate from another department, how would you address it?

A strong answer should demonstrate diplomacy, problem-solving skills, and a commitment to accuracy. The candidate might outline steps such as:

- Verifying the error and its impact on financial reports

- Gathering all relevant data and documentation

- Approaching the department head privately to discuss the issue

- Collaboratively investigating the root cause of the error

- Proposing and implementing solutions to prevent future occurrences

- Offering training or support if needed

- Following up to ensure the problem is resolved

Look for candidates who emphasize collaboration and a constructive approach rather than blame. They should also mention the importance of documenting the process and updating any affected reports or stakeholders.

4. How would you handle a situation where your team is consistently missing deadlines for monthly financial closings?

An effective response should showcase the candidate's leadership and problem-solving abilities. They might describe a plan that includes:

- Analyzing the current process to identify bottlenecks or inefficiencies

- Meeting with team members to understand their challenges

- Implementing a more structured timeline with clear milestones

- Redistributing workload if necessary

- Providing additional resources or training where needed

- Setting up a system for early identification of potential delays

- Regularly reviewing progress and adjusting the strategy as needed

Look for answers that balance addressing immediate issues with long-term solutions. The ideal candidate should also mention the importance of maintaining team morale and ensuring quality isn't sacrificed for speed.

5. How do you ensure the accuracy of financial forecasts in an uncertain economic environment?

A strong candidate should demonstrate their ability to navigate uncertainty and use various tools and techniques. They might mention:

- Utilizing multiple forecasting methods (e.g., scenario analysis, sensitivity analysis)

- Incorporating both internal data and external economic indicators

- Regularly updating forecasts as new information becomes available

- Collaborating with other departments to gather comprehensive insights

- Using advanced analytics or AI tools for more accurate predictions

- Maintaining conservative estimates to account for potential downturns

Look for answers that show a balance between using data-driven approaches and applying professional judgment. The ideal candidate should also emphasize the importance of clearly communicating the assumptions and limitations of their forecasts to stakeholders.

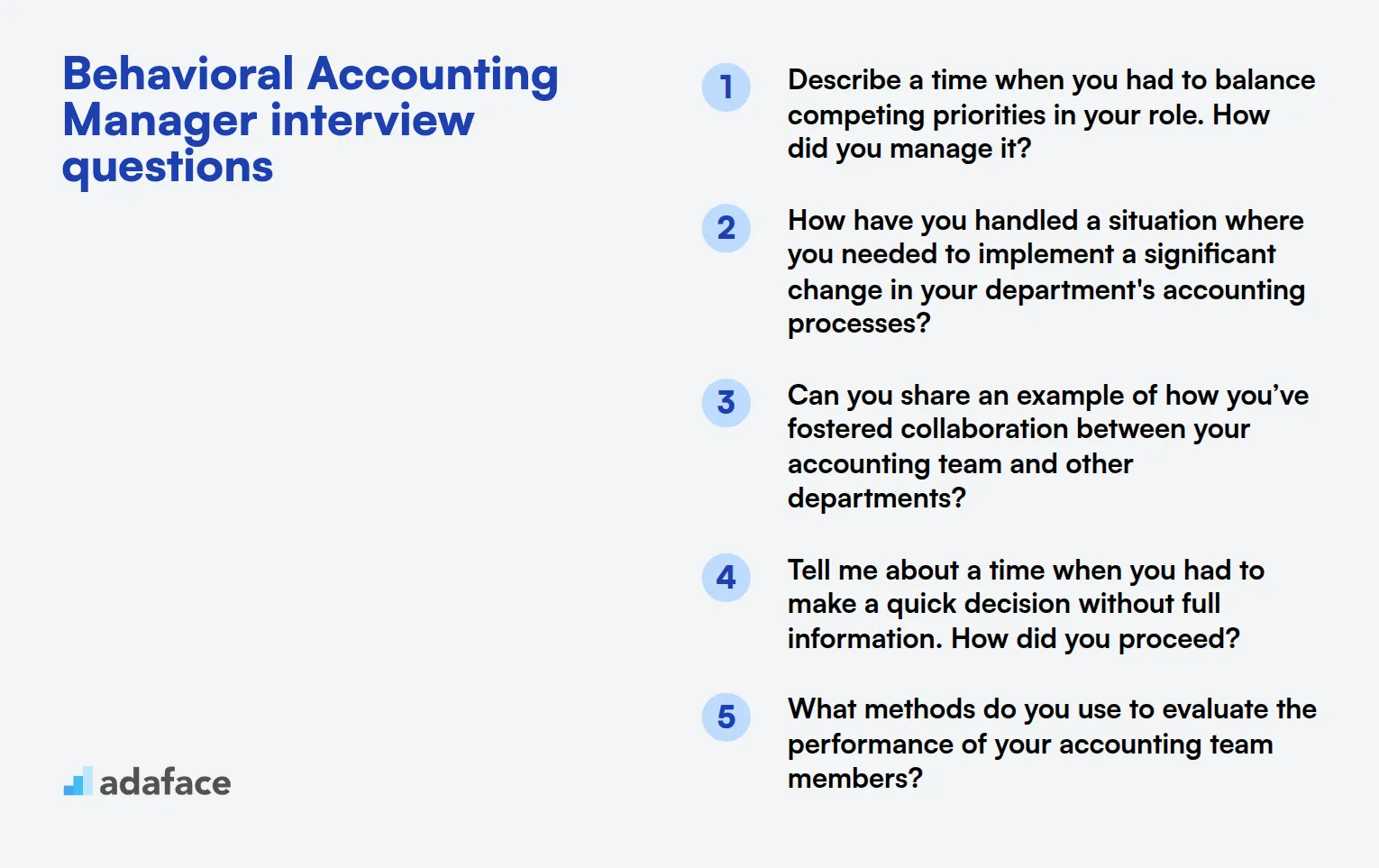

11 behavioral Accounting Manager interview questions

To ensure you select the best candidate for your Accounting Manager position, use these behavioral interview questions to uncover valuable insights into their past experiences and decision-making skills. These questions are crafted to help you gauge how candidates would handle real-world challenges in a managerial role. For more on what to expect from an Accounting Manager, check out our brief overview.

- Describe a time when you had to balance competing priorities in your role. How did you manage it?

- How have you handled a situation where you needed to implement a significant change in your department's accounting processes?

- Can you share an example of how you’ve fostered collaboration between your accounting team and other departments?

- Tell me about a time when you had to make a quick decision without full information. How did you proceed?

- What methods do you use to evaluate the performance of your accounting team members?

- Describe a situation where you had to communicate a complex accounting issue to your team. How did you ensure everyone understood?

- How have you previously addressed a situation where a team member consistently underperformed?

- What approach do you take to manage tight financial reporting deadlines?

- Can you give an example of a project where you successfully improved efficiency within your team?

- How do you cultivate a culture of continuous improvement within your accounting department?

- Tell me about a challenging problem you faced in your accounting career and how you resolved it.

Which Accounting Manager skills should you evaluate during the interview phase?

Assessing a candidate's suitability for an Accounting Manager position is a nuanced process that can't be fully completed in just one interview. However, there are core skills that are essential in this field. Evaluating these skills can provide valuable insights into a candidate's potential performance and fit for your organization.

Financial Analysis

To filter candidates based on their financial analysis skills, consider using an assessment test that includes relevant MCQs. You might want to explore our financial-accounting-test for this purpose.

Additionally, you can ask targeted interview questions to gauge a candidate's financial analysis skills effectively.

Can you describe a time when your financial analysis significantly influenced a business decision?

When asking this question, look for specific examples demonstrating the candidate's analytical skills and ability to interpret financial data. Their response should reveal how they used analysis to make informed decisions that had a tangible impact on the business.

Regulatory Knowledge

To assess regulatory knowledge, consider using an assessment test with multiple-choice questions covering relevant laws and guidelines. Our accounting-test could serve as a good resource.

You may also incorporate targeted interview questions to evaluate the candidate's depth of knowledge in this area.

How do you stay updated with changes in accounting regulations?

When this question is posed, evaluate the candidate's commitment to continuous learning and their strategies for staying informed. A proactive approach indicates a responsible and knowledgeable professional.

Attention to Detail

To assess attention to detail, consider implementing an assessment test that measures this skill through specific tasks. While we don't have a dedicated test listed, you can create scenarios based on common accounting tasks.

You could also ask targeted questions to further evaluate this critical skill.

Can you give an example of how your attention to detail prevented a financial error?

Look for examples where the candidate caught a mistake that could have resulted in financial loss, demonstrating their diligence and thoroughness in their work.

3 Tips for Effectively Using Accounting Manager Interview Questions

Before you start applying what you've learned about Accounting Manager interviews, here are some key tips to enhance your interviewing strategy.

1. Implement Skills Assessments Before Interviews

Utilizing skills tests prior to interviews can provide valuable insights into a candidate's capabilities. These assessments help you gauge specific skills that are critical for the role of an Accounting Manager.

For example, consider using the Accounting Test to evaluate fundamental accounting principles or the Excel Test for assessing proficiency in spreadsheets. These tests can highlight candidates who meet the baseline requirements and facilitate a more focused interview process.

Incorporating skills tests into your recruitment strategy allows you to streamline the selection process, ensuring that only qualified candidates progress to interviews. This efficiency leads to more effective evaluations and ultimately better hiring decisions.

2. Curate Focused Interview Questions

Given limited time during interviews, it's important to select the most relevant questions to maximize candidate evaluation. Aim for a balance between technical skills, behavioral aspects, and cultural fit, ensuring you cover essential areas within your time constraints.

Consider integrating additional interview questions that probe soft skills, such as communication and teamwork, which are crucial for an Accounting Manager. You might find value in exploring behavioral interview questions or situational interview questions to round out your interview framework.

By focusing on a curated list of questions, you enhance your ability to evaluate candidates effectively and efficiently, making the most of your time.

3. Utilize Follow-Up Questions

Simply asking initial interview questions may not provide the complete picture of a candidate’s suitability. Follow-up questions are essential to dig deeper and uncover the true depth of a candidate's experience and perspective.

For instance, if you ask a candidate how they handle a hectic month-end closing period and they respond with a general answer, a good follow-up would be, 'Can you provide an example of a specific challenge you faced during a month-end close, and how you addressed it?' This not only prompts candidates to share concrete experiences but also reveals their problem-solving skills.

Leverage Skill Tests and Interview Questions to Secure Top Accounting Managers

If you're in the process of hiring an Accounting Manager, verifying their skills is fundamental. The most accurate way to assess these skills is through specialized tests. Consider using our Accounting Test or Financial Accounting Test to ensure candidates meet your requirements.

After utilizing these skill tests, you'll be able to efficiently shortlist the most qualified candidates for interviews. To move forward with setting up assessments and managing candidates, visit our Sign Up page or learn more about our offerings on our Online Assessment Platform page.

Accounting Assessment Test

Download Accounting Manager interview questions template in multiple formats

Accounting Manager Interview Questions FAQs

This post covers basic, junior, intermediate, technical, financial reporting, situational, and behavioral interview questions for Accounting Managers.

The post includes 10 basic questions, 20 for junior managers, 10 intermediate questions, and 9 situational questions for top managers, among others.

Yes, the post provides 3 tips for effectively using these interview questions in your hiring process.

Yes, the post mentions leveraging skill tests alongside interview questions to secure top Accounting Managers.

40 min skill tests.

No trick questions.

Accurate shortlisting.

We make it easy for you to find the best candidates in your pipeline with a 40 min skills test.

Try for freeRelated posts

Free resources